Investors are starting to worry about negative U.S. interest rates as China trade war damage rises

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Goldman Sachs warned clients Sunday that it no longer expects a trade deal between the U.S. and China before the 2020 U.S. presidential election, it does predict more tariffs taking effect in September, and it lowered its U.S. fourth-quarter growth forecast to 1.8 percent accordingly. "Overall, we have increased our estimate of the growth impact of the trade war," Goldman Sachs chief U.S. economist Jan Hatzius wrote. "Fears that the trade war will trigger a recession are growing."

Slowing global growth and increased market turmoil have raised related concerns, too. Last week, Pimco economic adviser Joachim Fels said the escalating U.S.-China trade tensions could spark U.S. Treasuries slipping into negative territory, and "faster than many investors think." Between $14 trillion and $15 trillion of government debt around the world already bears negative yields, where investors earn less than they invested — meaning, "essentially, that savers holding these bonds are paying the government to store their money," The Wall Street Journal explains.

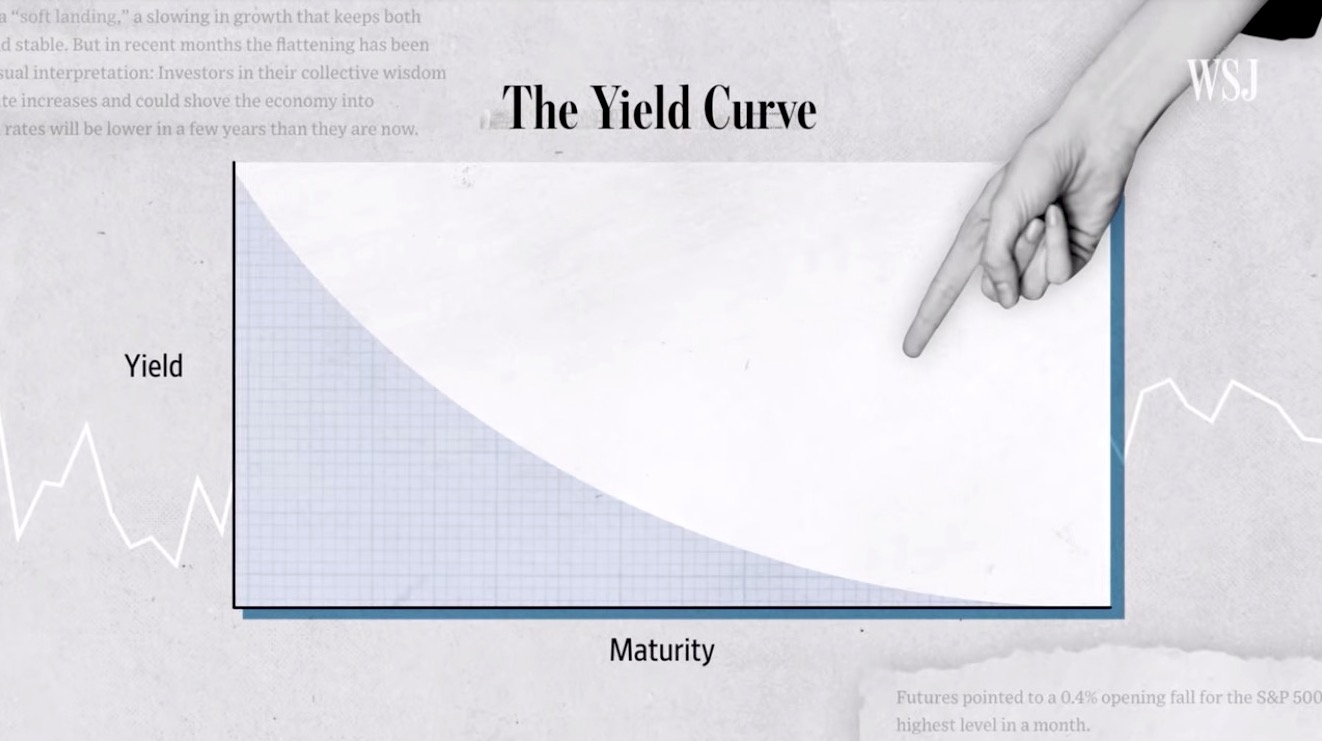

"So far, the U.S. has avoided that fate," the Journal reports, but a steep slide in U.S. government bond yields has raised fears that negative yields might be coming soon, or even "what was once unthinkable:" negative interest rates, as central banks have experimented with in Japan and some European countries to juice the economy. The yield on the benchmark 10-year Treasury note fell as low as 1.6 percent last week, roiling the markets as "falling yields are typically taken as an ominous sign for the economy," the Journal notes. Low yields on T-notes signal investors are flocking from stocks to bonds for safety, as yields drop when bond prices rise, as the Journal explained six months ago.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Until July 31, the U.S. Federal Reserve was steadily raising its benchmark interest rates, but if the Fed continues cutting rates "all the way back down to zero and restarts quantitative easing," Pimco's Fels wrote, "negative yields on U.S. Treasuries could swiftly change from theory to reality."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting