The daily business briefing: March 23, 2020

Senate fails to pass COVID-19 aid bill, stock futures plunge as uncertainty continues, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Senate fails to advance coronavirus aid bill

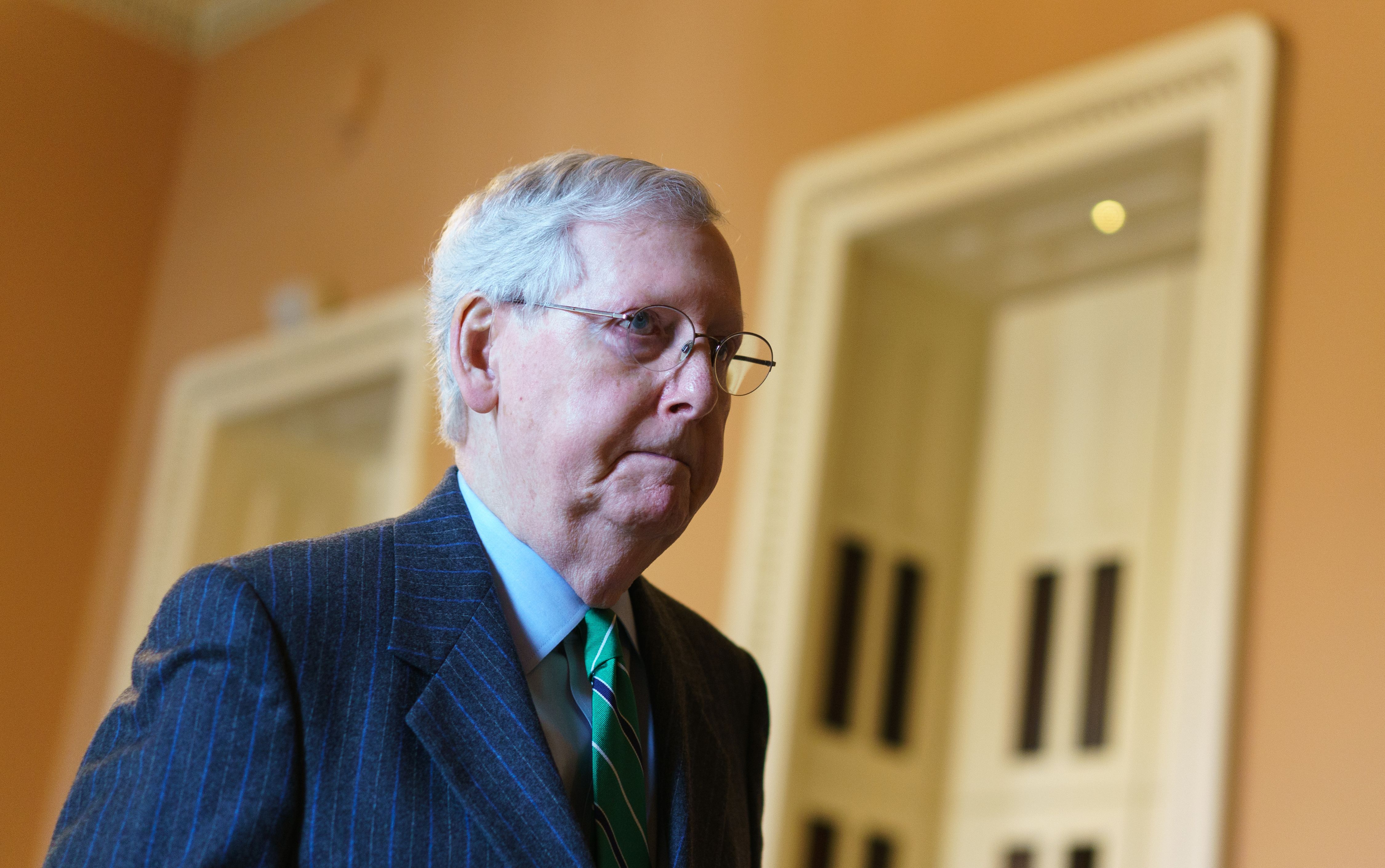

Senate Democrats on Sunday blocked a $1.8 trillion coronavirus stimulus bill from moving to a final vote, saying the legislation didn't go far enough to protect workers and placed too few restrictions on businesses receiving bailouts. Sen. Elizabeth Warren (D-Mass.) called a $500 billion loan program for businesses, states, and localities, to be handled by the Treasury Department, a "slush fund to boost favored companies and corporate executives — while they continue to pull down huge paychecks and fire their workers." Senate Majority Leader Mitch McConnell (R-Ky.) said the bill included many of the Democrats' proposals, and it was time for them to "take 'yes' for an answer." Treasury Secretary Steven Mnuchin said late Sunday that negotiators from the two parties were "very close" to a deal on the package, which includes a one-time $1,200 payment to individual adults.

The Washington Post The New York Times

2. Stocks fall further as coronavirus anxiety continues

U.S. stock index futures plunged early Monday after the Senate failed to advance its $1.8 trillion coronavirus stimulus bill, which includes a $500 billion loan package for businesses and states and one-time $1,200 payments to adults. Futures at one point were down by 5 percent, triggering a "limit down" trading halt. At 6:30 a.m., futures for the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite were down by about 3 percent. National Economic Council Director Larry Kudlow said the stimulus package ultimately will equal 10 percent of U.S. economic output. President Trump last week signed a $100 billion bill expanding paid leave. David Kostin, chief U.S. equity strategist at Goldman Sachs, said the speed of the market's recovery will depend on how fast the virus is contained and whether businesses have access to enough capital to survive up to 180 days.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Trump: Automakers given approval to make ventilators

President Trump tweeted on Sunday that Ford, General Motors, and Tesla were "being given the go ahead to make ventilators" and other products needed to fight the COVID-19 coronavirus. "FAST!" Trump wrote. "Go for it auto execs, let's see how good you are?" It was not immediately clear what authorization the Trump administration had given to the automakers. Trump last week signed an executive order invoking the Defense Production Act, a law dating back to the Korean War that lets the federal government draft American industry into manufacturing supplies during a crisis. Tesla founder and CEO Elon Musk said last week his company would "make ventilators if there is a shortage," but the companies haven't started and it could take months for them to deliver.

4. Fed leader: Coronovirus could push unemployment to 30 percent

The U.S. unemployment rate could hit 30 percent in the second quarter due to business shutdowns to stem the spread of COVID-19, Federal Reserve Bank of St. Louis President James Bullard told Bloomberg on Sunday. Bullard said the "planned, organized partial shutdown of the U.S. economy" could result in a 50 percent drop in gross domestic product, sparking the need for the Fed to act decisively to keep markets functioning normally and get enough money into the economy to replace $2.5 trillion in lost income. "Everything is on the table," he said. "The overall goal is to keep everyone, households and businesses, whole."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. SoftBank shares surge on stock buyback plans

SoftBank Group Corp. on Sunday unveiled a plan to raise up to $41 billion in the coming year to reduce its debt and repurchase stock to soothe investors worried about damage to its stability by the COVID-19 pandemic. Billionaire Masayoshi Son's Japanese conglomerate has major holdings in corporations that include Uber, WeWork, and China's online retail giant Alibaba. Selling some of those investments could raise enough money for its huge stock buyback. SoftBank's shares jumped 19 percent on the news, but analysts warned its problems weren't over. "This will just give a short-term boost to SoftBank's shares but it will not change SoftBank‘s fundamentals," said Mitsushige Akino, an executive officer at Ichiyoshi Asset Management Co. in Japan.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military