China's citizens aren't panicking over the market crash. The BBC explains why investors are.

China's stock market fell so far on Monday that the Western media has dubbed it Black Monday. On Tuesday, the benchmark Shanghai composite index opened 6.4 percent lower than Monday's depressed close, suggesting more turmoil to come. But inside China, "there's little sign of public panic," reports John Sudworth at BBC News. In Beijing, the view among the people on the street is that "this is a bubble that needed to pop."

Investors around the world are not so sanguine. Part of the problem, Sudworth explains in the video below, is that "China's real is economy is facing strong headwinds." Adding to the concern is that China has been trying everything to prop up its economy, to no avail. "China's Communist Party is learning the hard way about the limits of its ability to control its giant economy, and that's partly what's spooking the markets." Maybe the Chinese will become more concerned, too, when their pension funds start playing the markets, as China just allowed. Watch the whole BBC News report below. Peter Weber

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

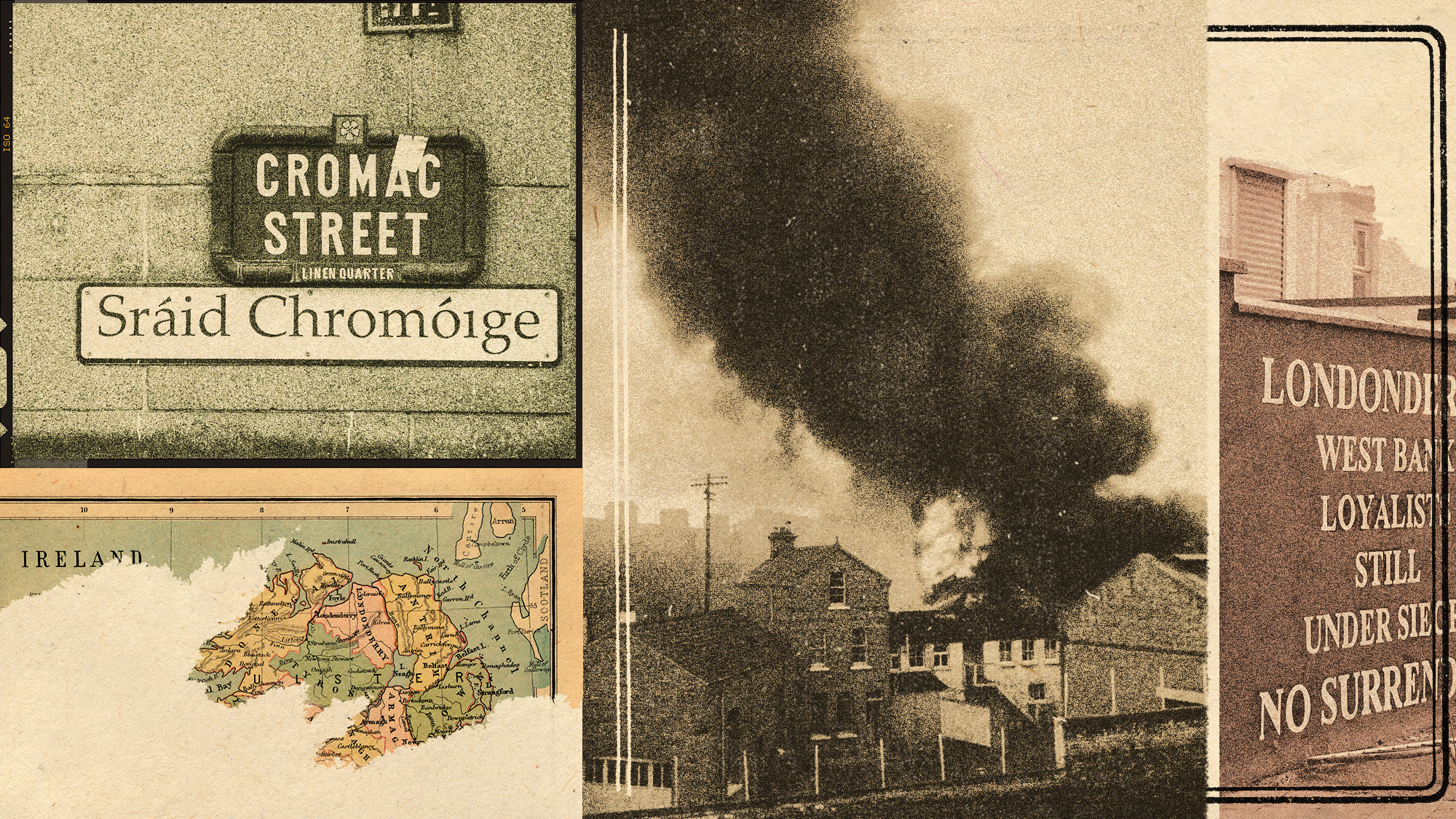

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting