Goldman Sachs will pay $2.9 billion after pleading guilty to bribing foreign leaders with Malaysia's money

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Goldman Sachs has pleaded guilty to criminal charges for the first time in its long history.

The bank pleaded guilty Thursday to charges of conspiring to violate anti-bribery laws as it helped Malaysian financiers and leaders siphon money from the country's economic development fund. It will pay $2.9 billion to U.S. authorities, including $1.3 billion to the Justice Department, the DOJ said in a Thursday press conference. That's the largest penalty ever charged under the Foreign Corrupt Practices Act, which bars U.S. companies from bribing foreign leaders, CNN reports.

The DOJ alleged Goldman Sachs of playing a role in a scheme in which a Malaysian financier, a former prime minister's family, and other powerful people in the country lifted $2.7 billion from the 1Malaysia Development Berhad fund. Those people used the money to buy yachts, van Gogh and Monet paintings, and even a share in developing the movie The Wolf of Wall Street. Goldman already settled with Malaysia over the summer to pay back $3.9 billion.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Despite its role in the 2008 financial crisis and dozens of other scandals, Goldman Sachs has never before had to plead guilty to criminal charges, The New York Times notes. The bank did have to pay fines to cover some of those past issues, but this $5.1 billion sum is more than it paid after "peddling bonds backed by risky mortgages a decade ago," the Times writes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kathryn is a graduate of Syracuse University, with degrees in magazine journalism and information technology, along with hours to earn another degree after working at SU's independent paper The Daily Orange. She's currently recovering from a horse addiction while living in New York City, and likes to share her extremely dry sense of humor on Twitter.

-

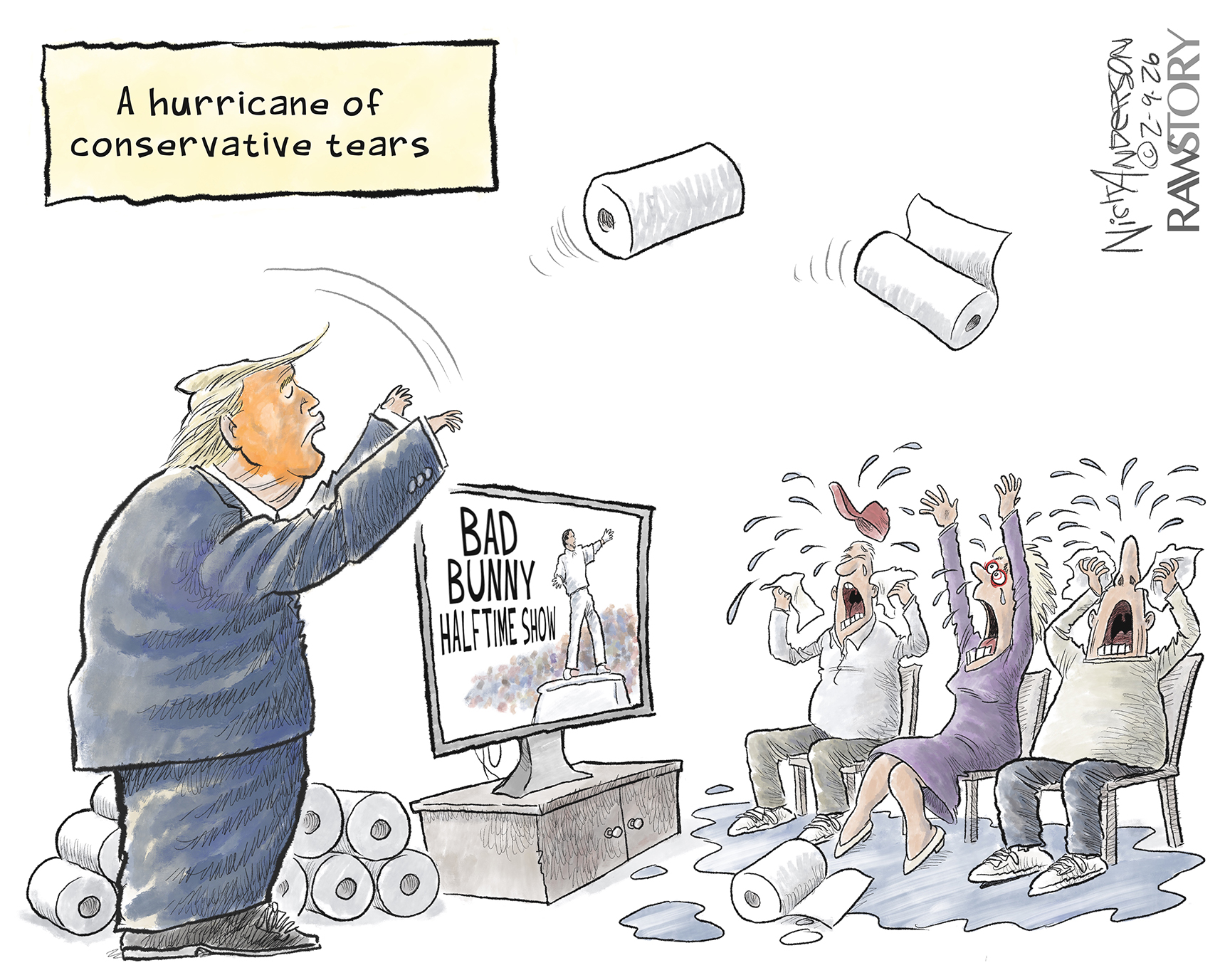

Political cartoons for February 10

Political cartoons for February 10Cartoons Tuesday's political cartoons include halftime hate, the America First Games, and Cupid's woe

-

Why is Prince William in Saudi Arabia?

Why is Prince William in Saudi Arabia?Today’s Big Question Government requested royal visit to boost trade and ties with Middle East powerhouse, but critics balk at kingdom’s human rights record

-

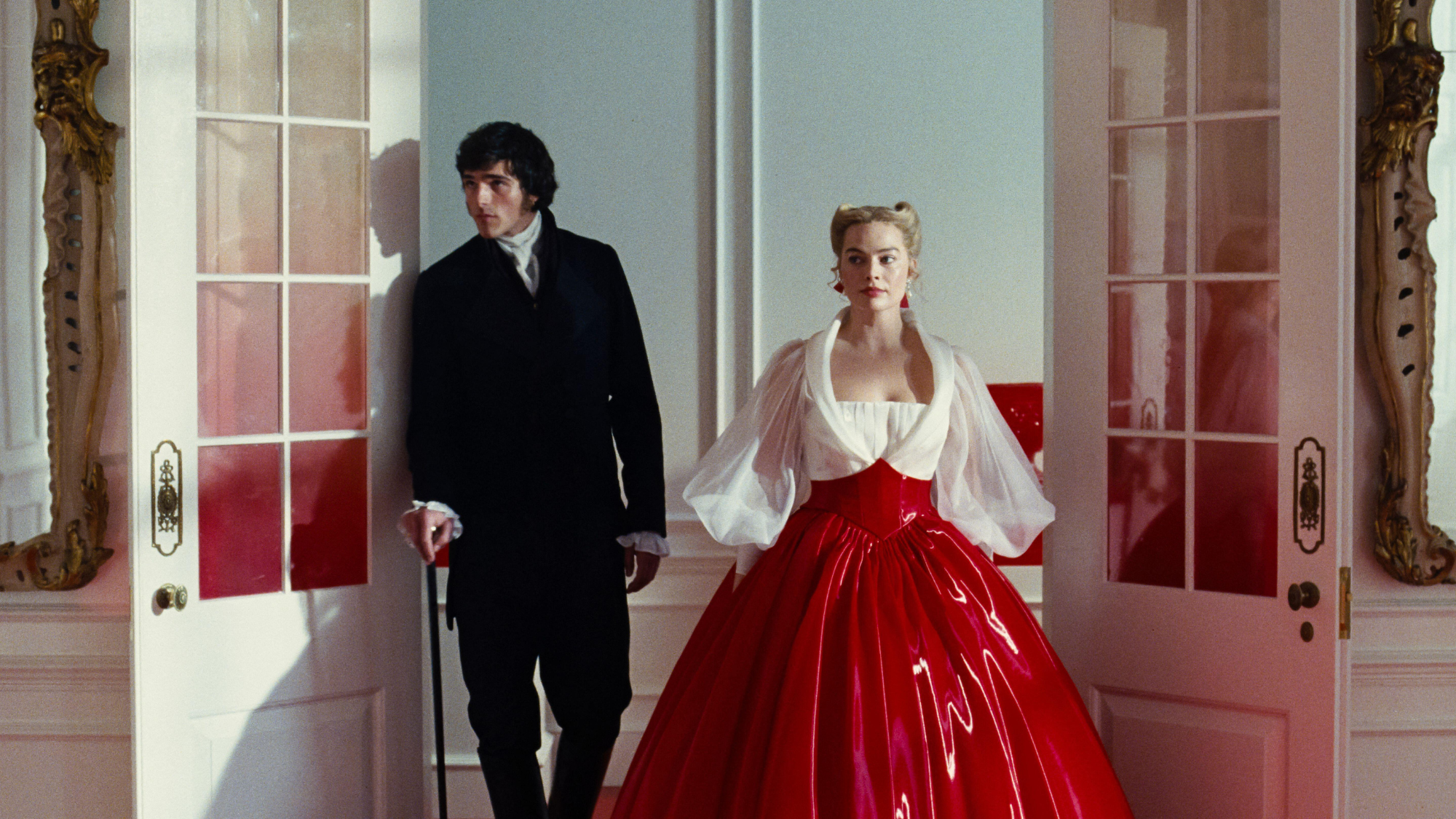

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depth

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depthTalking Point Emerald Fennell splits the critics with her sizzling spin on Emily Brontë’s gothic tale

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting