Labour to abolish non-dom tax status: how would it work?

Ed Miliband says he would scrap the non-dom status that has become 'a symbol of tax avoidance' in the UK

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Labour has announced plans to abolish Britain's 200-year-old non-domicile rule, which allows some of the country's wealthiest residents to limit their tax payments.

Ed Miliband will say today that the "non-dom" status has become a symbol of tax avoidance and "makes Britain an offshore tax haven".

So how would his policy work?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What are non-doms?

Non-doms are UK residents who are "domiciled" abroad. While most UK residents have to pay tax on all of their income, whether it comes from the UK or abroad, non-domiciled residents are obliged to pay tax only on their UK earnings – and on overseas earnings only if they bring that money back into Britain.

The definition of domiciled can be tricky. Essentially, non-doms must prove that they have strong links to their home country, says The Times. It can be someone who was born overseas or who has substantial assets outside the UK, but can also include people who have inherited the status from their father or reserved a burial plot abroad.

How many "non-doms" are there in Britain?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

According to the Financial Times, there are an estimated 116,000 people with non-domiciled tax status in the UK. Chelsea owner Roman Abramovich is believed to be one of them. Other famous non-doms in the past have included Conservative Lord Ashcroft and Labour-supporting businessman Sir Gulam Noon.

What does Ed Miliband want to do?

If Labour wins the election, Miliband says he wants to abolish the non-domicile rule altogether, although the FT says there would likely be new rules for temporary residents. For example, those seconded here for work might be given up to four years in which they do not have to pay UK tax on overseas earnings.

How much would this raise?

Speaking on BBC Breakfast, shadow chancellor Ed Balls said the clampdown could raise hundreds of millions of pounds, but he admitted that the figure is "very uncertain". Iain Watson, BBC political correspondent, says governments in the past have stopped short of abolishing the rule for fear that non-doms would flee the UK altogether, meaning the Treasury would lose out on their UK tax payments. However, Miliband thinks the vast majority would opt to stay as few other countries operate a similar system. He is also arguing that there is a "moral" case to abolish the rule.

What is the reaction to the pledge so far?

Neither the Conservatives nor the Liberal Democrats have opposed the move outright, although Tory Chief Whip Michael Gove warned that it could lead to a "talent flight". The Conservatives are standing by their own policy of a new £90,000 charge for those who are non-domiciled in the UK for tax purposes but have lived here for 17 of the past 20 years. Previously, Labour had introduced a £30,000 charge for non-doms who had lived here for seven out of ten years. The Lib Dems have also pledged to increase non-dom charges.

The Times describes Miliband's move as a "raid on the super-rich" and claims it is his biggest announcement of the election campaign so far. "Scrapping non-dom tax status represents a significant political gamble for Labour," says the newspaper. "It risks further alienating a business and finance community that is already wary of Mr Miliband's agenda."

But The Guardian says, if communicated clearly, the move will probably be popular with voters. It says that the "non-dom loophole is an anachronism that should have been archived a long time ago".

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’

-

How long can Keir Starmer last as Labour leader?

How long can Keir Starmer last as Labour leader?Today's Big Question Pathway to a coup ‘still unclear’ even as potential challengers begin manoeuvring into position

-

Three consequences from the Jenrick defection

Three consequences from the Jenrick defectionThe Explainer Both Kemi Badenoch and Nigel Farage may claim victory, but Jenrick’s move has ‘all-but ended the chances of any deal to unite the British right’

-

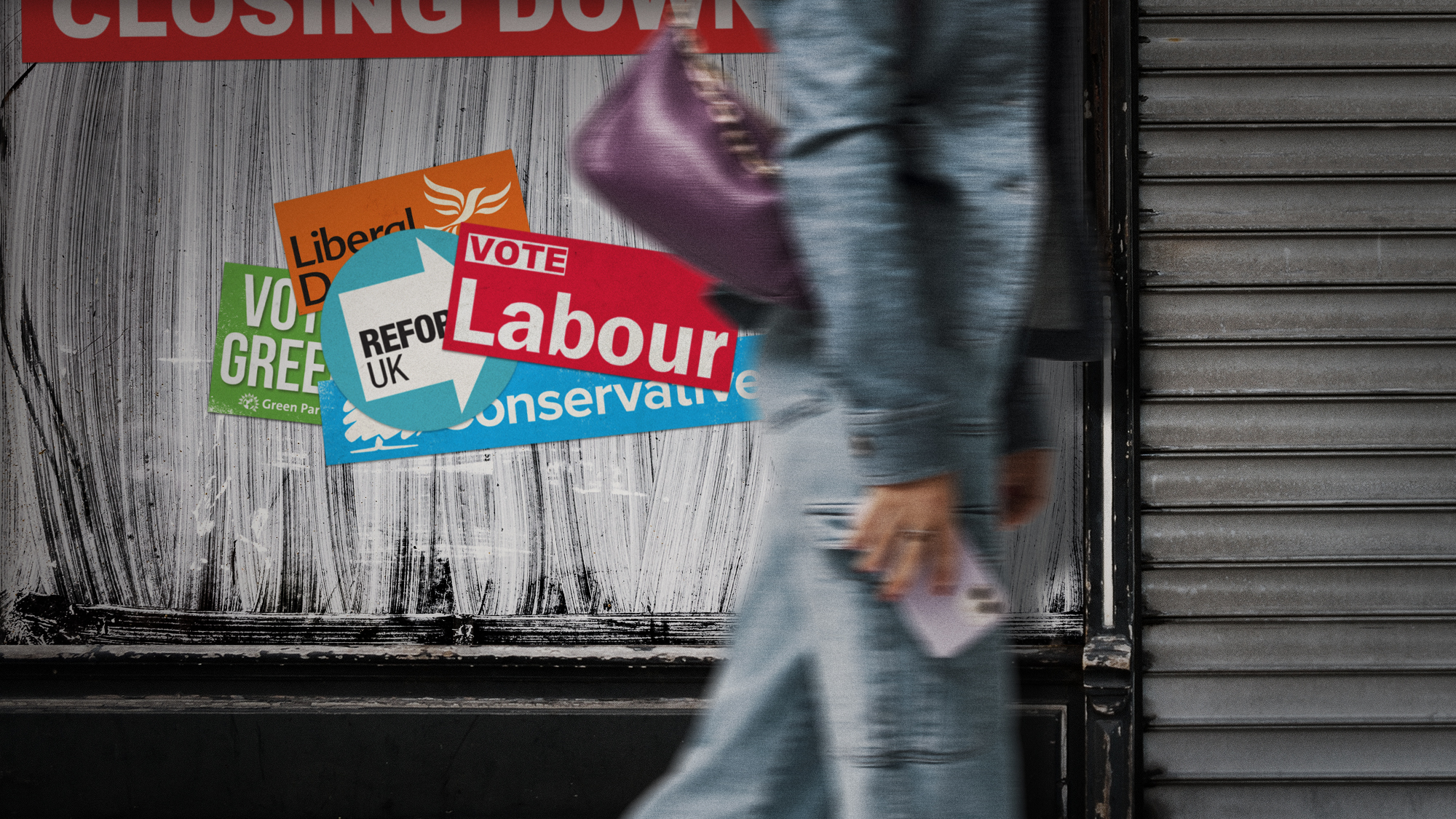

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK