Tata Steel strikes £550m deal to solve pensions riddle

Agreement will clear path for company to merge UK assets with ThyssenKrupp of Germany

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

EU leaders promise 'speedier' action on steel crisis

10 November

EU leaders have pledged "full and speedier" measures to halt the tide of cheap Chinese imports that are blamed for putting Britain's steel industry on a life support machine, according to The Guardian.

Leading European steelmakers are demanding immediate action to save an industry that has shed 85,000 jobs across the continent since 2008. UK steel companies have announced 5,000 job cuts in a matter of weeks, blaming Chinese imports, high energy costs and business rates, as well as the strong pound.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The UK government's handling of the crisis has been fiercely criticised. Business secretary Sajid Javid attended a crunch EU meeting yesterday, but the outcome of the summit has disappointed the unions.

Roy Rickhuss, the general secretary of Community, the steelworkers' union, said: "Council ministers and the (European) Commission have clearly failed to grasp the urgency of the current situation. Steelworkers whose jobs are at risk and who are seeing the impact of the dumping of cheap steel will take very little comfort from the conclusions of today's meeting."

Gareth Stace, the director of the industry body UK Steel, told the BBC: "The US and other countries have already moved to prevent cheap Chinese imports distorting their markets and now the EU must do the same and do so quickly."

Speaking after the meeting, Luxembourg's economy minister, Etienne Schneider, who chaired the talks, promised to "deliver the right conditions" to ease a "huge crisis" for Europe's steelmakers. He said EU leaders would try to make trade defence measures "full and speedier".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Steel imports to the UK from China have more than doubled since 2013 to 616,808 tonnes, with three months of the year still to go, according to data from the International Steel Statistics Bureau.

Steel campaigners demand end to China 'dumping'

09 November

Business Secretary Sajid Javid is being pressed to force Europe's hand and end China's alleged dumping of cheap steel into the market, which campaigners say is the main reason the sector is in crisis. High energy bills and a strong pound are also contributing to the relative cost of British steel.

After a chastening few months for producers, during which one company has gone bust, another entered administration and thousands of jobs have been lost, Javid is meeting his EU counterparts today to discuss the issue. He had requested the meeting himself at the height of the crisis last month, when he said that no options were off the table.

According to UK Steel, the industry’s lobby group, Chinese reinforcing steel will account for more than half the UK market this year. "In the EU, cases of dumping can take months to be accepted and investigated followed by another nine months before a provisional decision is taken," the group told The Guardian. "By contrast, the US took weeks to introduce measures to combat Chinese dumping."

Unions have called on the British government to offer subsidies to help with energy costs. David Cameron has pledged to refund £50m in green levies imposed on producers' energy bills, but says he needs EU state aid clearance to bring the policy into effect (see below).

Crisis continues

In the latest sign of the costs crisis across the sector, Indian-owned steel maker Tata Steel has reportedly written to suppliers demanding discounts of up to 30 per cent to help it to reduce costs. The BBC says the company wants an "immediate" price reduction of 10 per cent on all purchases and has said it may seek new supply deals if the terms are not met.

Tata recently announced it was cutting 1,200 jobs in the UK at plants in Scunthorpe and in Scotland. The news followed more than 2,200 job losses when the Thai-backed owner of the Redcar blast furnace went bust, and 450 job cuts at Capero Industries, which recently filed for administration.

Angad Paul, 45, the boss of Capero and son of billionaire former Labour peer Lord Paul, was recently found dead after falling from his eight-storey penthouse property in central London, the Daily Telegraph reports. He succeeded his father as chief executive of the business in 1996.

Capero Industries comprises 20 businesses, 16 of which are now in administration. Administrators PwC are said to be considering whether a series of high-profile ventures in supercars and film – Angad Paul is listed as executive producer on many of Guy Ritchie's films - contributed to the firm's collapse.

Steel crisis: Cameron pledges help on energy costs

29 October

One of David Cameron's more positive moments in a chastening Prime Minister's Questions this week came after he was asked about the plight of the UK steel industry.

In response, Cameron announced a new package of financial support for the sector.

Companies will be refunded millions of pounds' worth of green energy levies – the costs for investing in new renewable energies that are paid for through energy bills – to help alleviate a cost burden that producers say makes it impossible to compete.

Payments will be backdated and last for the full term of this parliament. Trade body UK Steel has quoted the cost of green levies at around £4m a month, putting annual compensation at close to £50m a year across the sector.

The Guardian notes the support is related to the 'energy-intensive industries compensation package' consulted on between 2011 and 2013.

The BBC says this was expected to come into effect in April 2016, but is now expected to be offered to Steel plants within weeks. The Prime Minister noted, however, it must first be approved in Brussels under 'state aid' rules.

The latest government action came as thousands of steel workers demonstrated outside parliament. Their sector is being hit with a combination of high UK energy bills, a strong pound that is making exports expensive and cheap steel flooding the market, from China in particular.

Angela Eagle, the shadow business secretary, accused the government of lacking an industrial strategy and providing an inadequate response to the crisis.

"China is currently responsible for a tsunami of cheap steel which is being dumped on European markets. The UK should be at the forefront of demanding rapid and effective action to stop it," Eagle said.

Business secretary Sajid Javid insisted yesterday he was doing just that, announcing he had secured a meeting with fellow European ministers to discuss the issue. He told Sky News the "nuclear option" of protectionist measures to block cheap imports should not be ruled out.

"I am determined this council leads to swift action, not just a talking shop," he said.

Could Scotland nationalise stricken steel plants?

23 October

Scottish first minister Nicola Sturgeon has left open the possibility of nationalising two steel plants that are facing closure amid a crisis in the sector.

On a visit to Tata Steel's plants in Motherwell and Cambuslang, which the company is planning to mothball thereby putting 270 jobs at risk, the Scottish National Party leader told the BBC that "nothing is off the table".

Sturgeon said the Scottish government would "leave no stone unturned" in its efforts to protect workers and keep the sites open. It will work with the Indian-owned Tata to find a buyer, but Sturgeon did not rule out following the example set with Glasgow Prestwick airport and taking the plants into public hands.

The administration north of the border acquired Prestwick for a nominal £1 after its parent company collapsed in November 2013. The airport continues to trade in the red, posting a loss of more than £4m last year.

Sturgeon's comments came as the UK government pledged to take action to help steel workers hit by the announcement that Tata is to cut 1,200 jobs across the UK, including 900 in Scunthorpe. Sky News says business secretary Sajid Javid has pledged £6m to add to the £3m that will be provided by the company itself in order to help local firms hire people who have lost their jobs.

This mirrors the £80m the government provided to support those affected by the closure of the Redcar blast furnace in Teeside, which collapsed earlier this month. But it is unlikely to quell criticism of the government from unions and the opposition Labour party, who argue it is not doing enough to protect the sector (see below).

British steel producers are facing a "perfect storm of cheap imports from China, high energy rates exacerbated by green levies, and a strong pound", reports the Daily Telegraph. Overcapacity in the Chinese market has driven the global price down 40 per cent from around £318 a ton to under £191 in the past year, Sky News notes.

Business minister Anna Soubry will be questioned next Tuesday by MPs on the Business, Innovation and Skills Select Committee, along with executives from the steel industry including senior staff at Tata.

UK steel crisis: what action is the government taking?

21 October

Business secretary Sajid Javid faced criticism in the House of Commons yesterday after the latest announcement of job cuts at Tata Steel added to the crisis in the UK steel industry.

Javid has hinted at that the government may introduce measures to alleviate cost pressures on UK producers in the coming months, building on the plans brought forward by working groups he announced at a summit in Rotherham last week. But he also warned "no government can change the price of steel in the foreign market".

What has happened?

The current crisis began with the announcement that the Redcar blast furnace, the second largest in Europe, was to close following the failure of the Thai-owned Sahaviriya Steel Industries UK. As many as 2,200 direct jobs have been lost at the plant as well as 1,000 contractors, while many more redundancies will be made throughout Redcar's supply chain, the Financial Times reports.

This was followed by the news that Indian-owned Tata Steel is to cut close to 1,200 jobs, with the BBC reporting nine hundred jobs will be lost at the firm's plant in Scunthorpe and a further 270 jobs will go in Scotland. Elsewhere, steel products maker Caparo Industries, owned by Labour peer Lord Paul, has filed for administration, putting 1,800 jobs under threat, the Telegraph reports.

Why is the industry struggling?

The steel industry is struggling globally, but price pressures are hitting UK producers particularly hard. UK firms are struggling to compete with cheap imports from China due to a combination of comparatively expensive labour costs and high energy bills. UK producers pay twice as much for the electricity as rivals in Germany, The Times notes.

Sales to overseas buyers are also being hit by the strong pound.

What do the unions and Labour want the government to do?

They'd like the government to intervene directly, either by subsidising costs in order to help UK producers compete or by forcing UK construction companies to buy from domestic suppliers. Tony Burke, assistant general secretary of the Unite union, told the Guardian that ministers should follow the example of Germany and Italy, which intervene directly in order to support their own domestic steel industries.

Has the government done anything?

Javid refused to invest millions in bailing out the Redcar plant, arguing that most of this money would have gone to Thai banks. He also claimed that European rules on state aid would have prevented him from doing so – although unions contest this.

The government has provided a package of £80m to help steelworkers find other employment. Some MPs have said that this is not enough, not least because local Labour MPs say ministers have confirmed this amount will include the redundancy payouts that will be covered by the state.

In the Commons debate yesterday, Javid did, however, hint that the government could offer tax breaks, with the Birmingham Post citing his comments that it was reviewing proposals as part of a general re-assessment of business rates. He also said he would seek to ensure UK steel producers gained significant business from infrastructure projects such as HS2.

Others have suggested the government could offer subsidies on energy bills, but ministers have said this would need to be approved by Brussels under state aid rules and may take time.

Can the government really save the sector?

Many say not – or at least not through direct action. Javid announced last week that three working groups had been set up to look into the current situation of the UK steel industry and these will report back by Christmas, Teeside local newspaper The Gazette reports. These groups will produce recommendations to help UK steel become more competitive globally.

One thing the government could do to help, say others, is to use its new cosy relationship with Xi Jinping to ask China to stop dumping cheaper steel into the UK market. David Cameron has said he will "of course" bring the issue up during the state visit by the Chinese president, who is set to sign off on £30bn of business deals during a meeting in Downing Street today.

Does UK steel have a future?

It's a sizable industry, so many are hopeful that it will. Last year, according to the Telegraph, about 30,000 people were employed across the sector. Steel contributed £9.5bn to the country's economy, with exports of £4.9bn.

If future closures can be abated it will also prevent major costs falling on the taxpayer, too. Clean-up costs for Redcar are thought to be around £500m, with future costs if more go bust potentially stretching into the billions of pounds, The Times reports.

Some optimism will have been provided by Friday's news that a steel mill in south Wales will reopen after more than two years out of operation.

Sanjeev Gupta, the managing director of the company that owns the Liberty Steel plant in Newport, told the Guardian it was a "good time for the mill to reopen because prices cannot go much lower, and there is lots of goodwill from suppliers and customers, against the backdrop of a growing UK economy".

Trusteesof the massive £14bn British Steel pension scheme have formally backedgovernment proposals to curb future payouts, which they say amount to a betterdeal for its 130,000 members.According to TheTimes, the trustees' official response to the public consultation about themodified deal warns that 58,000 members under 65 could face a ten per cent cutto their pensions if the scheme were placed in the industry bailout fund.Under Payment Protection Fund (PPF) rules, members underretirement age are entitled to 90 per cent of their payout, subject to a cap ofaround £30,000.Allan Johnston, the chair of the trustee board, says the"very large, well-funded" scheme would be a better option than thegovernment's lifeboat, in spite of the proposed reduction in annual increases.

-

How to navigate dating apps to find ‘the one’

How to navigate dating apps to find ‘the one’The Week Recommends Put an end to endless swiping and make real romantic connections

-

Elon Musk’s pivot from Mars to the moon

Elon Musk’s pivot from Mars to the moonIn the Spotlight SpaceX shifts focus with IPO approaching

-

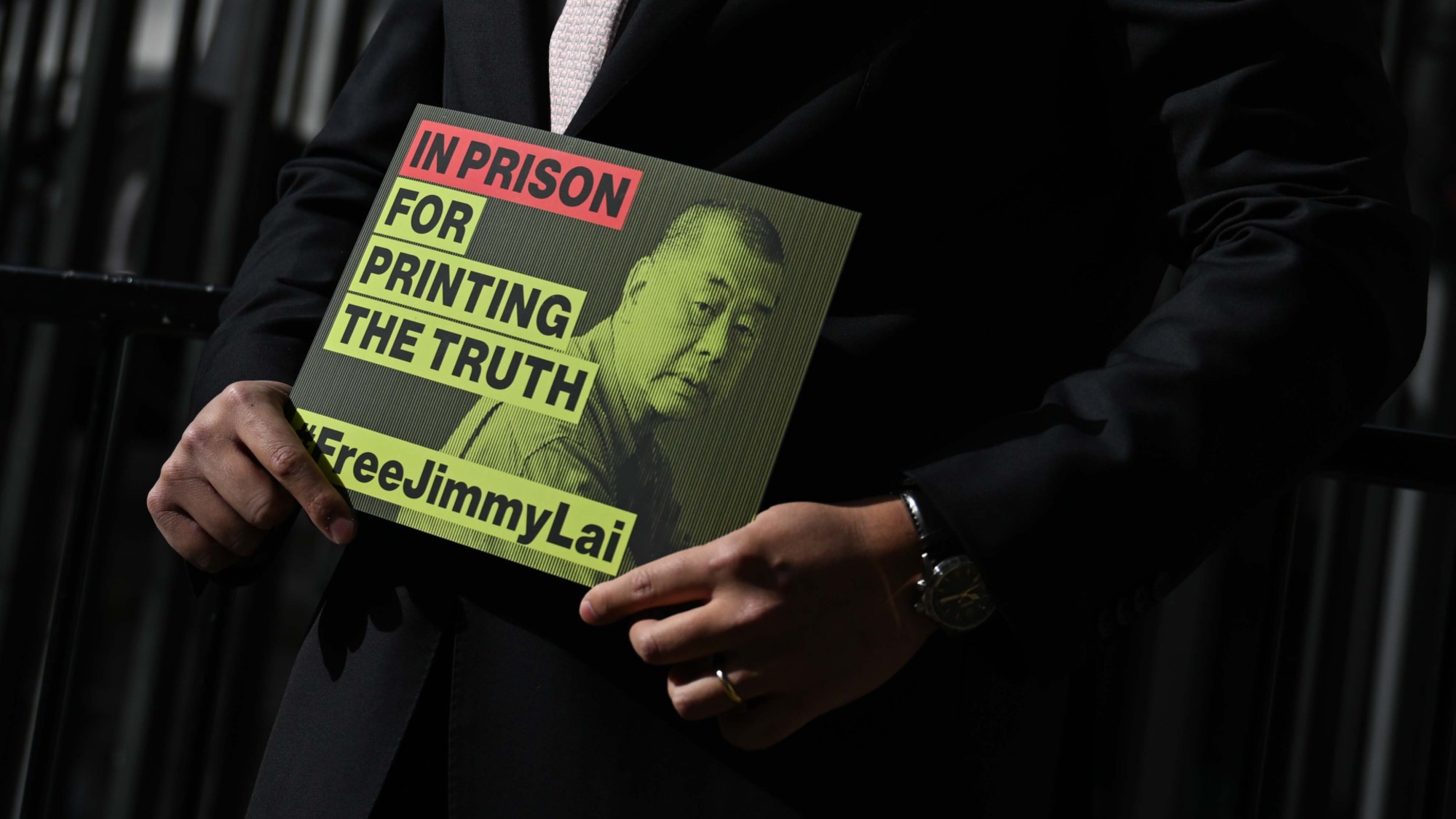

‘Hong Kong is stable because it has been muzzled’

‘Hong Kong is stable because it has been muzzled’Instant Opinion Opinion, comment and editorials of the day

-

Can the UK avoid the Trump tariff bombshell?

Can the UK avoid the Trump tariff bombshell?Today's Big Question President says UK is 'way out of line' but it may still escape worst of US trade levies

-

Five years on, can Labour's reset fix Brexit?

Five years on, can Labour's reset fix Brexit?Today's Big Question Keir Starmer's revised deal could end up a 'messy' compromise that 'fails to satisfy anyone'

-

Why au pairs might become a thing of the past

Why au pairs might become a thing of the pastUnder The Radar Brexit and wage ruling are threatening the 'mutually beneficial arrangement'

-

Brexit: where we are four years on

Brexit: where we are four years onThe Explainer Questions around immigration, trade and Northern Ireland remain as 'divisive as ever'

-

Is it time for Britons to accept they are poorer?

Is it time for Britons to accept they are poorer?Today's Big Question Remark from Bank of England’s Huw Pill condemned as ‘tin-eared’

-

Is Brexit to blame for the current financial crisis?

Is Brexit to blame for the current financial crisis?Talking Point Some economists say leaving the EU is behind Britain’s worsening finances but others question the data

-

How Brexit handed a ‘financial boon’ to former Soviet state Estonia

How Brexit handed a ‘financial boon’ to former Soviet state EstoniaIn Depth Around 4,000 companies have set up shop in member state since UK left EU, prime minister says

-

Why the UK is suffering a Walkers crisps shortage

Why the UK is suffering a Walkers crisps shortagefeature Production issues have forced snack giant to prioritise most popular varieties