How to fix Venezuela

The South American country's economy is a mess. Here's how to clean it up.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Venezuela is an absolute mess.

The South American nation has been crippled by debilitating power outages, collapsing public services, enormous poverty rates, and a massive crime wave. Large numbers of infants have died because hospitals lack basic medicine and equipment. Indeed, Venezuela faces shortages of nearly every basic good you can imagine, and is projected to have hyperinflation of more than 700 percent in 2016.

Is it any wonder that American intelligence observers are worried Venezuela could collapse into revolt before its next election?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are two basic storylines for what went wrong. The first, which you hear in America, is that Venezuela's government is being run by socialists, and socialism is bad. The second, which you hear from the ruling Socialist Unity Party and President Nicolas Maduro — who took over from the late Hugo Chávez — is that Venezuela is being screwed by a hazy something-or-other called "external and foreign aggressions against our country."

But as Mark Weisbrot — the co-director of the Center for Economic Policy Research, who has written extensively on Venezuela and Latin America — explained to The Week, the main reason for Venezuela's troubles is likely a lot more technocratic, and a lot more banal: Namely, their currency exchange system is a mess.

Venezuela isn't quite as socialist as many people assume. The government does run the country's oil industry, and it gets a bit over half its revenue from international oil sales. But the rest of its revenue comes from taxes, just like in America. The government employs about 20 percent of Venezuela's workforce, which is actually a smaller portion than you see in many major European countries, and is roughly the same as you'd find in France. "It's not Cuba," as Weisbrot put it.

Now, consider Venezuela's currency exchange system, which governs how much Venezuela's currency — the bolívar — trades for against other currencies — most importantly the U.S. dollar. A functional currency exchange system is important because it allows all the various parts of a country's economy to exist in dynamic equilibrium with the flow of goods and services coming in from outside the country; it allows the domestic economy to adapt and rebalance as flows of exports and imports change.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

America has a floating exchange rate. The dollar isn't pegged to anything, like another currency or the value of gold. So how much of another currency you get in exchange for a dollar "floats" up and down all the time, reacting to countless forces in the market.

Venezuela's system, by contrast, is a dysfunctional mess. The country's official exchange rate is pegged to the dollar — specifically, it's 10 bolívares for $1. So no matter what happens, whenever the government does business with anyone, it gets or gives 10 bolívares for every $1.

But there's also an enormous black market currency exchange. This is where the hyperinflation is coming from: The number of bolívares you can get for $1 on the black market has rocketed up to well over 1,000, and may go considerably higher.

This causes no end of problems. The black market inflation raises the price of imports for basic goods, which drives the government to clamp down with rationing and price controls, which causes shortages, which drives more people into the black market, which drives the black market exchange rate ever higher and feeds further inflation. It leads to rampant theft and corruption, because if you can get your hands on U.S. dollars you can make a killing in bolívares. It causes people to engage in all sorts of economically irrational behavior, like stockpiling dollars for their own sake because they're the only stable store of value; or taking real goods and commodities out of Venezuela to sell them elsewhere for U.S. dollars, so they can return to Venezuela with those dollars and make a killing.

For the government, the situation creates a needless fiscal deficit. The government sells oil on the international market and generally gets U.S. dollars in exchange, and then it sells those U.S. dollars to people in Venezuela, since Venezuela's economy relies heavily on imports denominated in U.S. dollars for so many everyday goods. But of course, the government only gets 10 bolívares back for each $1. Which isn't enough to balance its finances.

Fixing Venezuela's problems — or at least the crucial first step — is thus relatively straightforward, Weisbrot argues: Unify the exchange system into one floating rate that everyone, including the government, uses. This would allow the government to get its fiscal house in order, and give Venezuelans a stable place to go to trade in the country's own currency.

Because of the rampant dysfunction and currency speculation in the black market, it's hard to know the "real" market value of the bolívar. But Weisbrot figures Venezuela's currency would stabilize around a few hundred bolívares for every dollar.

Once that's done, Venezuela would need to put a system of cash aid in place so its citizens can afford to buy basic necessities like food. And it would need to eliminate the rationing and price control regulations, which really do play havoc with the market.

Finally, Venezuela's government should invest in new and different industries that would allow the country to diversify away from oil. There's no reason for Venezuela to rely so heavily on imports for food — it got 24 percent of its food from abroad in 2011, the last year for which data is available — and relying on imports for basic necessities has of course interacted horribly with the currency system's problems.

Unfortunately, moving to a unified floating exchange system is unpopular with the Venezuelan public, precisely because it would involve a one-time but very big drop in the official value of the bolívar against the dollar.

Still, it's worth remembering that Venezuela's problems are not really what either the country's own president or his American critics would have you believe.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

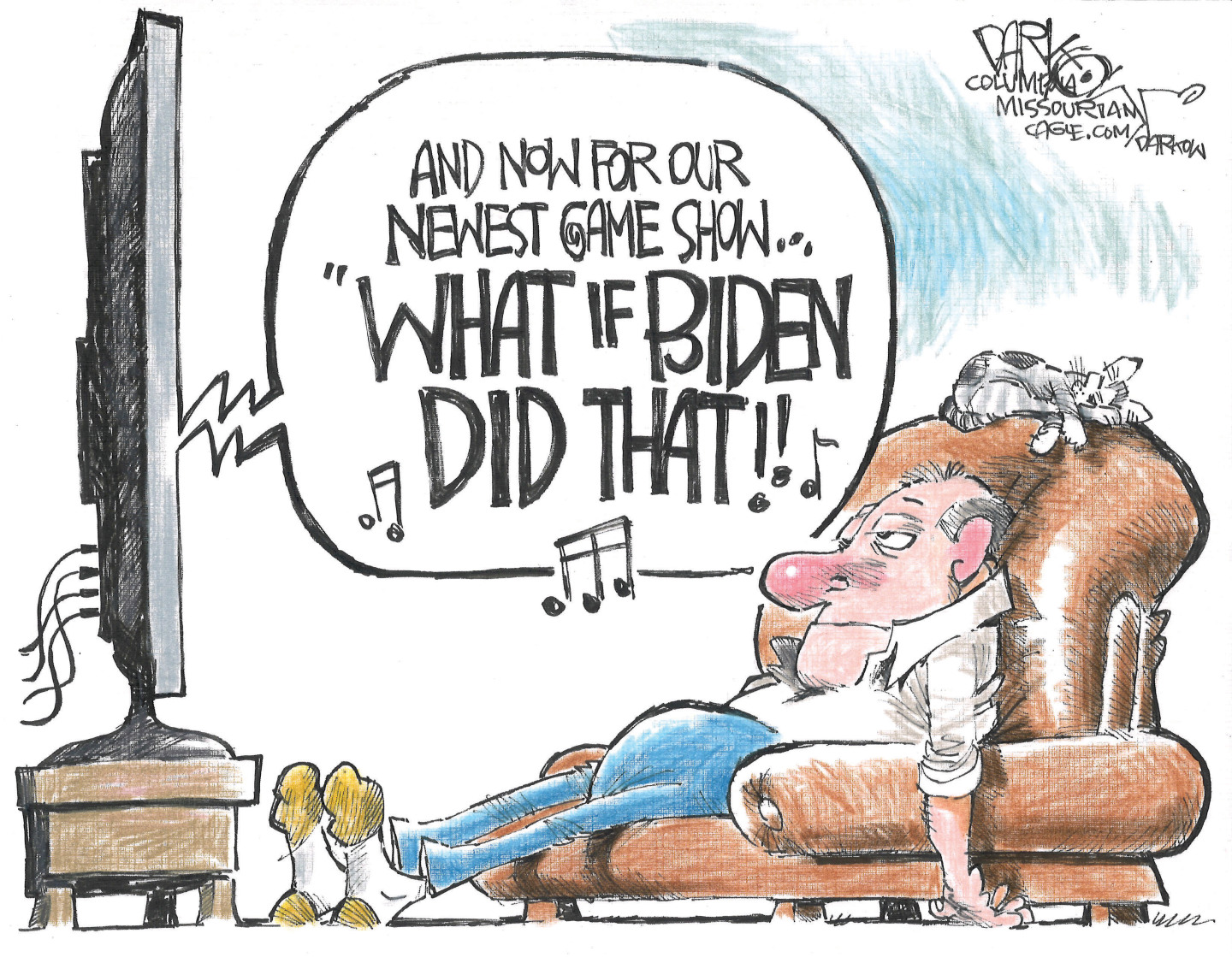

Political cartoons for February 13

Political cartoons for February 13Cartoons Friday's political cartoons include rank hypocrisy, name-dropping Trump, and EPA repeals

-

Palantir's growing influence in the British state

Palantir's growing influence in the British stateThe Explainer Despite winning a £240m MoD contract, the tech company’s links to Peter Mandelson and the UK’s over-reliance on US tech have caused widespread concern

-

Quiz of The Week: 7 – 13 February

Quiz of The Week: 7 – 13 FebruaryQuiz Have you been paying attention to The Week’s news?

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military