What are share buybacks, dubbed ‘corporate cocaine’?

Left and right in US unite to criticise Wall Street over the booming practice

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

US politicians from both sides of of the political divide have bucked recent partisan bickering and united around an unlikely issue to lambast Wall Street for the booming practice of share buybacks.

The practice sees companies with spare money repurchase their own shares from the market, putting cash directly back into investor’s pockets while at the same time improving the value of the shares.

“They have very much been a feature of the post financial crisis era,” says Michael Mackenzie in the Financial Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

According to TrimTabs data, the value of stock repurchases announced by US companies surged to more than $1 trillion last year, around seven times the amount in 2009.

“The trend is spreading, too” says the Daily Telegraph. Just last week in the UK, blue-chip heavyweights Glencore, Relx and Lloyds all announced that they would sink billions of pounds into buybacks.

“For the past several decades, the goals of American businesses has become benefitting shareholders. Given that just 10% of the wealthiest Americans own 84% of all corporate stocks, this “shareholder primacy” model tends to benefit those who already have means,” says Eillie Anzilotti for Fast Company.

“This is in contrast to how companies previously directed profits, into growing the company and increasing worker salaries,” she adds.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A report published last week from Lenore Palladino, senior economist at The Roosevelt Institute think tank, argues the shift toward shareholder primacy, not coincidentally tracks along with corporate attacks on unions, which played a significant role in protecting worker prosperity.

CNN Business says “the steady drumbeat of buybacks comes despite the political backlash against the tactic”, which has united the left and right in opposition at what has been described as “corporate cocaine”.

Republican senator Marco Rubio has announced plans to overhaul the tax status of the practice, while far-Left presidential candidate Bernie Sanders penned an op-ed in the New York Times in which he said “corporate boardrooms have become obsessed with maximising only shareholder earnings to the detriment of workers and the long-term strength of their companies”.

“Should Washington follow through on one proposal of taxing buybacks at a higher rate, or veer left and ban them unless a company bolsters pay for its employees, the outcome will resonate globally,” says Mackenzie.

“But the politicians are missing a key point” he writes. “Buybacks often reflect the fact that a strong business model is generating a surfeit of cash, a situation that tends to attract activist investors demanding higher dividends and buybacks, as was the case with Apple. For the long term health of the economy, it’s far better that excess cash is returned to investors.”

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

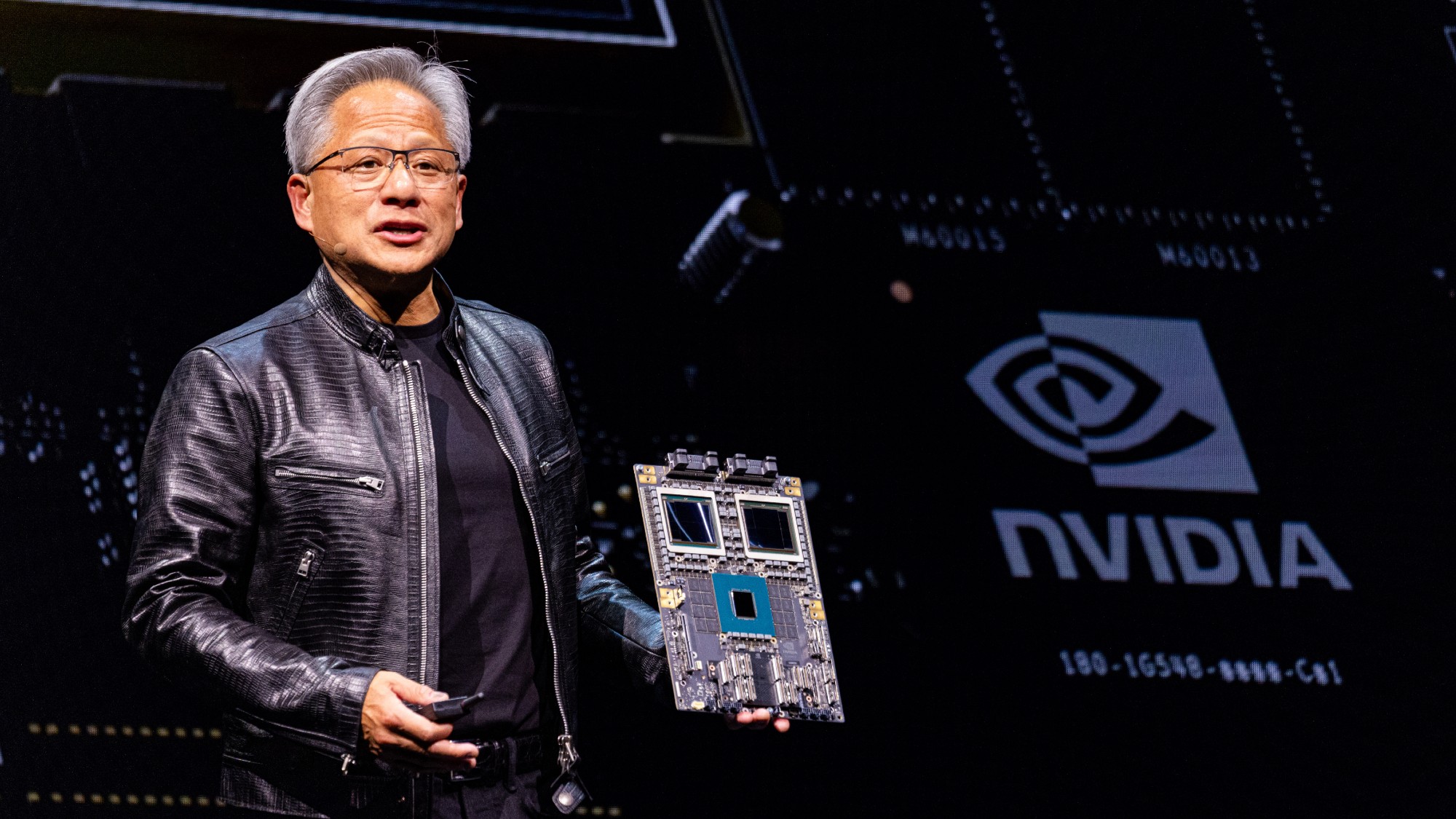

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room