Apple launches appeal against £11bn EU back-tax bill

Company says the case 'has never been about how much tax Apple pays, it's about where that tax is paid'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

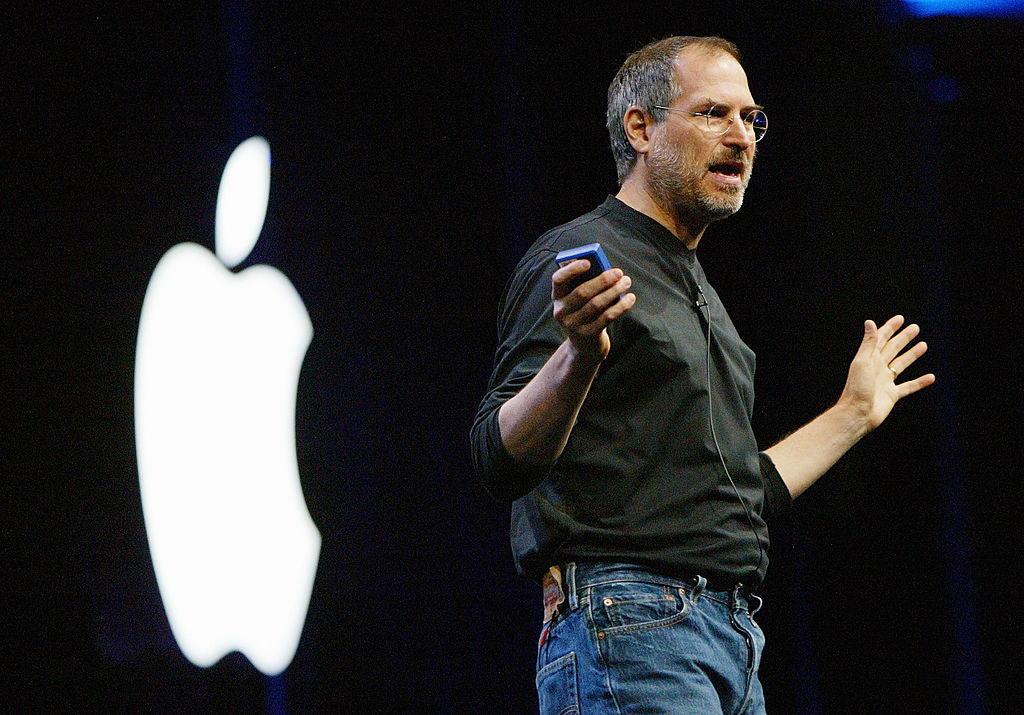

Apple should pay more tax, says co-founder Steve Wozniak

22 April

Apple is one of several large firms having its tax affairs scrutinised by the European Commission (EC) and now co-founder Steve Wozniak has said the tech giant should pay more.

Speaking to the BBC, Wozniak, who left the company in 1985, said he paid 50 per cent tax himself and believed the world's largest tech firm should do the same.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Tax rates are different for companies than they are for a person and that's something that bothers me to this day. I don't like the idea that Apple might be unfair - not paying taxes the way I do as a person," he said.

"I do a lot of work, I do a lot of travel and I pay over 50 per cent of anything I make in taxes and I believe that's part of life and you should do it. Every company in the world should."

Speaking of the early days of Apple, he added: "We didn't think we'd be figuring out how to go off to the Bahamas and have special accounts like people do to try to hide their money."

In 2014, the tech giant bowed to public pressure and promised to stop using its "double Irish" tax arrangement, which exploited the fact that Irish tax law did not cover transfer pricing, the movement of cash between divisions of a company.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Apple still channels much of its business through one of its Irish subsidiaries because corporation tax there is 12.5 per cent, as opposed to the UK's 20 per cent. These arrangements are being investigated by the EC.

Based on earlier rulings, it is thought the commission may decide the tech firm owes as much £5.6bn in back taxes.

Wozniak's views are not shared by current chief executive Tim Cook, says The Guardian, who said in a recent interview that the notion Apple was avoiding tax was "political crap" and he would appeal against any EC ruling.

"There's no truth behind it. Apple pays every tax dollar we owe," he said.

Apple has a £150bn cash pile – so why is it raising £8bn in debt?

17 February

Apple is among the largest companies in the world and has a cash reserve of £151.5bn, according to the Financial Times.

To put that in perspective, that's more than the World Bank estimated GDP in 2014 for Romania, New Zealand and Ukraine.

So it may come as a surprise that the company is taking on debt. Yesterday, it issued corporate bonds totalling $12bn (£8.4bn), adding to a pile the FT says now stands at $55bn (£38.6bn).

It is going to use the money to buy back some of its own shares from investors as part of a programme that has, so far this financial year, returned around $153bn of a promised $200bn to shareholders. The programme of buy-backs is reviewed in April each year, after the company publishes its results for the quarter ending in March that includes full-year totals.

Why doesn't Apple simply use some of its ample reserves to buy the shares and return cash, you may ask. Surely in the current low interest rate environment, this money is doing very little?

The answer is: tax. At the moment, most of Apple's cash reserves are held outside the United States, where it would be forced to pay a high corporation tax rate of 40 per cent. According to the FT, around 93 per cent of its money is held overseas, while The Guardian puts the stockpile in lower-tax jurisdictions at $177bn (£124bn).

If Apple wanted to buy back the shares with its own funds, it would need to first repatriate the money and incur a hefty US tax bill. On the other hand, with demand high for such safe bonds at a time of equities uncertainty – orders had reached $28bn by mid-morning – the interest rates on the debt are very low.

In short: it costs the company less to keep the cash and service the loans.

Apple stressed that it pays all the tax it owes and, of course, is doing nothing wrong in issuing the bonds. In fact, some Republicans argue the issue here is actually the high tax rate in the US - in the UK, by comparison, the corporate tax rate is 20 per cent, falling to 18 per cent by 2020.

The European Commission might yet disagree that Apple has paid all the tax it should on this side of the Atlantic, though, as it gathers evidence in what could be the biggest in a series of clampdowns. If it decides the company has paid less in Ireland, where its European headquarters are based, than its rivals, it could be made to repay $8bn (£5.6bn) or even more.

Apple fights back in bid to avoid 'biggest-ever' tax clawback

22 January

Apple chief executive Tim Cook flew into Brussels yesterday for private talks with the EU's competition commissioner in an effort to prevent the company being hit with a multibillion-dollar tax bill.

The Financial Times says the meeting was not expected and comes ahead of a ruling in the coming weeks over the tech giant's tax arrangements in Ireland.

The case, which comes amid a wider clampdown on "sweetheart" tax deals across the continent, has become a touchstone as the potential bill Apple faces would almost certainly be "the biggest sum ever involved in a commission decision".

"Bloomberg Intelligence estimates the potential clawback at around $8bn [£5.5bn], while JPMorgan has argued that Apple could have to pay $19bn [£13.2bn] in a worst-case scenario," the paper adds.

European officials have resorted to using "state aid" rules to tackle over-generous bespoke tax deals enjoyed by multinationals in some member states. The agreements are designed to encourage big companies to base in a country, bringing investment and jobs, but are controversial as they reduce overall tax revenues and give an unfair advantage over smaller firms.

Last year, the European Commission ordered Luxembourg and the Netherlands to reclaims millions of pounds in backdated tax from car-maker Fiat Chrysler and coffee chain Starbucks, while earlier this month, Belgium was told it must claw back €700m (£528m) from companies including Budweister brewer AB InBev.

Apple itself has said its deal differs from others in that it has a sizeable presence in Ireland, where its European headquarters employs 5,500 people, and not a small office that merely exists to generate a tax benefit. It also claims "money earned in Ireland is simply deferred tax that will ultimately be payable to the US Treasury once [it] repatriates the funds", notes the FT.

For its part, the Irish government has also hit out against allegations it gave the company a preferential deal. Taoiseach Enda Kenny described as "false and baseless" claims that Ireland is a tax haven for Apple, The Irish Times says. Kenny added the Irish tax authority has "never done specific deals or a favourable deal with any particular company".

-

Can Europe regain its digital sovereignty?

Can Europe regain its digital sovereignty?Today’s Big Question EU is trying to reduce reliance on US Big Tech and cloud computing in face of hostile Donald Trump, but lack of comparable alternatives remains a worry

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Magazine printables - February 13, 2026

Magazine printables - February 13, 2026Puzzle and Quizzes Magazine printables - February 13, 2026

-

Apple in first union contract with retail employees

Apple in first union contract with retail employeesSpeed Read The deal with employees at the Towson, Maryland, store marks the first labor agreement for any US Apple employees

-

Surviving mid-career job loss

Surviving mid-career job lossfeature And more of the week's best financial insight

-

Troubled union: Apple's China problem

Troubled union: Apple's China problemfeature How will Apple branch away from building products in China?

-

Elon Musk claims Apple threatened to remove Twitter from the App Store

Elon Musk claims Apple threatened to remove Twitter from the App StoreSpeed Read

-

Steve Jobs' used Birkenstocks sell at auction for $218,000

Steve Jobs' used Birkenstocks sell at auction for $218,000Speed Read

-

Less free coffee with those donuts

Less free coffee with those donutsfeature

-

Weak Apple projections hint at global slump

Weak Apple projections hint at global slumpfeature Should the Federal Reserve keep raising interest rates?

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’