The daily business briefing: September 15, 2023

United Auto Workers strike against Detroit's Big 3, Arm shares climb in year's biggest IPO, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

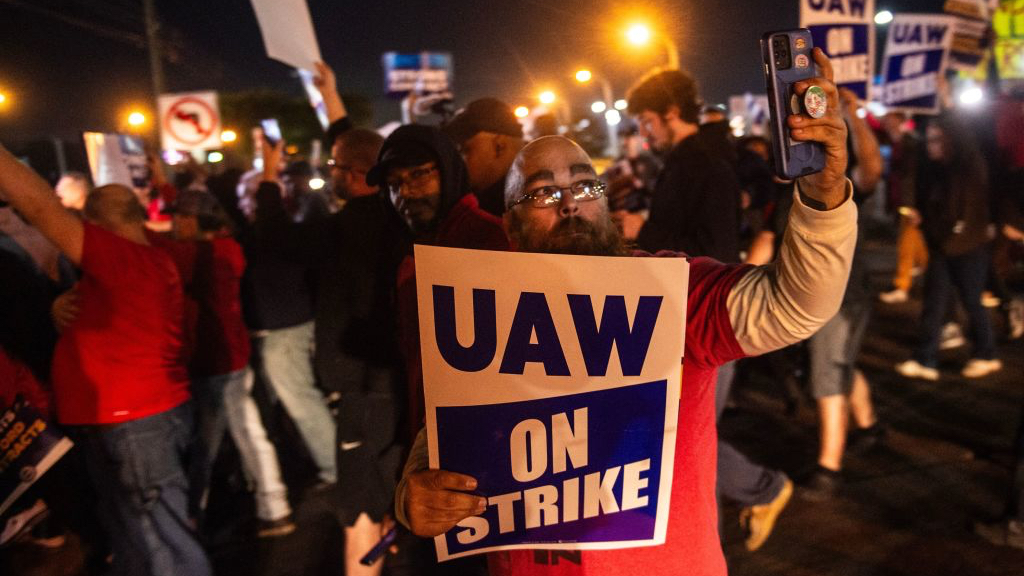

1. UAW limited strike targets Ford, Stellantis, GM

The United Auto Workers on Friday launched a limited strike against Ford, Chrysler-owner Stellantis and General Motors after a deadline for a new contract expired overnight. It is the first time the union has staged walkouts against all three of the major Detroit automakers at once. About 12,900 UAW workers went on strike at a Ford plant in Michigan, a Stellantis plant in Ohio and a GM factory in Missouri. The union is using a new strategy, keeping most of its 150,000 members at the three companies working, to maintain leverage in ongoing negotiations. "This union is making history," UAW President Shawn Fain said. "This is our time." Fain is expected to meet automaker representatives for negotiations on Saturday. The Detroit News

2. Arm shares surge in Nasdaq debut

Arm shares jumped nearly 25% in their Nasdaq debut on Thursday and another 6% early Friday, bringing the U.K.-based chip designer's market cap to more than $70 billion. The IPO was the biggest since 2021, ending two dry years for new stock offerings. Japan's SoftBank, which acquired Arm in 2016 for $32 billion, is holding on to a 90% stake. Arm isn't a household name in the United States, but Apple, Samsung, Nvidia, Google and other major tech firms use its designs for their microchips, giving it a key role in the production of smartphones, laptops, video games and other popular tech gear. Many of the same tech giants had expressed interest in investing in the IPO, according to CNN. CNN, CNBC

3. ECB hikes interest rate to record high

The European Central Bank raised its benchmark interest rate to a record-high 4% on Thursday, but indicated the hike would probably be the last in its push to raise borrowing costs to fight inflation. The ECB, the central bank for the 20 countries using the euro, has raised rates 10 times in the last 14 months. "Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target," the ECB said. It now expects inflation to gradually fall toward its 2% target, dropping from 5.6% in 2023 to 3.2% in 2024 and 2.1% in 2025. Reuters

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

4. Dow, S&P 500 futures add to Thursday's gains

U.S. stock futures rose slightly early Friday after Arm's IPO gave markets a boost on Thursday. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.3% and 0.1%, respectively, at 7 a.m. ET. Nasdaq futures were flat. The Dow jumped 1% on Thursday in its best day in a month. The S&P 500 and the tech-heavy Nasdaq rose 0.8%. The producer price index rose 0.7% in August, higher than the 0.4% economists had projected, but the core PPI, excluding volatile food and energy costs, was up 0.2%, as expected. The news on wholesale inflation boosted expectations that the Federal Reserve would hold interest rates steady as it nears the end of its inflation-fighting hikes. CNBC

5. IRS freezes pandemic employer tax benefit to fight fraud

The Internal Revenue Service said Thursday it would freeze a pandemic-era employer tax benefit while it figures out ways to prevent rampant fraud. The IRS has started more than 250 criminal investigations involving fraudulent claims that allegedly have cost the federal government nearly $3 billion. The Employee Retention Credit was created to help small businesses keep people employed during the coronavirus crisis. "We are deeply concerned that this program is not operating in the way it was intended," IRS Commissioner Daniel Werfel said on Thursday. "We believe you should see only a trickle of employee retention claims coming in. Instead, we are seeing a tsunami." The New York Times

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.