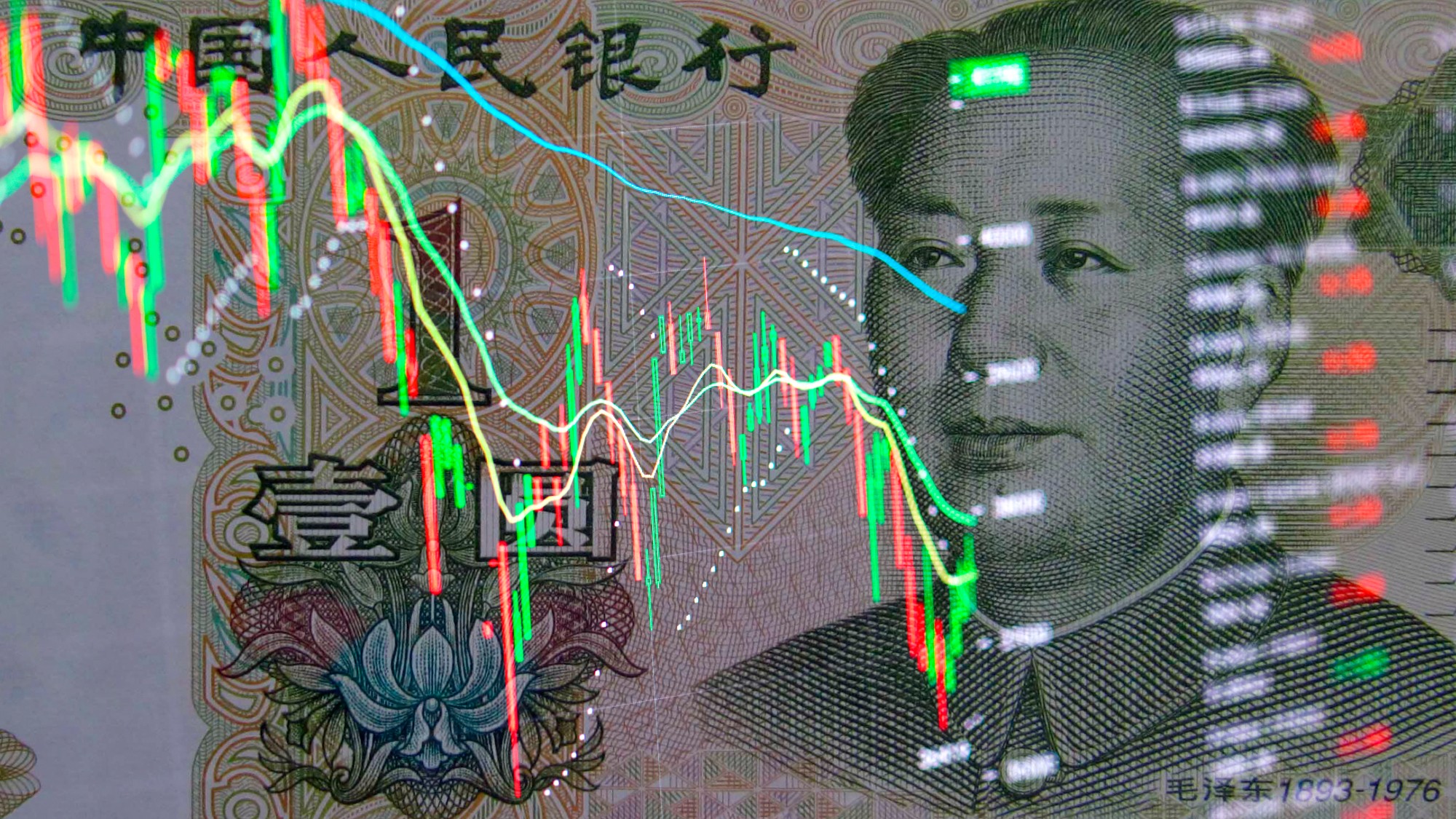

A new stimulus might (or might not) jump-start China's economy

Fears of social instability drive rate cuts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Doldrums continue to plague China's post-pandemic economy. Now the country's leaders are firing up a new round of plans to jump-start growth. It just might not be enough.

Amid concerns of a "prolonged structural slowdown," China's central bank this week unveiled the "biggest stimulus" of the post-Covid era, Reuters said. The "broader-than-expected" package includes mortgage interest rate cuts and other measures designed to pull the country's economy out of a "deflationary funk." That's the good news. The not-so-good news? "The move probably comes a bit too late, but it is better late than never," said Natixis' Gary Ng to Reuters.

It's a "massive adrenaline shot" for an economy beset by a "property market blowout, consumer price weakness and rising global trade tensions," said Bloomberg. But the "sweeping" effort doesn't meet demands to "fundamentally reconfigure" the economy away from manufacturing exports and toward domestic consumption. The missing piece? "A coherent strategy to get China's 1.4 billion people to ramp up spending," Bloomberg said.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

'Likely to disappoint'

"Chinese households and businesses are getting another credit stimulus that's likely to disappoint," said The Wall Street Journal in an editorial. The new stimulus is the "most aggressive" attempt to pull China's economy out of a slowdown. But it won't create the "investment opportunities" that the economy needs to truly grow. "Only greater freedom for private innovators and entrepreneurs can do that," said the Journal. Beijing isn't ready to go that route, which means "China's domestic economy will continue to underperform."

The stimulus is "hefty but insufficient," said The Financial Times. The "poorest households" need a boost that includes "social security and healthcare support" and investors need "policy stability and deregulation." But those measures would require Beijing to "spend big" and overcome its "desire to control the private sector." A "more focused policy" response is needed, but the stimulus could be a good first step. "It is a sign that Chinese officials are waking up to the urgent need to re-energize its economy," FT said.

Fears of 'social instability'

China's central bank announcement came as the youth unemployment rate "reached record highs," said The Los Angeles Times. In August, the unemployment rate for 16- to 24-year-olds hit 18.8% — "notably worse" than other Asia-Pacific countries. That has led to concerns among Chinese leaders that "social instability" rising from mass youth unemployment could become a "political liability," said the Times. The new stimulus is an effort to keep that instability at bay.

Despite its problems, China still has the world's second-largest economy: Continued efforts to goose growth could have "global ripple effects," Jared Blikre said at Yahoo Finance. The stimulus focused mostly on policy changes. The next step? Beijing could start "throwing more government money at the problem." That could set off a chain reaction of "major shifts in supply chains and pricing for raw materials" that would create "headaches" for U.S. manufacturing firms. That means, as one economist said, the world could be "looking at more inflation volatility over the next decade."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Shein in Paris: has the fashion capital surrendered its soul?

Shein in Paris: has the fashion capital surrendered its soul?Talking Point Despite France’s ‘virtuous rhetoric’, the nation is ‘renting out its soul to Chinese algorithms’