Americans still love saving and hate spending

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

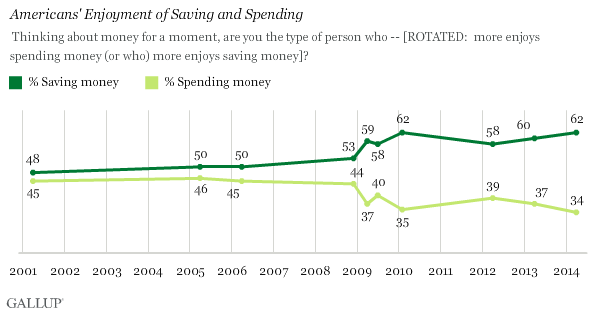

Gallup's latest figures on saving and spending are out — and the results are broadly the same as they've been ever since the 2008 financial crisis. The desire to save is much stronger than the desire to spend:

[Gallup]

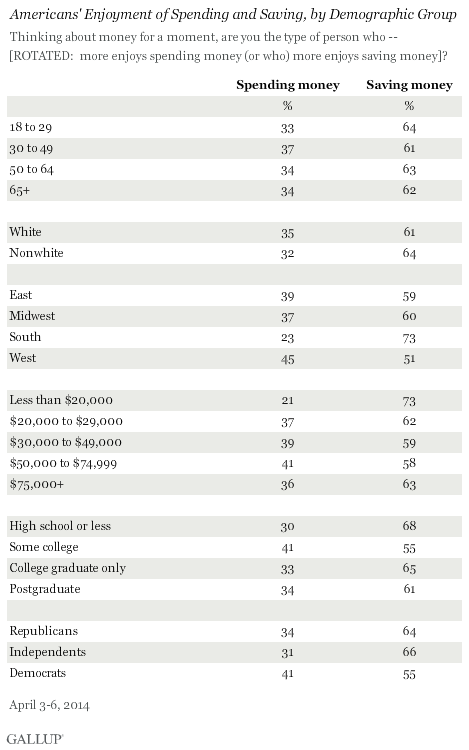

Who likes saving the most? People on low incomes, and Southerners:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

[Gallup]

This, unsurprisingly, has translated into a huge growth in savings. The level of U.S. savings deposits since 2008 has risen dramatically from around $4 trillion to $7 trillion.

And what are the broader economic effects of Americans' love of saving? Well, every dollar saved is a dollar not spent. While some saving is necessary — to build up capital to invest, or to build up protection for a rainy day — everybody's spending is someone else's income. If lots and lots of people save a high proportion of their incomes, economic activity suffers. That — what John Maynard Keynes called the paradox of thrift — goes some way to explaining the relatively weak economic recovery since 2008.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.