Budget 2015: Osborne 'shoots Labour foxes' ahead of election

Ed Miliband no longer has an economic narrative after Osborne's Budget speech, say commentators

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Budget 2015 predictions: what does Osborne have up his sleeve?

18 March

George Osborne will today deliver his final Budget speech before the general election, with further pension changes expected to woo older voters.

The Chancellor has insisted there will be "no giveaways, no gimmicks", but analysts have suggested that the growing economy and low inflation give him some room for manoeuvre.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

He will be looking to champion the government's commitment to balancing the books, while trying to entice the electorate to vote his party back into office, with only a limited ability to legislate for change before Parliament is dissolved at the end of the month.

Osborne will begin his speech after Prime Minister's Questions, usually at around 12.30pm. Here are some of the predicted announcements:

Spending cuts

Osborne is looking at reducing the scale of his planned spending cuts over the next five years now that the medium-term outlook for public finances has improved, says the Financial Times. With an expected surplus of almost £30bn by 2019/20, Osborne has a newfound flexibility that could help counter Labour's claims that the Tories will take state spending back to the levels of the 1930s.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Personal tax

Bill Dodwell, Deloitte's head of tax policy, predicts that the personal allowance will be raised to £12,500 over the course of the next Parliament. The Daily Telegraph says the government looks likely to raise the personal allowance threshold for 2015/16 from £10,600 to £11,000 to come into force before the election.

Analysts say increasing the allowance is one major policy on which both Coalition parties agree. However, Sian Steele, PwC tax partner, says that if this proves too expensive raising the threshold at which the 40 per cent tax rate kicks in might appease some middle earners instead.

Tax returns

The days of the annual tax return could be over. Osborne is expected to announce a new digital tax account that automatically collates tax information from employers, banks and investment firms throughout the year.

Welfare

The Daily Mail predicts a new welfare cap as Osborne sets out more than £12bn in benefits cuts. Child benefit could be restricted to three children for new claimants and under-25s could lose the right to housing and employment benefits if they refuse offers of work, training or education, says the newspaper.

Savings

Last year, Osborne announced a radical shake-up of Isas, increasing the amount of tax-free saving from £11,520 to £15,000 a year. Emma Simon at the Daily Telegraph suggests there might be smaller amendments this year, such as allowing Isas to be transferred to any beneficiary, not just spouses or civil partners, free of tax. The government has also said it plans to allow savers to invest in "peer-to-peer" lending though an Isa.

But The Independent claims the biggest "rabbit" in the Chancellor's Budget will be to scrap tax on any savings income for anyone who pays up to the basic 20p rate of tax. People paying the higher 40p tax rate will still have their savings taxed.

Pensions

Up to five million existing pensioners are expected to be given the ability to swap their fixed annual payments for a fixed lump sum, says the BBC. It follows the extensive pension reforms announced last year that allow working people to cash in all or part of their defined contribution pension when they retire. There is also speculation that higher tax reliefs on pensions might be introduced.

Housing

The Conservatives have already committed to the construction of 200,000 affordable houses across the UK as part of their manifesto, but some analysts believe Osborne may go a step further in his budget by introducing new planning measures aimed directly as addressing the housing shortage. The Chancellor may also look to raise cash by announcing the withdrawal of private residence relief on houses worth more than £2 million. Currently UK residents pay no tax on the profits from the sale of their primary residence, but under the proposed policy anyone selling a home worth more than £2 million would have to pay capital gains tax. If introduced, the measure would also offer some political protection against Labour's proposed mansion tax.

Immigration

Immigration has already emerged as a central theme of the 2015 election campaign. With Conservative party strategists anxious not to lose voters to Ukip, some analysts believe that Osborne could announce a tax on foreign workers or introduce restrictions on non-UK residents' ability to claim the UK personal tax allowance.

National Insurance

An attractive option to help low-paid workers would be to increase the amount people can earn before they have to pay National Insurance, as this has become a "far greater burden" on low earners than income tax, says PwC's Sian Steele.

Devolution

Devolution is predicted to be a major theme of the Budget speech, with speculation that Osborne might assign more economic decision-making powers to the regions. He has already said that "building a Northern powerhouse" and connecting regions around the country will play an important role in the Budget.

Industry levies and tax breaks

Several experts are expecting the introduction of a tobacco levy, with some predicting that it might lay the foundations for introducing similar levies in other industries in the future. Meanwhile, other sectors such as oil and gas might receive tax breaks.

Tax avoidance

A 'Google tax' crackdown on multinational companies avoiding paying tax in Britain is also likely to be a key theme in Osborne's speech. More powers for HMRC to combat tax avoidance are expected to be announced.

Inheritance tax

Ian Thomas, from Ernst & Young, thinks there will be an increase in the amount of money people can inherit before they are taxed, suggesting that the threshold might be raised to £1m by 2020. "Reforming inheritance tax wouldn't cost much, since hardly anyone actually pays it, but the question is whether the Liberal Democrats would countenance it – especially since it's unlikely they'd get any electoral credit," says Jonathan Eley at the Financial Times.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

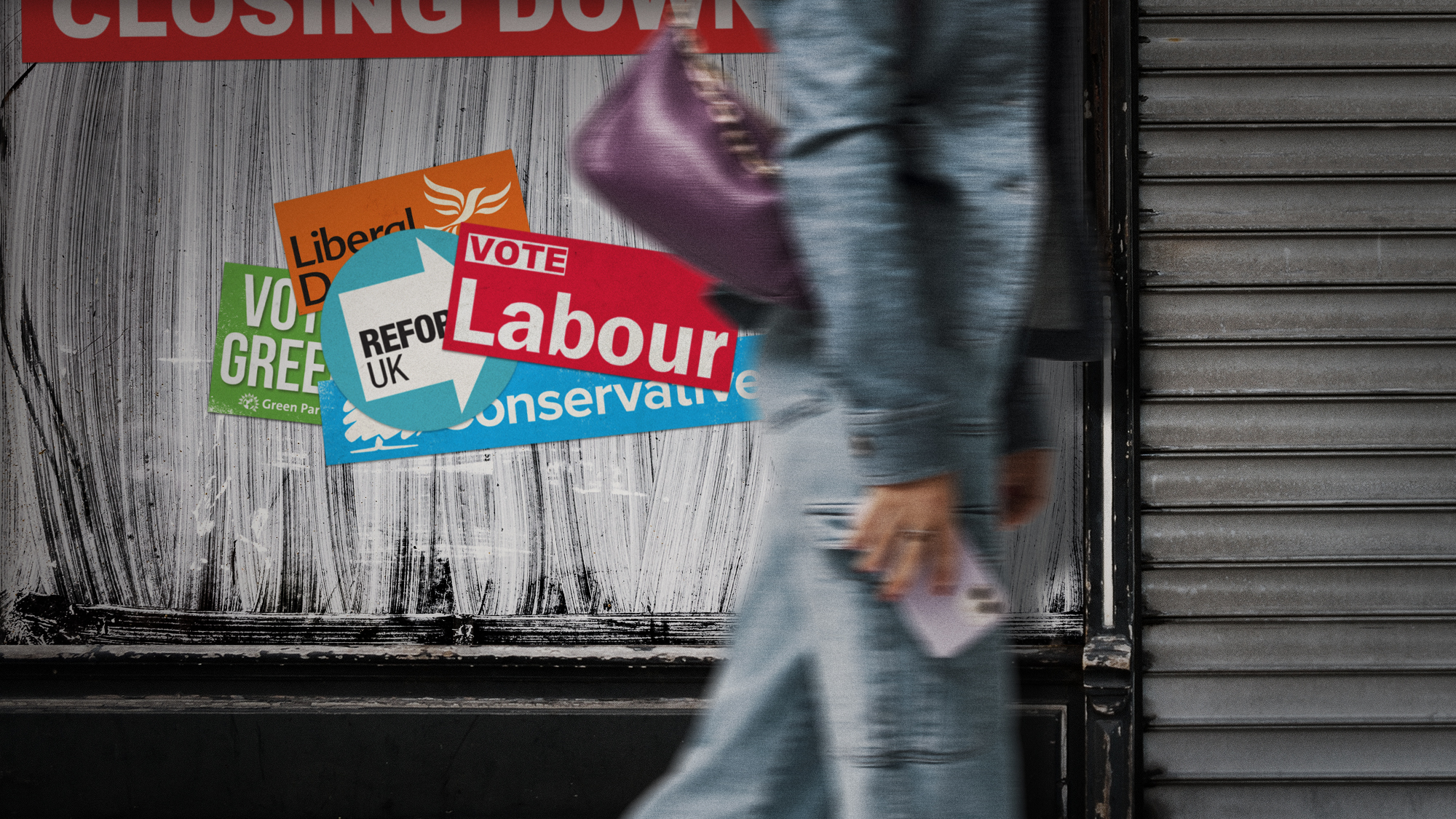

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

What difference will the 'historic' UK-Germany treaty make?

What difference will the 'historic' UK-Germany treaty make?Today's Big Question Europe's two biggest economies sign first treaty since WWII, underscoring 'triangle alliance' with France amid growing Russian threat and US distance

-

Is the G7 still relevant?

Is the G7 still relevant?Talking Point Donald Trump's early departure cast a shadow over this week's meeting of the world's major democracies

-

Angela Rayner: Labour's next leader?

Angela Rayner: Labour's next leader?Today's Big Question A leaked memo has sparked speculation that the deputy PM is positioning herself as the left-of-centre alternative to Keir Starmer