Why Apple's $3 trillion valuation bodes well for us all

Mega-rich companies are a good sign for America

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Apple becoming the first public company worth $3 trillion — as it did briefly this week before retreating a bit as part of a sell-off in the sector — was great news for its shareholders, of course. Actually, they've been getting lots of great news for a while now. Apple stock has been on quite a tear, hitting a $1 trillion value in 2018, $2 trillion in 2020, and then climbing another 30 percent in the last year thanks to a pandemic-driven surge in demand for iPhones, iPads, and Macbooks. And unlike many other tech companies, Apple was able to adeptly navigate global supply-chain bottlenecks to deliver those products to consumers.

Now, no company is perfect. In a much-watched lawsuit, developer Epic Games accused Apple of running an illegal monopoly through its App Store. And although a federal judge disagreed with that charge in a decision last September, the ruling also concluded Apple has been engaging in unfair competition under California law and should open up the App Store so developers can more easily avoid paying Apple's commissions. So it would be going too far to say that what's good for Apple is always good for America.

But Apple's success has a meaning beyond fat investment returns. That $3 trillion milestone, though temporary, provides opportunity to consider the wider importance of the achievement.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For starters, it's a sign that something is going right in an economy still struggling with the COVID-19 pandemic. While the stock market is not the same as the economy, its ups and downs do say something important about the economy's broad prospects moving forward. Bad times in the economy typically accompany bad times in the stock market. For example: The nearly two-thirds decline in inflation-adjusted S&P 500 from 1968 through 1982, seemed to anticipate the volatile, stagflationary 1970s where real incomes barely budged. A bad 14 years for labor and capital alike.

Now Apple isn't the whole stock market, but it's a pretty good chunk of it. At that $3 trillion valuation, according to The New York Times, Apple accounted for nearly 7 percent of the total value of the S&P 500, breaking IBM's record of 6.4 percent in 1984. It's not crazy to think the condition of this massive consumer-products company — which also directly employs nearly about 100,000 full-time workers in the U.S. and many multiples more through its suppliers and App Store developers — provides a serviceable shorthand for the state of the U.S. economy. Not the only data point, but hardly an insignificant one.

Second, while Apple generates a growing share of its revenue from subscribers to services such as music streaming and on-demand video, it's also a company that still makes stuff. The iPhone is perhaps the best-selling consumer product in history. It would be kind of deflating if the most valuable company generated by the U.S. economy was, say, a social media company that made its money delivering ads.

But Apple works in atoms as well as bits, designing cool-looking products that work well. This is especially important given Washington's kvetching that what Silicon Valley does is profitable but unimportant. Most people think their phones are pretty important, and one factor driving investor enthusiasm is that Apple could enter the car industry within the next five years or so.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Third, Apple is a good if imperfect model of capitalism, American style. America doesn't really do "national champion" companies, businesses gifted a dominant position in their industry by the government. That's more a European thing, especially back in the 1970s. (Recall it was government-controlled British Air and Air France that joined forces to build the now-scuttled Concorde supersonic airliner.)

But Apple is a national champion of sorts in that it's successful in passing the "market test" by creating value through products and services, which is how companies get big and rich in America. This isn't China or Russia where government favor is essential. Indeed, the entire Washington establishment seems to have it out for Big Tech, these days. Apple is setting records nonetheless.

As the saying goes, markets will fluctuate. Stocks will rise and fall. But when the biggest of them are also the most innovative, it says something good about the American economy.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

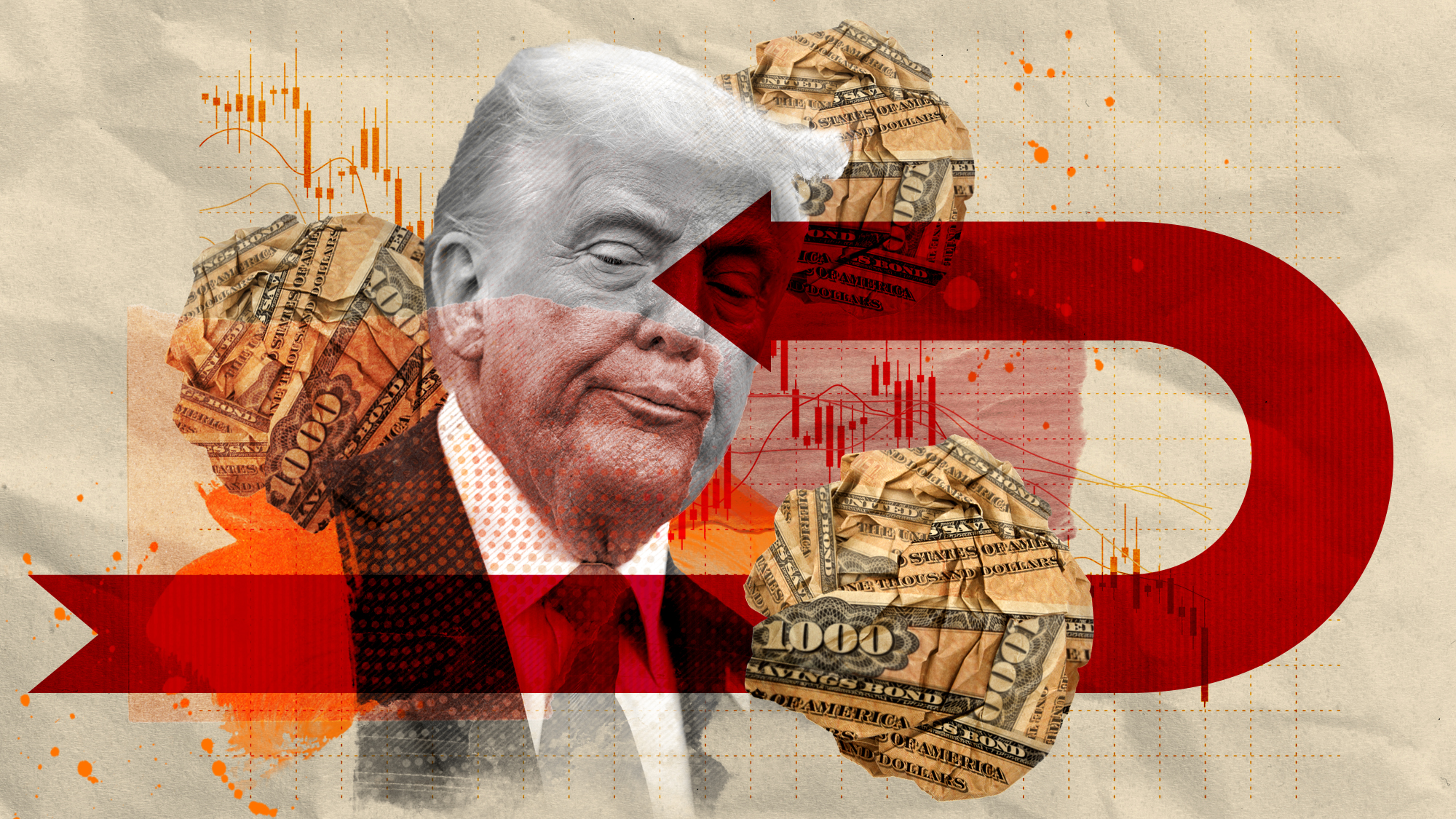

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

The AI bubble and a potential stock market crash

The AI bubble and a potential stock market crashToday's Big Question Valuations of some AI start-ups are 'insane', says OpenAI CEO Sam Altman

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Dollar faces historic slump as stocks hit new high

Dollar faces historic slump as stocks hit new highSpeed Read While stocks have recovered post-Trump tariffs, the dollar has weakened more than 10% this year

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields