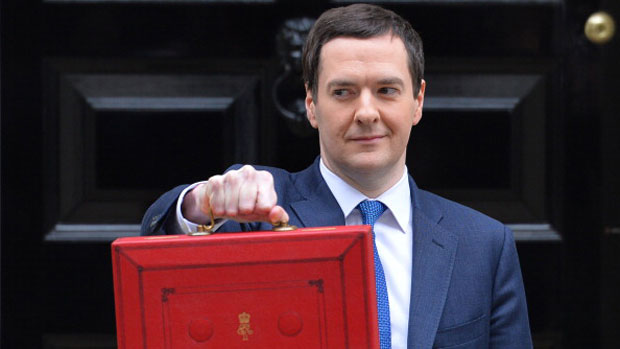

Budget 2014: key points from George Osborne's statement

Beer duty down, tobacco duty up, while savers and pensioners given a helping hand from Treasury

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

PENSIONERS and savers appeared to come out on top as George Osborne delivered his Budget to the House of Commons this afternoon. The Chancellor warned that the nation still does not "invest enough, export enough or save enough" and announced a range of measures for a "resilient economy". Beer duty was cut, tobacco duty hiked and fuel duty was frozen, while tax-free cash Isa limits were increased. Here is a summary of the key points:

Day-to-day costs

- Duty on beer cut by one penny a pint for the second year running. Duty on cider and spirits frozen, and the above-inflation duty escalator for wine abolished.

- The maximum tax-free childcare support increased to £2,000 per year for each child.

- Bingo tax cut from 20 per cent to 10 per cent, but duty on fixed-odds betting terminals raised to 25 per cent.

- Government to invest £140m of new funding to repair damaged flood defences.

- Fuel duty rise planned for September cancelled. Osborne claims this will make petrol 20p lower per litre than it would have been.

- Tobacco duty to rise by two per cent above inflation, making a packet of 20 cigarettes around 28p more expensive.

Economy

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

- Britain's GDP forecast to grow by 2.7 per cent this year and 2.3 per cent next year, then by 2.6 per cent in 2016 and 2017 and by 2.5 per cent in 2018.

- Deficit forecast to be 6.6 per cent of GDP this year and 5.5 per cent in 2014/15. It is then expected to fall to 0.8 per cent by 2017/18, with a surplus of 0.2 per cent in 2018/19.

- Borrowing forecast to be £108bn this year and £95bn next year, leading to a surplus of almost £5bn in 2018/19.

- Around 1.5 million more jobs expected over the next five years, while unemployment set to fall to just over five per cent. Earnings to start growing faster than inflation this year and the national minimum wage for adults will increase by three per cent in October.

Tax

- Tax-free personal allowance to increase from £10,000 to £10,500 in April 2015. This means more than 3.2 million low earners will no longer pay income tax.

- Higher rate income tax threshold to rise from £41,450 to £41,865 next month, and then to £42,285 next year.

- Tax increase for homes owned through companies. The threshold extends from residential properties worth more than £2m to those worth more than £500,000.

- Inheritance tax waived for emergency service workers who give their lives in the line of duty.

- All long-haul flights to carry the lower rate of air duty currently charged on flights to US, while air ambulance fuel duty waived.

Pensions and savings

- From 1 July 2014, savers will be able to put a total of £15,000 a year in cash and/or shares into a tax-free New Isa, which replace the old Isa scheme.

- From June, savers can buy up to £40,000 in Premium Bonds, with double the number of £1m jackpots available.

- Greater flexibility for pensioners, giving people more freedom to choose whether they access their defined contribution pension savings as a lump sum, draw them down over time or buy an annuity.

- A new Pensioner Bond, paying market-leading rates, to be available from January to all people over 65, with interest rates of 2.8 per cent for one-year bonds and 4 per cent for three-year bonds.

Welfare

- Welfare budget to be capped at £119bn for 2015/16 and will rise in line with forecast inflation to £127bn in 2018/19.

Business

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

- Annual investment allowance to be doubled from £250,000 to £500,000 until the end of 2015.

- UK export finance to double its lending scheme to £3bn and cut lending rates by a third to help British businesses reach fast-growing emerging markets, such as Africa, India and China.

- Energy costs to be reduced in a bid to ensure the UK remains a competitive location for manufacturing.

Housing

- Plans to build the new garden city in Ebbsfleet to go ahead, with government hinting that more garden cities will follow.

- Help to Buy scheme extended to 2020. It is expected to help another 120,000 families to buy a new-build home by 2020.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

Autumn Budget: will Rachel Reeves raid the rich?

Autumn Budget: will Rachel Reeves raid the rich?Talking Point To fill Britain’s financial black hole, the Chancellor will have to consider everything – except an income tax rise

-

Pros and cons of a wealth tax

Pros and cons of a wealth taxPros and Cons Raising revenue and tackling inequality vs. the risk of capital flight and reduced competitiveness

-

Is Rachel Reeves going soft on non-doms?

Is Rachel Reeves going soft on non-doms?Today's Big Question Chancellor is reportedly considering reversing controversial 40% inheritance tax on global assets of non-doms, after allegations of 'exodus' of rich people

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

-

What's next for electric vehicles under Trump?

What's next for electric vehicles under Trump?Today's Big Question And what does that mean for Tesla's Elon Musk?

-

The row over UK maternity pay

The row over UK maternity payTalking Points Tory leadership hopeful Kemi Badenoch implied that taxpayer-funded benefit was 'excessive' and called for 'greater responsibility'

-

Will the UK economy bounce back in 2024?

Will the UK economy bounce back in 2024?Today's Big Question Fears of recession follow warning that the West is 'sleepwalking into economic catastrophe'

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight