Saudi Arabia just trolled the global oil market

Here's why OPEC's decision to cut oil prices wasn't serious

Will Russia, Qatar, Venezuela, and Saudi Arabia finally have mercy on the global oil industry?

That was the question raised on Monday, when the four countries announced a tentative deal to freeze their oil output — pursuant to a few as yet unmet conditions, of course.

Up through mid-2014, the price of oil had been cruising along at about $110 per barrel. But problems were brewing: The slowdown in the global economy was cutting demand for oil in China and other developing markets. Meanwhile, the boom in North American shale oil production was driving up supply. And that's not the sort of thing companies can just flip off like a switch: The costs of paying off loans or of maintaining major projects like deepwater drilling can force companies to keep pumping to cover these expenses even when oil prices plunge.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Finally, the Organization of the Petroleum Exporting Countries (OPEC) — which includes Saudi Arabia, Qatar, and Venezuela, and keeps in dialogue with Russia — made an unusual decision. Instead of cutting production to bring supply more in line with demand, they decided to keep boosting production — the explicit point being to drive down the price and knock competitors out of business so they could corner more of the global oil market.

By the end of 2013 supply overtook demand and the global industry began building up big stockpiles of unused oil. Around mid-2014, the financial markets could no longer bridge the gap to sustain prices. The cost of a barrel of oil dropped like a rock, reducing itself by almost two-thirds. It's now bouncing around between $30 and $35 per barrel — the lowest it's been in a decade.

This brings us to the problems with the new deal proposed by Saudi Arabia & Co.

First off, the proposition is to freeze oil production at its January levels. They'd keep pumping, they just wouldn't increase the rate at which they're pumping. But industry experts weren't really expecting Russia, Qatar, and Venezuela to increase production much anyway, since they're already pumping about as fast as their infrastructures can manage.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

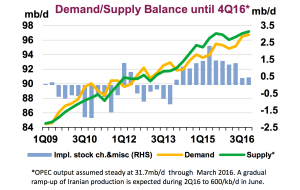

As it stands, OPEC pumped a whopping 32.3 million barrels per day (mb/d) in January. Simply freezing at that rate isn't going to help much, as these December projections from the International Energy Agency (IEA) show:

(Graph from the International Energy Agency's December 2015 Oil Market Report)

The IEA actually assumed a slightly lower rate of OPEC output than what the international group pumped in January, and their projections still show supply (the green line) outpacing demand (the yellow line) at least through the end of 2016's third quarter. This means increases in oil stockpiles (the blue bars, measured on the right axis) will keep happening every quarter. But what's needed is for demand to overtake supply again, so that those blue bars can go negative again and the global industry can draw down the glut of oil stockpiles it's already built up.

"The market does not need a freeze. It needs a reduction," Michael Lynch, president of Strategic Energy and Economic Research in Massachusetts, told The New York Times. "They are not offering anything like that."

This isn't too surprising: Several OPEC nations, such as Saudi Arabia and Venezuela, are so thoroughly dependent on oil to fund their governments and power their economies that they can't really afford to stop pumping regardless of the price.

There are other wrinkles, too. The deal only holds "if other producers join this initiative," according to the Russian Energy Ministry. And neither Iran nor Iraq — both OPEC members — were among the initial four floating the idea.

Iraq is also already pumping about as fast as it can. And Iran is looking to ramp up: Its oil production was already slumping when sanctions were imposed on its exports in 2012. That drove Iranian production even lower, and it hasn't recovered since. Thanks to the nuclear deal, the sanctions were lifted last month, and Iran has made it clear they want to return to their pre-sanction rates of oil production. (IEA's projections assumed a ramp up in Iranian production as well.)

In short, even if the deal goes through, the main thing it might head off is an extra 0.73 mb/d from Iran. And that's nowhere close to what's needed to stabilize the price of oil. And the deal probably won't go through anyway, unless Saudi Arabia, Russia, Qatar, and Venezuela can convince Iran to swallow its pride.

At this point, the deal doesn't look like much more than Saudi Arabia & Co. trolling the global oil market.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Why is Trump’s alleged strike on Venezuela shrouded in so much secrecy?

Why is Trump’s alleged strike on Venezuela shrouded in so much secrecy?TODAY'S BIG QUESTION Trump’s comments have raised more questions than answers about what his administration is doing in the Southern Hemisphere

-

Vance’s ‘next move will reveal whether the conservative movement can move past Trump’

Vance’s ‘next move will reveal whether the conservative movement can move past Trump’Instant Opinion Opinion, comment and editorials of the day

-

Why recognizing Somaliland is so risky for Israel

Why recognizing Somaliland is so risky for IsraelTHE EXPLAINER By wading into one of North Africa’s most fraught political schisms, the Netanyahu government risks further international isolation

-

How Bulgaria’s government fell amid mass protests

How Bulgaria’s government fell amid mass protestsThe Explainer The country’s prime minister resigned as part of the fallout

-

Femicide: Italy’s newest crime

Femicide: Italy’s newest crimeThe Explainer Landmark law to criminalise murder of a woman as an ‘act of hatred’ or ‘subjugation’ but critics say Italy is still deeply patriarchal

-

Brazil’s Bolsonaro behind bars after appeals run out

Brazil’s Bolsonaro behind bars after appeals run outSpeed Read He will serve 27 years in prison

-

Americans traveling abroad face renewed criticism in the Trump era

Americans traveling abroad face renewed criticism in the Trump eraThe Explainer Some of Trump’s behavior has Americans being questioned

-

Nigeria confused by Trump invasion threat

Nigeria confused by Trump invasion threatSpeed Read Trump has claimed the country is persecuting Christians

-

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime minister

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime ministerIn the Spotlight Takaichi is a member of Japan’s conservative, nationalist Liberal Democratic Party

-

Russia is ‘helping China’ prepare for an invasion of Taiwan

Russia is ‘helping China’ prepare for an invasion of TaiwanIn the Spotlight Russia is reportedly allowing China access to military training

-

Interpol arrests hundreds in Africa-wide sextortion crackdown

Interpol arrests hundreds in Africa-wide sextortion crackdownIN THE SPOTLIGHT A series of stings disrupts major cybercrime operations as law enforcement estimates millions in losses from schemes designed to prey on lonely users