US stock market hits record high on trade war optimism

S&P touches new heights as Trump says phase one will be signed earlier than thought

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The S&P 500 index opened at a new all-time high after positive comments from both sides of the US-China trade war.

On an upbeat day on Wall Street, the S&P 500 gained 15 points or 0.4% to hit 3,038 points, a new record level.

Meanwhile, the Dow Jones industrial average opened higher, up 112 points or 0.4%, while the tech-focused Nasdaq index gained 0.5%.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

US President Donald Trump had earlier told reporters he expected to ink a significant part of the trade deal with China earlier than expected.

“We are looking probably to be ahead of schedule to sign a very big portion of the China deal, we’ll call it phase one but it’s a very big portion,” he said.

Earlier, China’s commerce ministry had said that technical talks about the phase one trade deal text with Washington were “basically completed”.

Neil Wilson of Markets.com said that stock market “bulls” were pushing Wall Street higher. He said it’s a “remarkable achievement against faltering corporate earnings, a festering (if not quite total) trade war, and softer macro data everywhere you look”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Urging a degree of caution, he added that: “the bar on a US-China trade deal had been set so low that the market seems content with this pretty puny agreement”.

The Guardian was also measured in its assessment of the deal. “This is only for a phase one trade deal, which might reset relations between the two sides and could lift some tariff,” it said. “A full-blown agreement, tackling stickier issues such as forced technology transfers and China’s subsidies, is some distance off.”

However, Reuters points out that sentiment over the positive signs around the trade dispute was not the only factor at play on the markets. It explains that “rising bets on a third rate cut by the Federal Reserve” have also fuelled optimism among Wall Street traders.

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues for £6–––––––––––––––––––––––––––––––

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

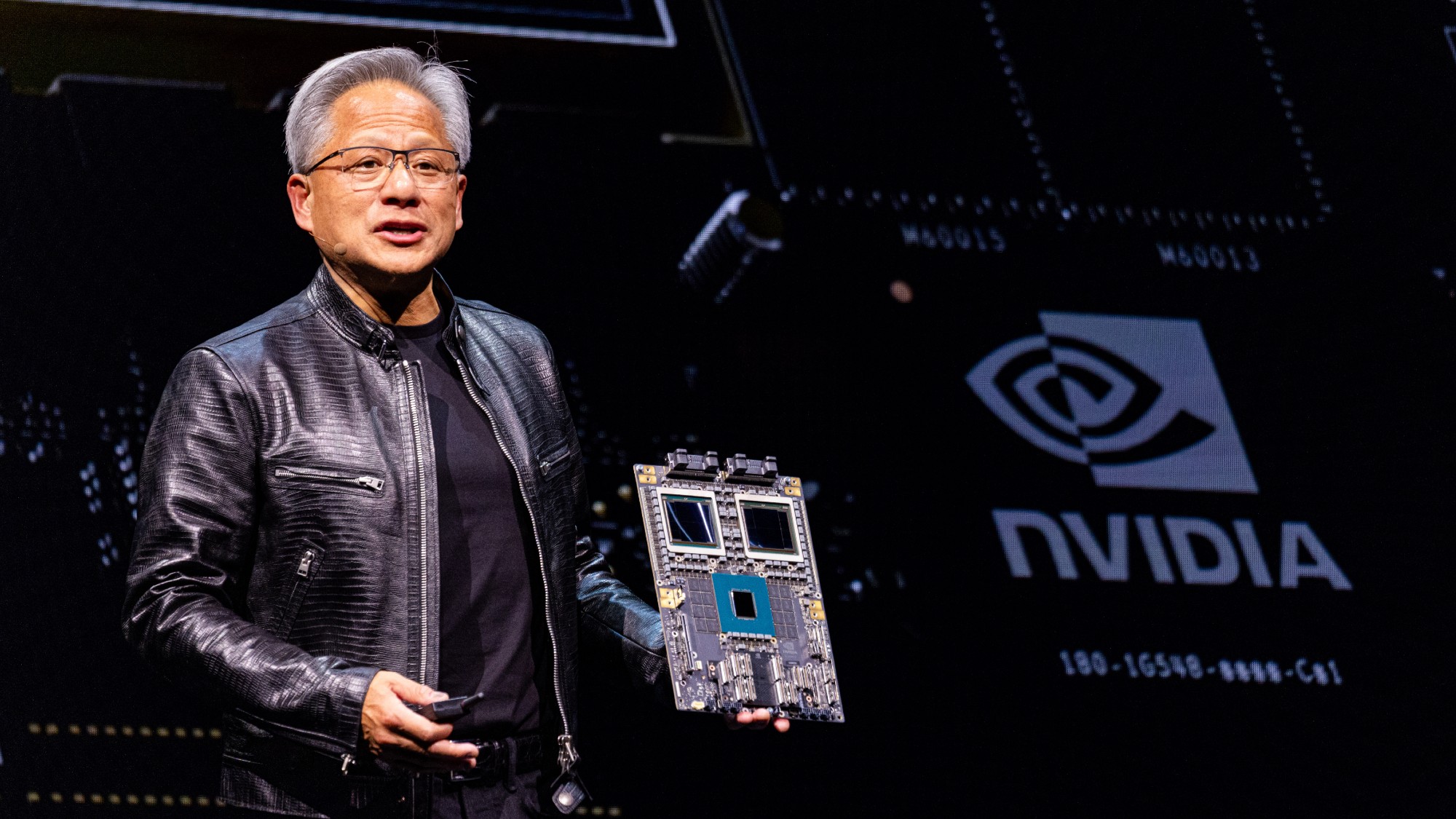

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Is Trump's tariffs plan working?

Is Trump's tariffs plan working?Today's Big Question Trump has touted 'victories', but inflation is the 'elephant in the room'