The Dow's record high is a big deal if you own stocks. Half of Americans don't own any.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

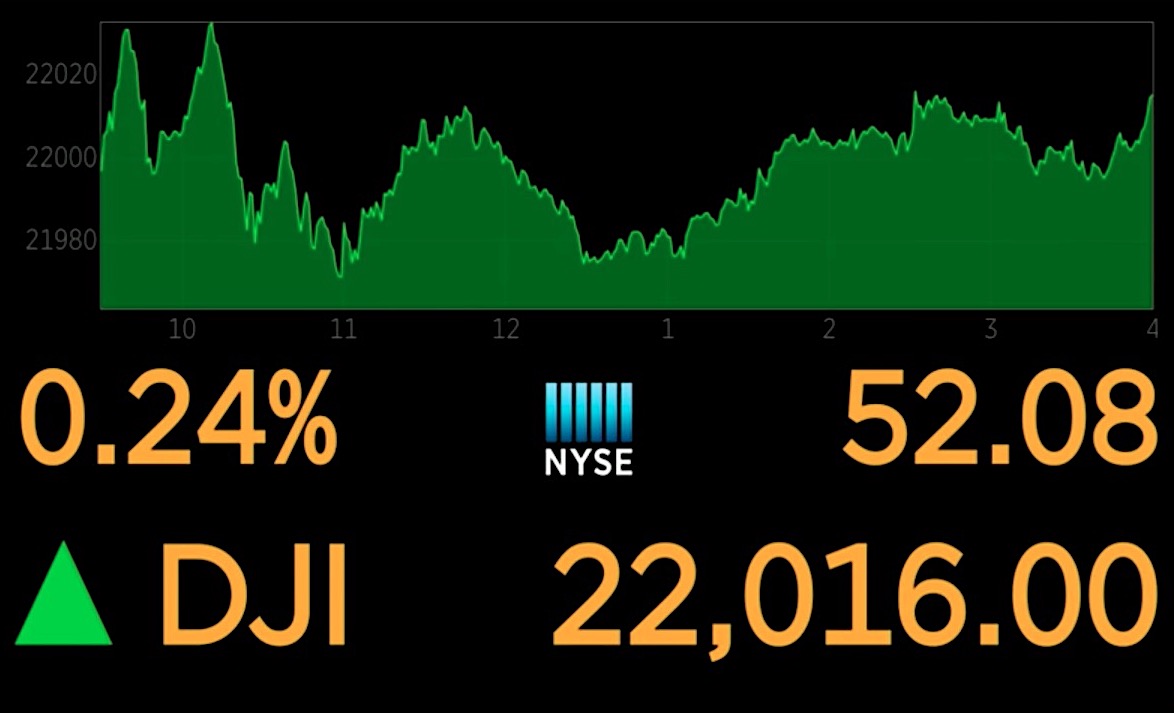

Wall Street rejoiced early Wednesday when the Dow Jones Industrial Average — a benchmark index of 30 U.S. companies — rose above 22,000 for the first time, then celebrated again when it closed above 22,000.

But fewer than 15 percent of Americans own individual stocks and about half of the country has no money invested in the stock market at all — not through a 401(k), IRA, mutual fund, or pension fund — according to Federal Reserve surveys and Gallup polls. Those people are probably not as excited about the Dow's new high-water mark, and its sprint northward from about 18,000 last November — the "Trump bump," sustained by robust corporate earnings.

"Only people with assets like stocks and houses are benefiting, and that's why this recovery has been weak," Torsten Slok, chief international economist at Deutsche Bank, tells The New York Times. According to Gallup, 89 percent of households earning $100,000 or more have some amount invested in the market, versus only 21 percent of families earning $30,000 or less. Stock ownership is "heavily tilted toward rich guys: doctors, lawyers, accountants," Steven Rosenthal, a senior fellow at the Tax Policy Center, tells The Washington Post. "It's not the middle class."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That has always been true, but the disparity seems to have gotten worse after people were burned in the 2008 market crash. Before the crash, in 2007, 65 percent of Americans adults were invested in the stock market, versus 54 percent currently.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.