Making money: five alternative investments for 2022

Diversify your portfolio with quirky investments such as Lego and digital art

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Lego beats gold

Researchers at Russia’s Higher School of Economics made a startling discovery last month, said Mark Sweney in The Guardian. “Investing in Lego is more lucrative than gold, art and wine.” The study looked at the second-hand prices of 2,322 “unopened” sets from 1987 to 2015, and concluded that the market has risen 11% annually – a better long-term return than almost every other asset, including stocks and bonds.

The best-performing sets include the Millennium Falcon, other Star Wars models, and the Taj Mahal. But the key message, if you want to build a nest egg, is that “not all sets are equally successful”, said Professor Victoria Dobrynskaya in The Times. Top performers have gained 600%, while others have proved lossmakers. Prices tend to rise two or three years after a set disappears from the shelves and very small and very big sets usually do best. Above all, it’s important “to be a fan” and “know the market”. And probably a good idea to keep them well away from compulsive builders…

2. Pet company shares

Rather than buying a puppy or a kitten for your children, why not buy some “shares in a pet company instead”, said David Brenchley in The Sunday Times. You’re unlikely to get “smiles and thank-yous” in the short-term, but you’ll give them “entry into an increasingly successful corner of the stock market”. The obvious question is whether the pandemic pet craze, which has fuelled big rises in animal-care shares (ranging from retailer Pets at Home to vet specialist Dechra) has legs.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Dogs Trust reported that calls from owners seeking to re-home their pets rose 35% after lockdown lifted in July last year. Even so, many fund managers still feel the sector is ripe for investment. For a broad-brush approach, try ProShares Pet Care ETF, which tracks a variety of firms and has gained 119% since March 2020.

3. Fine wine and rare whisky

It was a vintage year for wine lovers in 2021 with collectors and tipplers “having a great time of it”, said Chris Carter on MoneyWeek. The value of fine wine rose by 13% in the year to the end of June, according to research by analytics company Wine Owners, and this was a far better performance than products such as watches and classic cars.

Fine wine is not the only alcoholic drink that investors have a taste for. Whisky investors will also “have much to toast in 2022”, The Scotsman reported. In its outlook report for 2022, whisky investment firm VCL Vintners said across all age statements, “prices are steadily increasing and the ‘majors’ are becoming scarcer”.

Also expect to see “continuing strong investment” by millennials into whisky. The “instability of the markets” under the forces of Covid variants, supply chain bottlenecks, and the energy transition, is pushing investors to “seek alternative ways to grow their money”, said Stuart Thom, co-founder of VCL Vintners. And a “growing number of savvy millennials are finding whisky”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

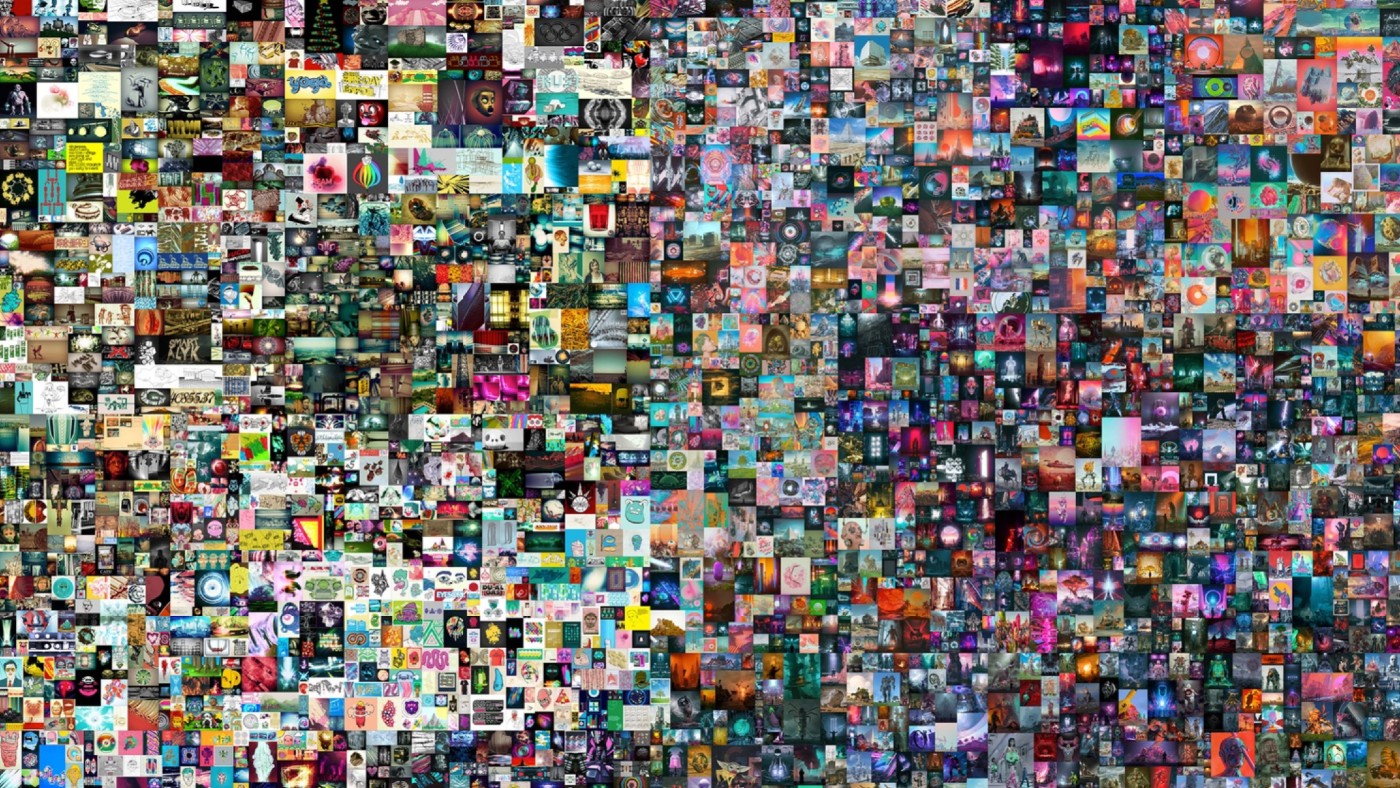

4. Traditional and digital art

Investing in art “may be a great idea if it’s something you truly love”, said Amy Bergen on MoneyUnder30. However, it “can be risky, so you need to do your research”. Art is a long-term investment and profits won’t happen overnight. “Experts recommend art investment for patient investors with a time window of ten years or more, so think long term,” she added.

Historically, investing in art was “something only the nobility and the wealthy enjoyed”, said Jarvis Dobrik on ValiantCEO. However, the emerging market for digital art and non-fungible tokens (NFTs) has seen more companies, auction houses, artists, celebrities, collectors, and investors “getting in on the act”. Some investors are seeing “considerable returns” on their crypto-collectibles and other digital assets. Is NFT art a good investment and can you make money? The answer is yes, Dobrik said. NFT art can be considered a “short and long-term investment”.

5. Luxury collectibles and stocks

It was a strong year for the luxury goods sector in 2021, the FT reported. And analysts forecast that this year “will be even better”.

In Knight Frank’s Wealth Report published last February, Hermés handbags topped the luxury investment index for the second year in a row, followed by fine wine. The average price of the French fashion house’s bags rose by 17% in 2020, while wine saw a 13% incremental value on investment.

Luxury stocks “have a place in almost any portfolio”, The Motley Fool said. These stocks have “a history of outperforming the broader market” and are relatively low-risk investments. Three stocks it advises to buy include US upscale home-furnishings company RH, luxury giant LVMH Moet Hennessy Louis Vuitton, and sports car company Ferrari.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

Received a windfall? Here is what to do next.

Received a windfall? Here is what to do next.The Explainer Avoid falling prey to ‘Sudden Wealth Syndrome’

-

How to invest in the artificial intelligence boom

How to invest in the artificial intelligence boomThe Explainer Artificial intelligence is the biggest trend in technology, but there are fears that companies are overvalued

-

What’s the difference between a bull market and bear market?

What’s the difference between a bull market and bear market?The Explainer How to tell if the market is soaring or slumping.

-

Is it a good investment to buy a house?

Is it a good investment to buy a house?The Explainer Less young people are buying homes, opting to rent and invest in the stock market instead

-

What is day trading and how risky is it?

What is day trading and how risky is it?the explainer It may be exciting, but the odds are long and the risks high

-

What to know about investing in ETFs

What to know about investing in ETFsThe Explainer Exchange-traded funds can be a great choice for beginners

-

Retail investors drive a flurry of IPOs

Retail investors drive a flurry of IPOsFeature After years of slowness, companies like Klarna and Gemini are reviving the IPO market