Tech giants facing EU ‘digital tax’

Google and Facebook could be forced to pay 3% of European digital revenues

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The world’s biggest tech companies could be forced to pay a 3% tax on digital revenue earned in Europe, under new measures announced by the European Commission.

All firms with global annual revenue in excess of €750m (£655m) and taxable EU revenue above €50m (£44m) would be subject to the new ‘digital tax’, which could raise over €5bn (£4.4bn) for the bloc.

There have been widespread claims in recent years that the likes of Facebook and Google pay too little tax. The Commission says top digital firms pay an average tax rate of just 9.5% in the EU, compared to 23.3% for traditional companies.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Unveiling the measures, the EU’s economics affairs commissioner Pierre Moscovici said the “current legal vacuum is creating a serious shortfall in the public revenue of our member states”.

The EU has led the way in standing up to Silicon Valley tech giants. Competition regulators have fined Apple and Amazon, while Google is appealing against a record €2.4bn (£2.1bn) fine for abusing its dominance to favour its own shopping services. The EU has also ordered Apple to pay Ireland billions of euros in unpaid taxes and EU agencies are looking to tighten rules on data privacy.

However, the 28 EU countries, whose unanimous ratification is required to pass the new digital tax into law, are divided on the issue. Ireland warned the proposals could actually reduce tax yields, while other countries believe they should apply to smaller companies as well.

“Some will say Mr Moscovici’s timetable is overly ambitious, and that gaining agreement from all the EU member states will prove difficult,” BBC economics editor Kamal Ahmed predicts.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“His answer to that? That the political direction of travel is clear, voters want to see digital giants like Facebook and Google pay more tax. And here is a thought through plan to do it.”

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

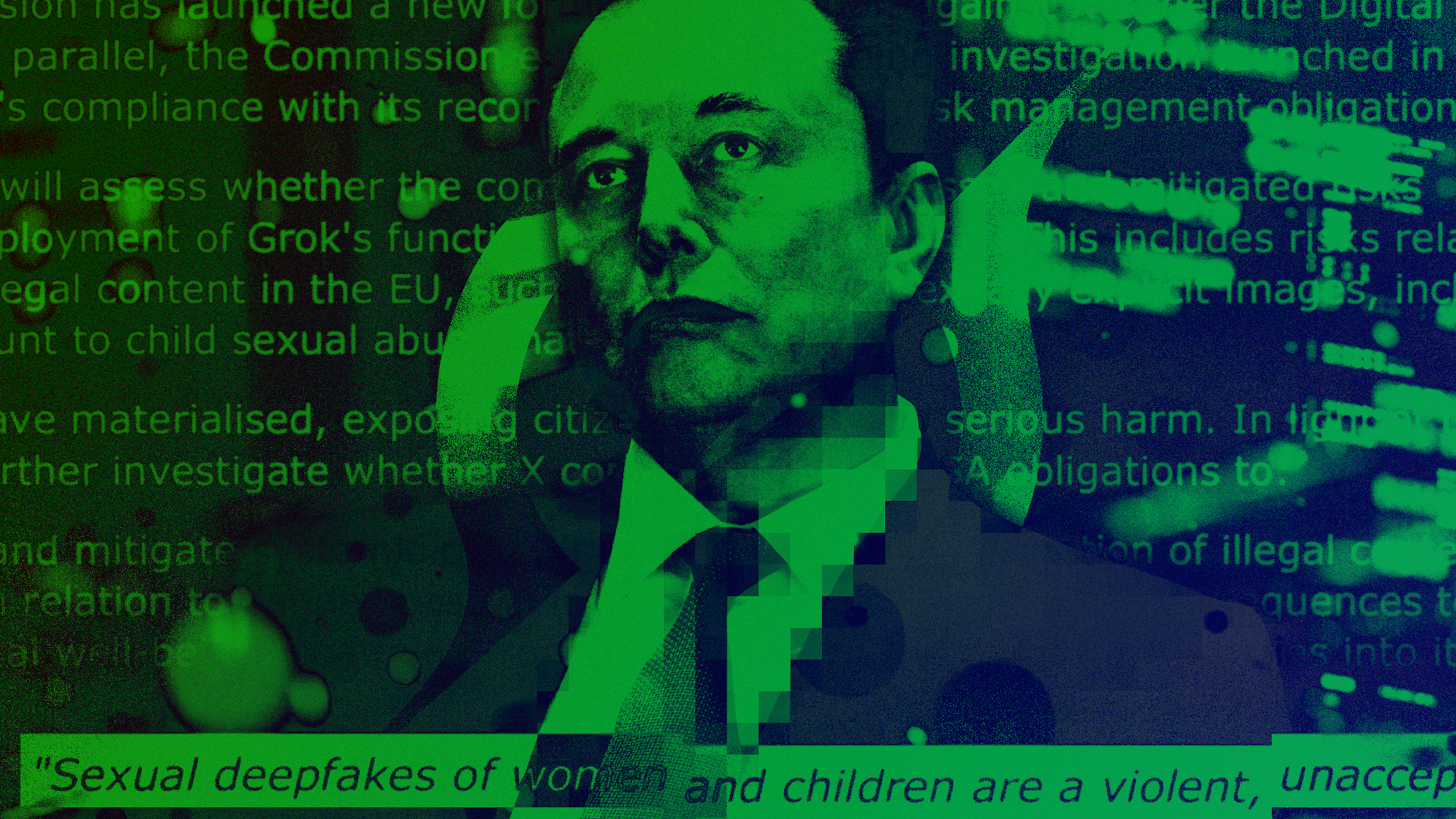

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Europe moves troops to Greenland as Trump fixates

Europe moves troops to Greenland as Trump fixatesSpeed Read Foreign ministers of Greenland and Denmark met at the White House yesterday

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult