The Republican tax bill is an assault on American values

This bill was written by the landed aristocracy, for the landed aristocracy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

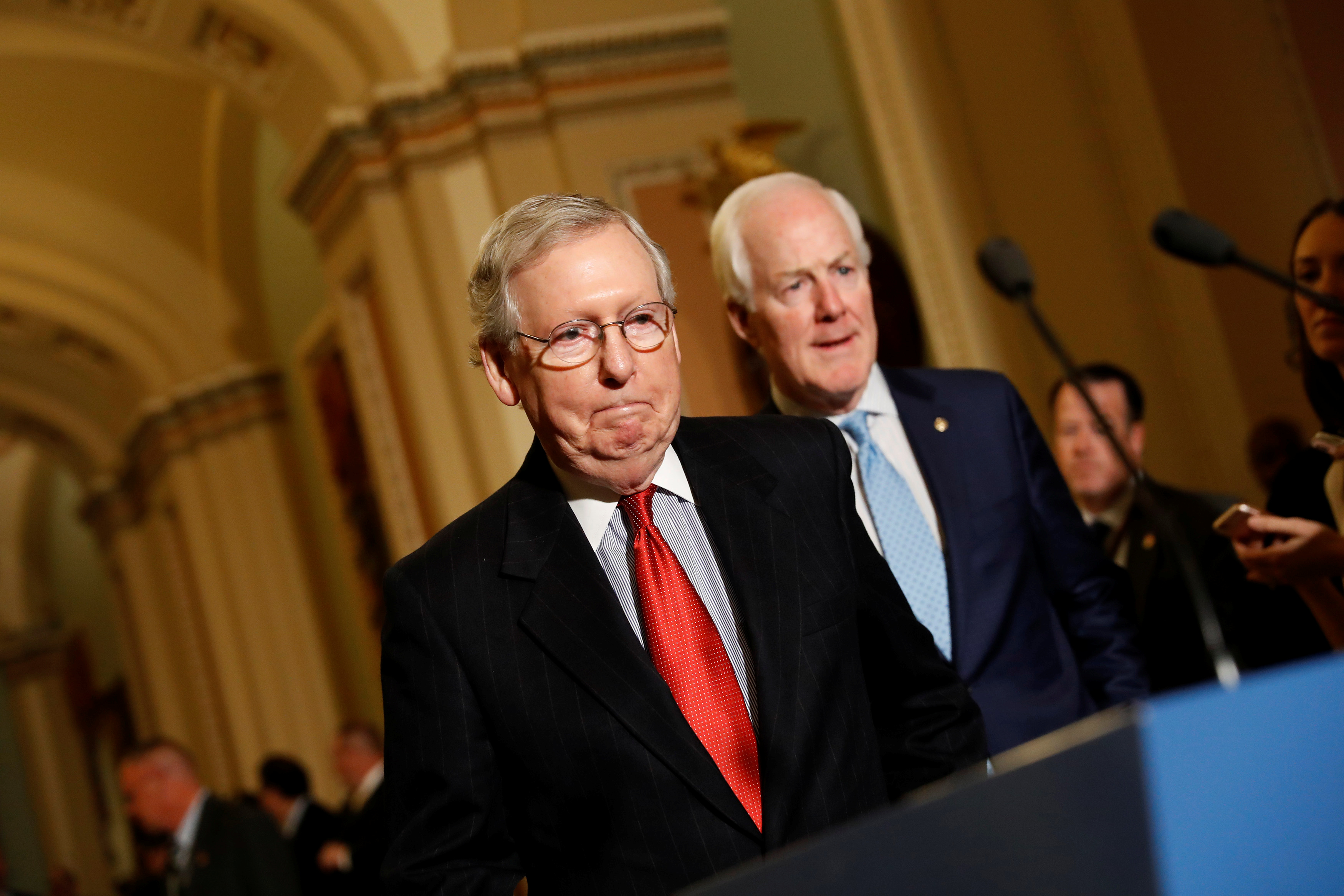

In the dead of night, the Republican tax bill passed the Senate on a party-line 51-49 vote, with Sen. Bob Corker (R-Tenn.) the lone dissenting Republican. It will now either have to be reconciled with the already passed House bill, and passed again by both chambers, or simply passed by the House as is and sent on to President Trump.

But regardless of the coming parliamentary procedural hurdles, the lessons of Friday's vote are clear: Some version of this tax bill is going to become law. And that is very bad for America.

It's almost wrong to call this legislative monstrosity a tax bill at all. It is more a top-to-bottom restructuring of American society — one which is a sharp attack on several bedrock American values: education, homeownership, and entrepreneurship.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

One of the cherished myths of conservatism as a political ideology is that it is about preserving existing society in more or less its current form — that if reform must be had, it should be gradual and not too disruptive. As Michael Oakeshott famously wrote, "To be conservative, then, is to prefer the familiar to the unknown, to prefer the tried to the untried, fact to mystery, the actual to the possible, the limited to the unbounded, the near to the distant, the sufficient to the superabundant, the convenient to the perfect, present laughter to utopian bliss."

As Corey Robin writes in The Reactionary Mind, this is a total crock and always has been. Conservatism is rooted in the felt experience of having power, losing it, and trying to get it back by any means necessary. That's the story from the French Revolution to the current day.

American conservatives have routinely supported violently disruptive counterrevolutionary acts to stamp out movements of liberation and force the lower orders back into a coercive hierarchy. That's the story of the Confederacy, it's the story of white supremacist "Redeemers" who overthrew Reconstruction and built Jim Crow, it's the story of the Reagan Republicans who leveraged racial resentment to tear up the New Deal, and it's the story of this bill.

The biggest single goal of this bill is a huge tax cut for the top 1 percent. The bill slashes taxes on corporations, increases tax benefits for foreign dividends, and cuts taxes for "pass-through" corporations (which will immediately become the new hotness in tax shelter legal chicanery). Ultra-wealthy heirs get a particular bonus through the abolishment of the inheritance tax. All that will be partially paid for by jacking up taxes on graduate students by up to 400 percent, limiting homeownership tax benefits, repealing the ObamaCare individual mandate, changing inflation calculations to increase taxes more broadly, and by cutting the deduction for state and local taxes (though Susan Collins got some of it restored). Future deficits created by these cuts will almost certainly require large cuts to Medicare and Medicaid.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Some of the tax benefits the GOP is attacking are actually somewhat bad — the mortgage interest deduction, for instance, is a ludicrously rich-tilted subsidy. But it was at least aimed at the traditional American value of homeownership, and did help a nontrivial number of middle-class Americans. The GOP bill sharply reduces this benefit and gives the proceeds to Eric Trump and Co.

The bill is an attack on homeownership, education, entrepreneurs, and the middle class, all to benefit the owners of existing huge businesses — especially people who inherit them. Forget entrepreneurial startups. Republicans are all about handing as much money as possible to the third- and fourth-generation idle rich. It is a bill written by the landed aristocracy, for the landed aristocracy.

This conservative radicalism and contempt for precedent can be seen not only in the god-awful content of the bill, but also in the way it was passed. At every point Republicans relied on lies, concealment, and trampling over traditional democratic deliberation. They held no hearings, they had no official score from the Joint Committee on Taxation (the JCT scored an earlier draft, but not the most recent one, especially not a slew of last-minute giveaways to corporations and hedge fund managers) — indeed, they did not even release the final text until the last possible moment. House Speaker Paul Ryan lied constantly about its contents. Treasury Secretary Steven Mnuchin repeatedly promised an analysis "showing" that the bill would not increase the deficit by turbo-charging growth. This was such a preposterous lie that he didn't even bother faking the numbers. The secrecy prevented people from examining how it is stuffed full of quiet corporate handouts, only some of which have been discovered — like a big one to General Electric.

This bill will explode the deficit. And make no mistake, when it does, Republicans (and deficit scolds, who have been notably quiet up to now) are going to immediately start demanding cuts to Social Security, Medicare, and Medicaid — indeed, under congressional rules Medicare is due for a $25 billion cut in 2018 alone.

Let us hear no more about how Republicans are the defenders of traditional American values. They are about strip-mining the citizenry to give as much money as possible to rich people. There is no other coherent explanation for this bill.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.