The GOP tax plan would ax the deduction for student loan interest

House Republicans released their tax overhaul plan Thursday, proposing a number of major changes to the decades-old code. Part of the bill, for example, calls for the elimination of so-called "special interest deductions," such as a tax credit for adopting children or an "itemized deduction for medical expenses, a crucial provision to households with extraordinary health-care costs," The Wall Street Journal writes.

The special interest deductions category also includes the deduction for student-loan interest. As the rules stand now, qualifying individuals are able to deduct up to $2,500 in interest paid toward federal and private student loans, CNBC reports. While there are certain income restrictions that go along with that, the deduction as it stands now counts as "above-the-line," applying directly to taxable income. In 2015, 12 million people used the student loan interest deduction on their 1040 forms.

For most people, the loss of the deduction under the GOP bill, if it passes, won't be a huge hit. It will affect graduate students or undergrads with exceptional student loan debt and low incomes much more: To hit the $2,500 interest cap, a borrower would need to have $54,000 in undergraduate debt. Otherwise, CNBC writes that "looking at … 2015 IRS records, the average amount of interest is roughly $1,100, saving someone in the 25 percent tax bracket about $275."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Still, that's not an insignificant amount of money to someone freshly out of college — it's the equivalent of almost 15 avocado toasts. Read more about what the GOP tax plan means for people with student loans at CNBC.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeva Lange was the executive editor at TheWeek.com. She formerly served as The Week's deputy editor and culture critic. She is also a contributor to Screen Slate, and her writing has appeared in The New York Daily News, The Awl, Vice, and Gothamist, among other publications. Jeva lives in New York City. Follow her on Twitter.

-

Trump’s budget bill will increase the deficit. Does it matter?

Trump’s budget bill will increase the deficit. Does it matter?Today's Big Question Analysts worry a 'tipping point' is coming

-

Film reviews: The Phoenician Scheme, Bring Her Back, and Jane Austen Wrecked My Life

Film reviews: The Phoenician Scheme, Bring Her Back, and Jane Austen Wrecked My LifeFeature A despised mogul seeks a fresh triumph, orphaned siblings land with a nightmare foster mother, and a Jane fan finds herself in a love triangle

-

Music reviews: Tune-Yards and PinkPantheress

Music reviews: Tune-Yards and PinkPantheressFeature "Better Dreaming" and "Fancy That"

-

Crypto firm Coinbase hacked, faces SEC scrutiny

Crypto firm Coinbase hacked, faces SEC scrutinySpeed Read The Securities and Exchange Commission has also been investigating whether Coinbase misstated its user numbers in past disclosures

-

Starbucks baristas strike over dress code

Starbucks baristas strike over dress codespeed read The new uniform 'puts the burden on baristas' to buy new clothes, said a Starbucks Workers United union delegate

-

Warren Buffet announces surprise retirement

Warren Buffet announces surprise retirementspeed read At the annual meeting of Berkshire Hathaway, the billionaire investor named Vice Chairman Greg Abel his replacement

-

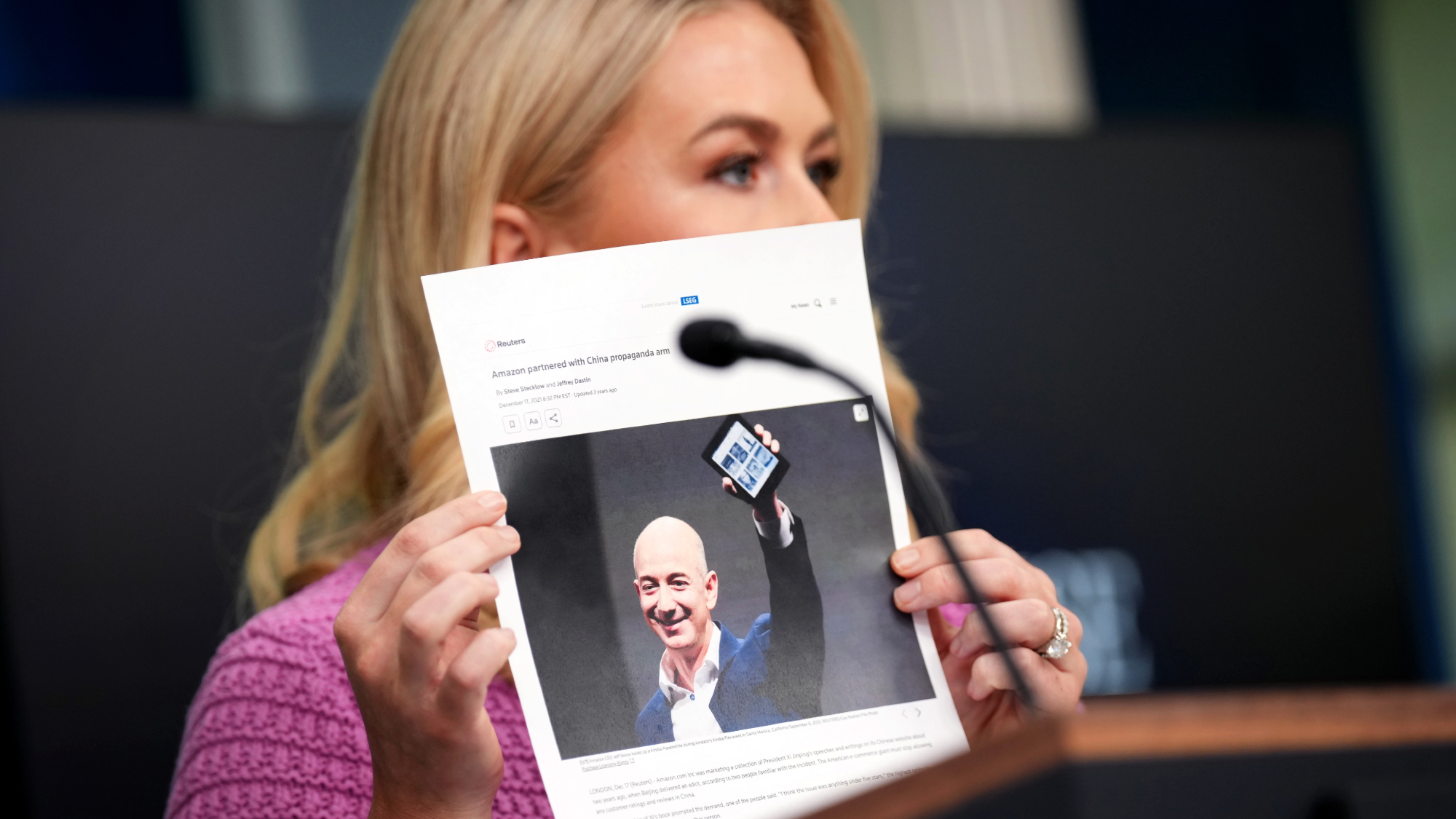

Trump calls Amazon's Bezos over tariff display

Trump calls Amazon's Bezos over tariff displaySpeed Read The president was not happy with reports that Amazon would list the added cost from tariffs alongside product prices

-

Markets notch worst quarter in years as new tariffs loom

Markets notch worst quarter in years as new tariffs loomSpeed Read The S&P 500 is on track for its worst month since 2022 as investors brace for Trump's tariffs

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

-

Crafting emporium Joann is going out of business

Crafting emporium Joann is going out of businessSpeed Read The 82-year-old fabric and crafts store will be closing all 800 of its stores

-

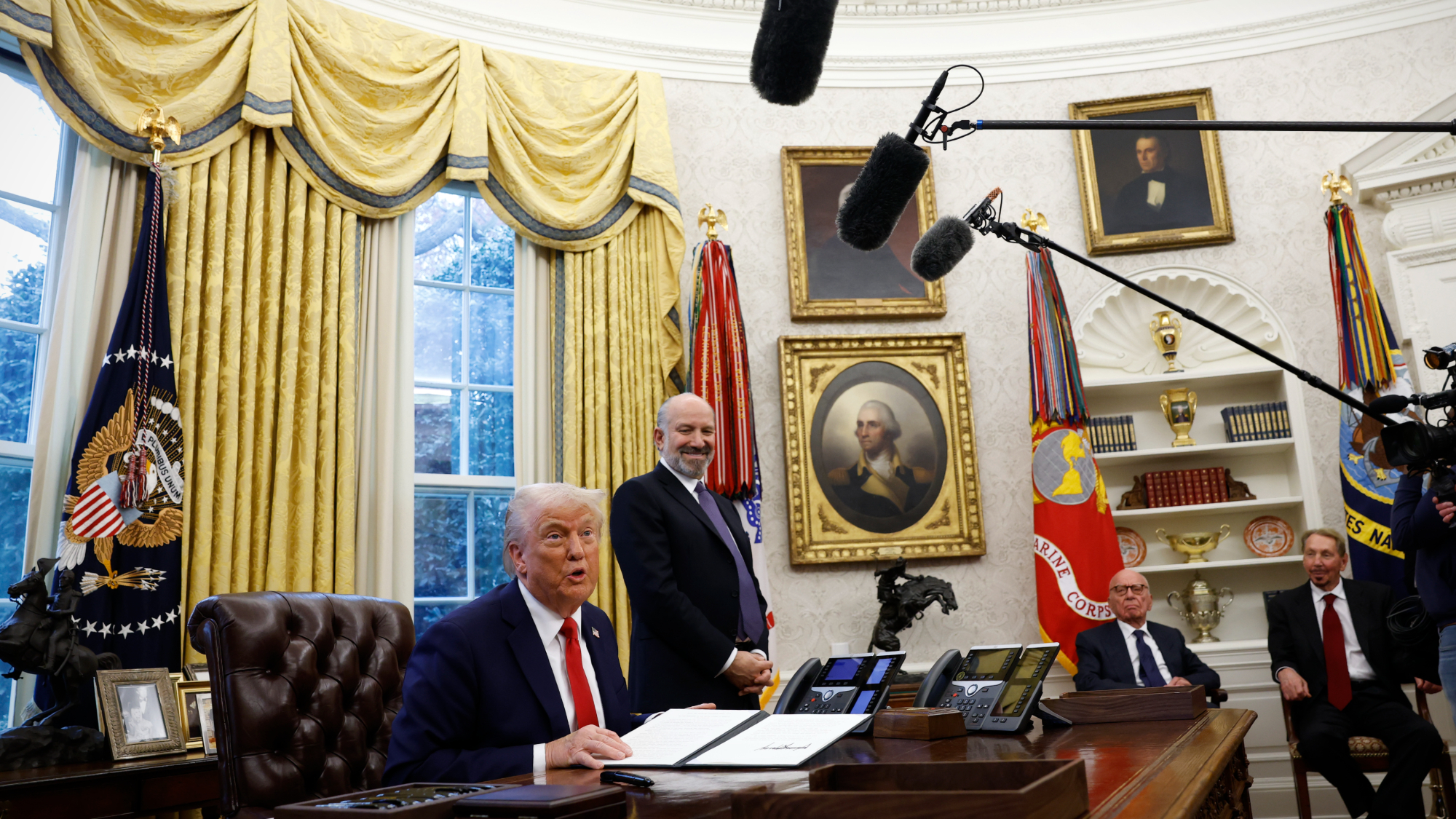

Trump's China tariffs start after Canada, Mexico pauses

Trump's China tariffs start after Canada, Mexico pausesSpeed Read The president paused his tariffs on America's closest neighbors after speaking to their leaders, but his import tax on Chinese goods has taken effect