Senate passes bill that eases Dodd-Frank rules for banks

The Senate on Wednesday voted 67-31 for a bill that would ease some rules on banks that were enacted after the 2008 financial crisis.

Dodd-Frank was signed into law in 2010, put into place to prevent another financial meltdown, and liberal Democrats argued that the new bill, sponsored by Sen. Mike Crapo (R-Idaho), increases the likelihood of another financial catastrophe. Under the bill, banks with less than $10 billion in assets would be exempt from a rule that bans institutions from stock trading for their own profit and the largest banks would no longer have to undergo a yearly stress test conducted by the Federal Reserve. There are also some consumer protections, including offering free credit monitoring to active-duty military members.

Crapo said the bill was "designed to protect community banks and credit unions, and that's why we have such bipartisan support for it." It's unclear how the bill will hold up in the House, but President Trump has said he will sign it.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

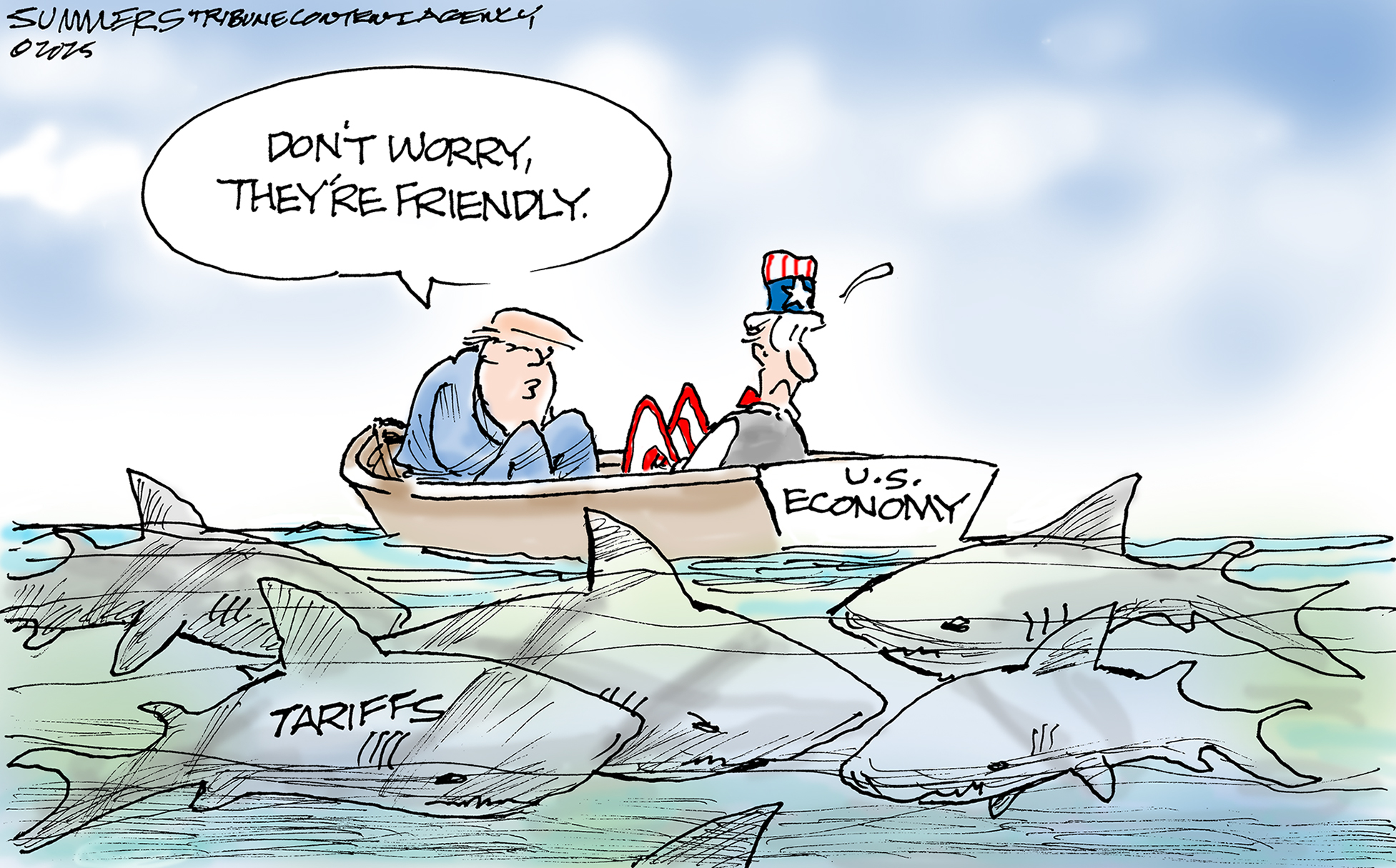

Today's political cartoons - May 11, 2025

Today's political cartoons - May 11, 2025Cartoons Sunday's cartoons - shark-infested waters, Mother's Day, and more

-

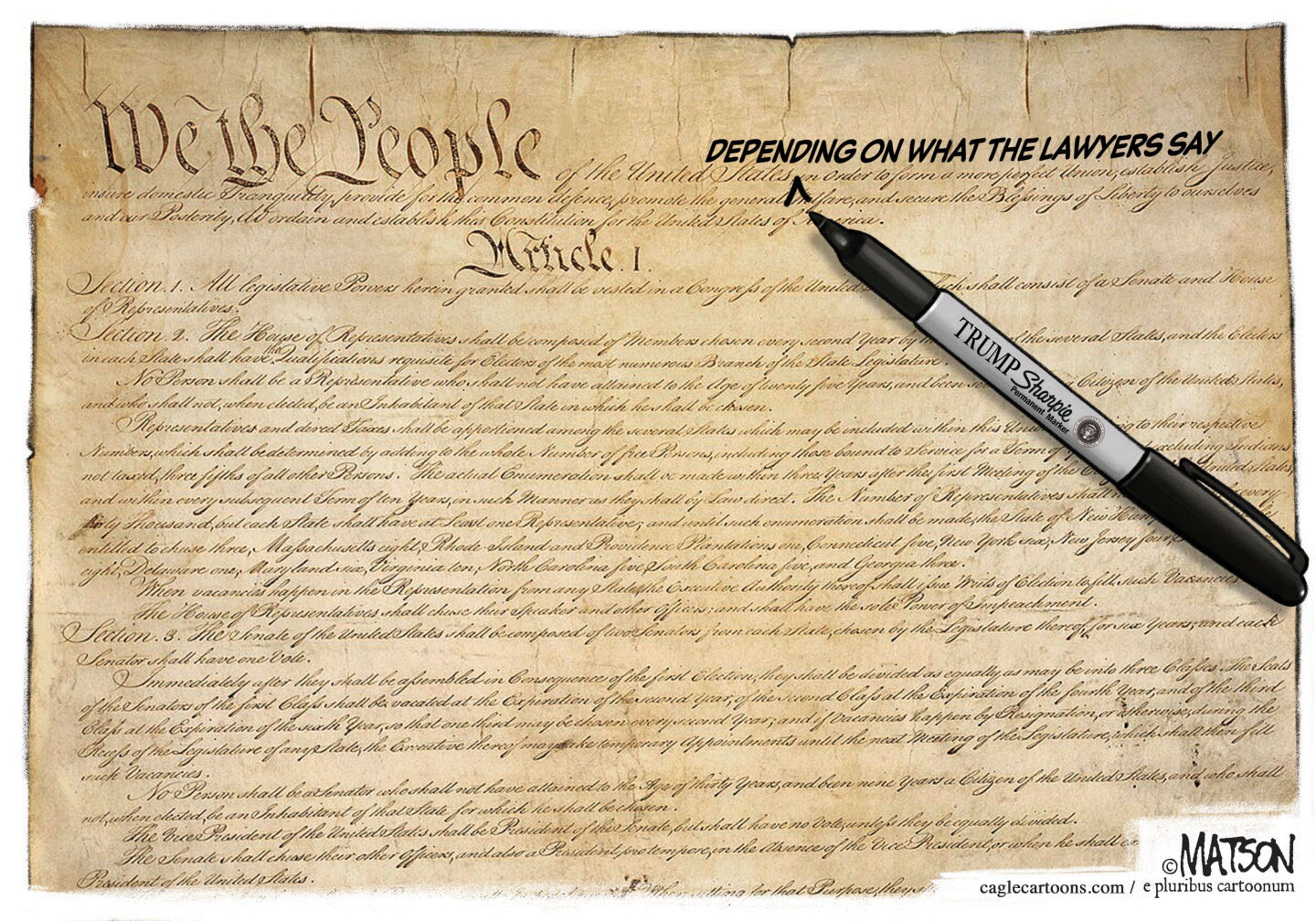

5 fundamentally funny cartoons about the US Constitution

5 fundamentally funny cartoons about the US ConstitutionCartoons Artists take on Sharpie edits, wear and tear, and more

-

In search of paradise in Thailand's western isles

In search of paradise in Thailand's western islesThe Week Recommends 'Unspoiled spots' remain, providing a fascinating insight into the past

-

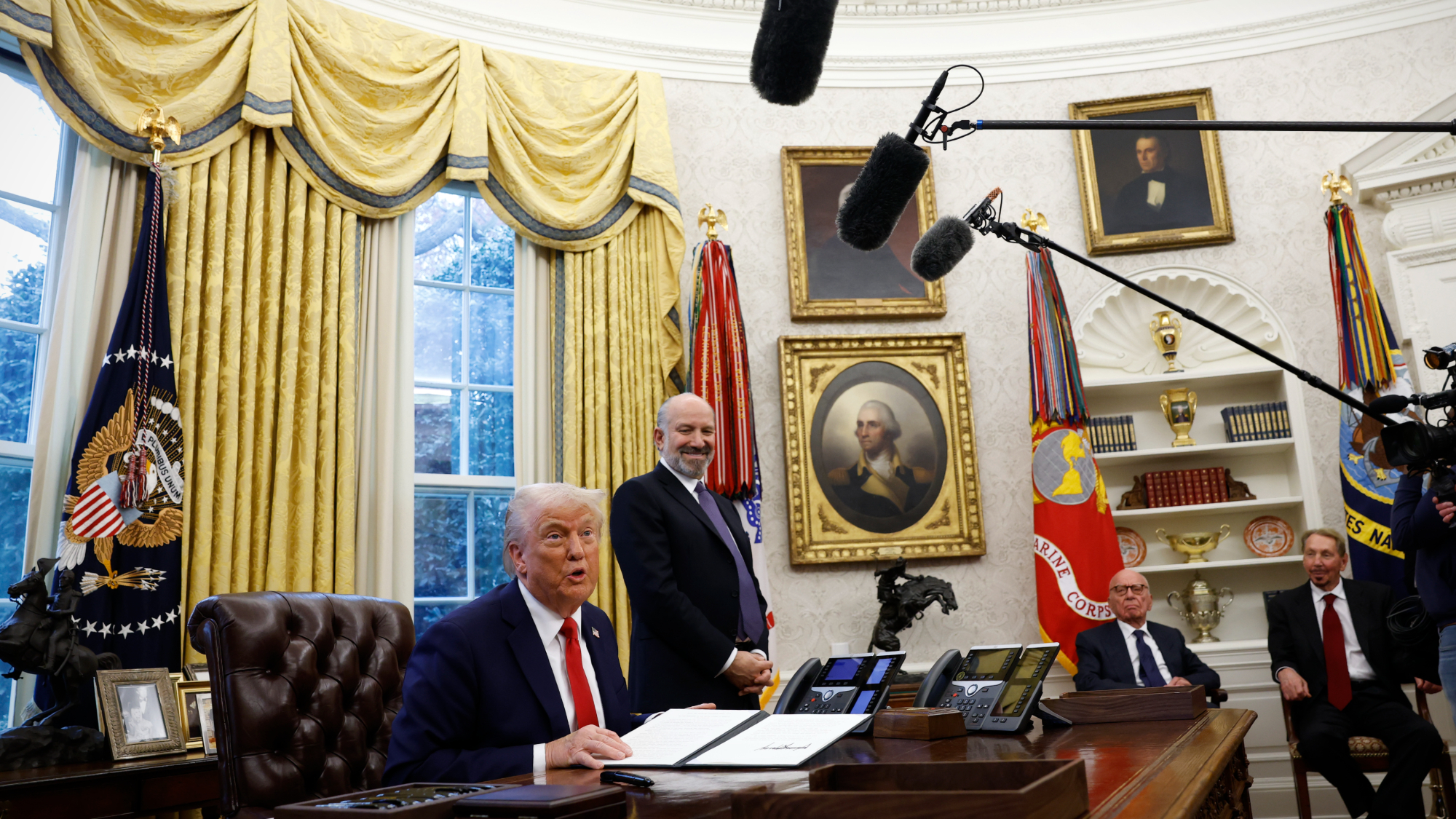

Warren Buffet announces surprise retirement

Warren Buffet announces surprise retirementspeed read At the annual meeting of Berkshire Hathaway, the billionaire investor named Vice Chairman Greg Abel his replacement

-

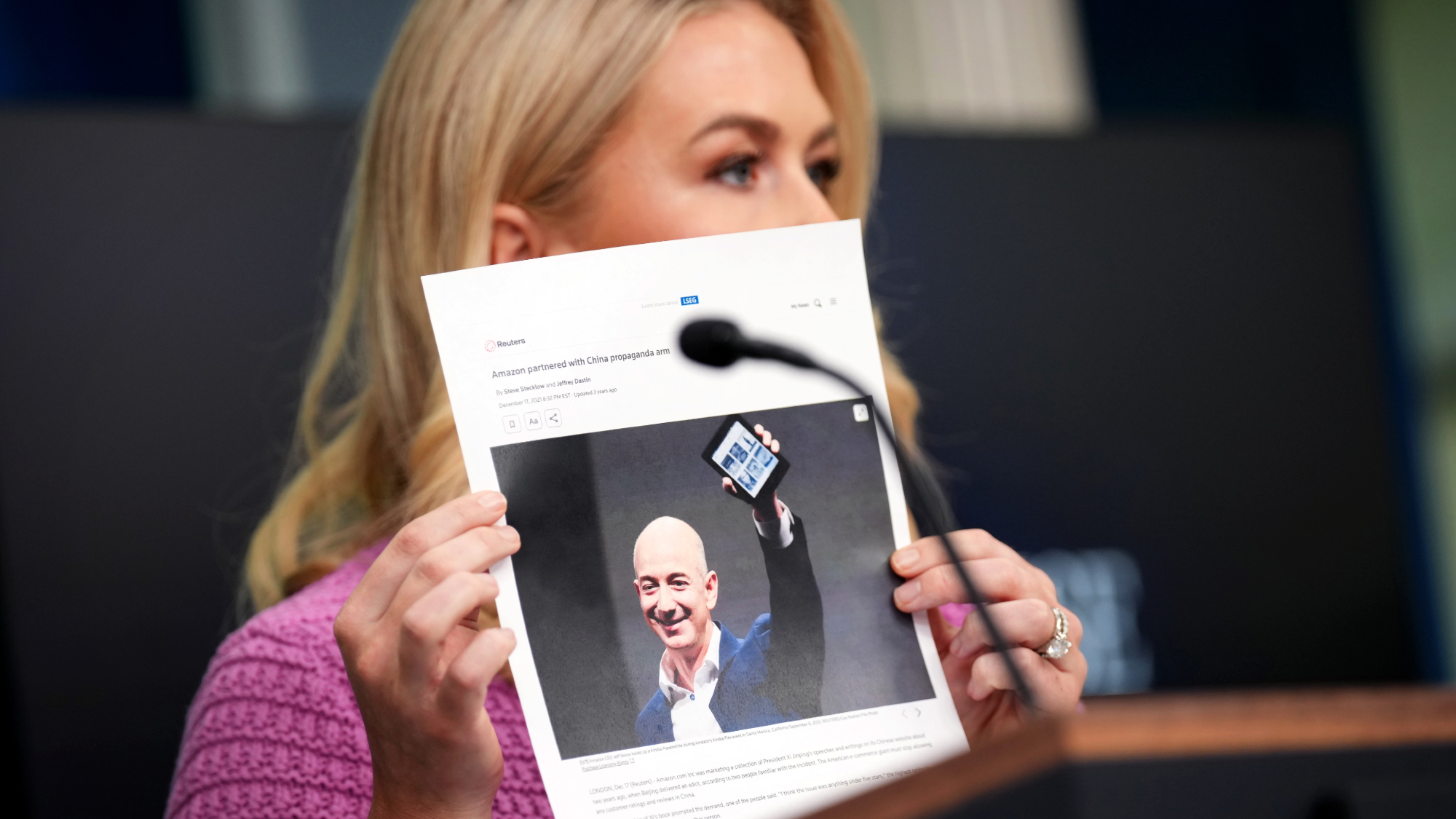

Trump calls Amazon's Bezos over tariff display

Trump calls Amazon's Bezos over tariff displaySpeed Read The president was not happy with reports that Amazon would list the added cost from tariffs alongside product prices

-

Markets notch worst quarter in years as new tariffs loom

Markets notch worst quarter in years as new tariffs loomSpeed Read The S&P 500 is on track for its worst month since 2022 as investors brace for Trump's tariffs

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

-

Crafting emporium Joann is going out of business

Crafting emporium Joann is going out of businessSpeed Read The 82-year-old fabric and crafts store will be closing all 800 of its stores

-

Trump's China tariffs start after Canada, Mexico pauses

Trump's China tariffs start after Canada, Mexico pausesSpeed Read The president paused his tariffs on America's closest neighbors after speaking to their leaders, but his import tax on Chinese goods has taken effect

-

Chinese AI chatbot's rise slams US tech stocks

Chinese AI chatbot's rise slams US tech stocksSpeed Read The sudden popularity of a new AI chatbot from Chinese startup DeepSeek has sent U.S. tech stocks tumbling

-

US port strike averted with tentative labor deal

US port strike averted with tentative labor dealSpeed Read The strike could have shut down major ports from Texas to Maine