Coronavirus and house prices: how the pandemic broke the UK property market

Treasury braced to take major hit as house prices tumble and sales dry up

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Treasury is set to lose almost £5bn in stamp duty as the coronavirus triggers a dramatic fall in property sales and prices, a leading estate agent has warned.

Savills is predicting that revenues from the tax will drop by between £4.78bn and £3.47bn this year - a fall of between 40% and 56%.

The projection comes a week after the government effectively froze the UK’s property market, which “had already been grinding to a halt as viewings and surveys were cancelled”, says The Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How the pandemic derailed the market

Following the December general election, and the resulting greater certainty on Brexit, confidence in the housing market had increased.

Data published by Rightmove in mid March showed that average UK asking prices had risen by 3.5% year-on-year to an all-time high of £312,625. And a report published in February by Zoopla said the UK housing market had enjoyed its strongest January and February for four years.

But according to Sohail Rashid, chief executive of property tracking website View My Chain, that growth looks set to be wiped out as the coronavirus crisis takes its toll.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Rashid told The Times that 10,197 fewer properties were listed for sale in the first week of social distancing (from 23 March) compared with the 2019 weekly average.

As the market shuddered to a near halt, 5,072 fewer house sales were agreed and 2,078 sales that had been agreed previously fell through.

With demand for housing likely to continue falling in the coming months, Lucian Cook, head of residential research at Savills, has calculated that in a worst-case scenario, “a predicted 1.06 million house sales in 2020 will fall to 495,500” - with prices dropping by 10%, reports The Times.

This price drop projection tallies with that made by Ray Boulger, senior technical manager at mortgage brokers John Charcol, who predicted last week that house prices “are likely to fall 10% over the rest of this year because of the virus crisis”, says industry news site Estate Agent Today.

Some predictions are far more pessimistic, with financial services group Jefferies suggesting that house prices could fall by 20%, knocking £46,900 off average prices, reports This is Money.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced take on the week’s news agenda - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

And the impact on the Treasury?

As homeowners see the values of their properties falling as the market stalls, the impact will be felt at Whitehall.

The Times reports that Lucian Cook, head of residential research at Savills, has estimated that even in a best-case scenario, the number of UK house sales in 2020 will drop to 652,634 and prices fall by 5%, leading to a £3.47bn drop in tax revenues.

As the newspaper notes, during the financial crash of 2008, “property transactions fell by 57% and prices by 19%, and it took until the middle of 2014 for transactions to recover”.

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

AI is creating a luxury housing renaissance in San Francisco

AI is creating a luxury housing renaissance in San FranciscoUnder the Radar Luxury homes in the city can range from $7 million to above $20 million

-

Exurbs: America's biggest housing trend you haven't heard of

Exurbs: America's biggest housing trend you haven't heard ofUnder the Radar Northeastern exurbs were the nation's biggest housing markets in 2024

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

-

Why are home insurance prices going up?

Why are home insurance prices going up?Today's Big Question Climate-driven weather events are raising insurers' costs

-

Homebuyers are older than ever

Homebuyers are older than everThe Explainer Rising prices and high mortgages have boxed millennials out of the market

-

Could 'adult dorms' save city downtowns?

Could 'adult dorms' save city downtowns?Today's Big Question 'Micro-apartments' could relieve office vacancies and the housing crisis

-

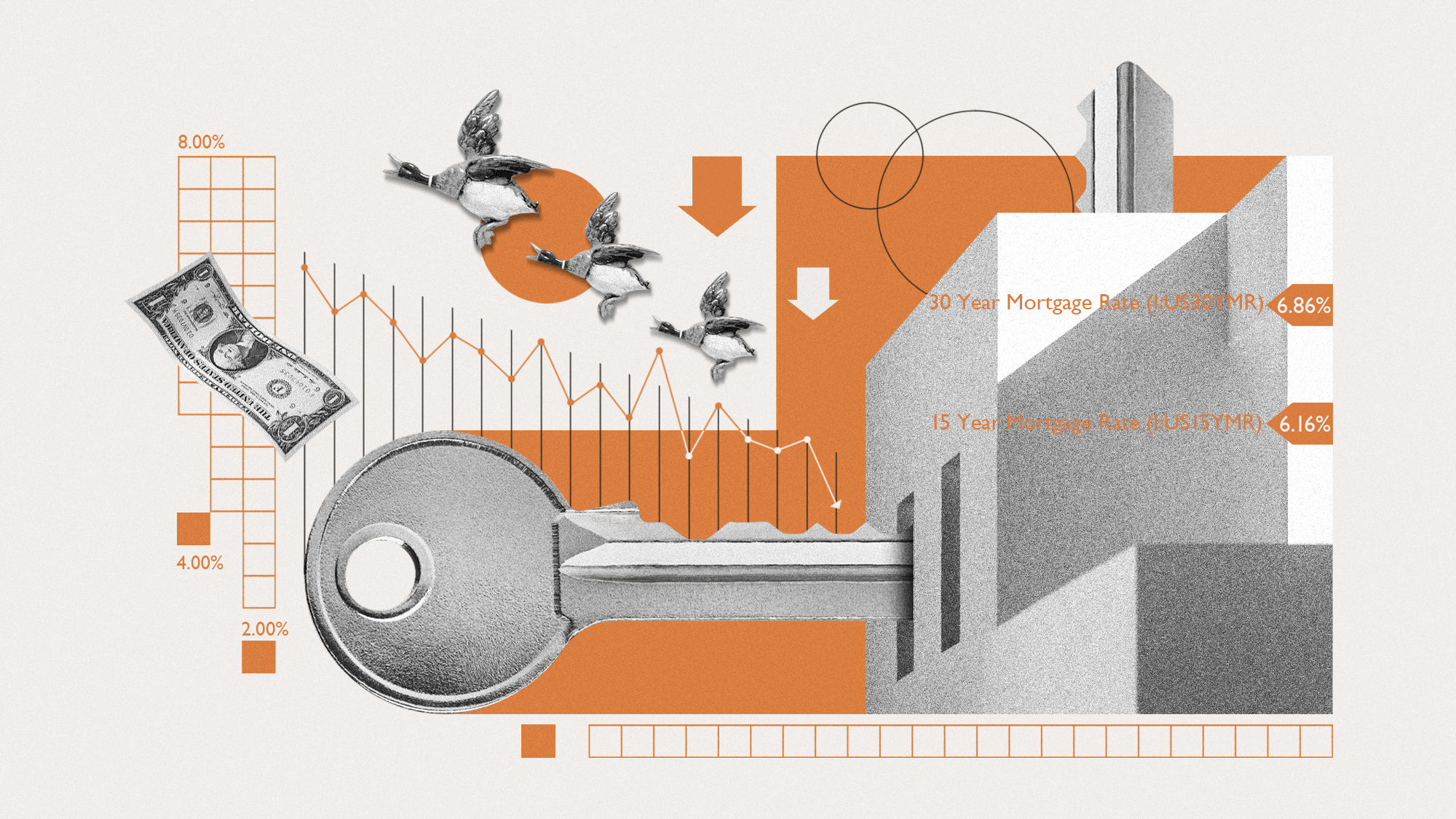

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down