Watch an economist use Legos to explain how taxes affect U.S. income distribution

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

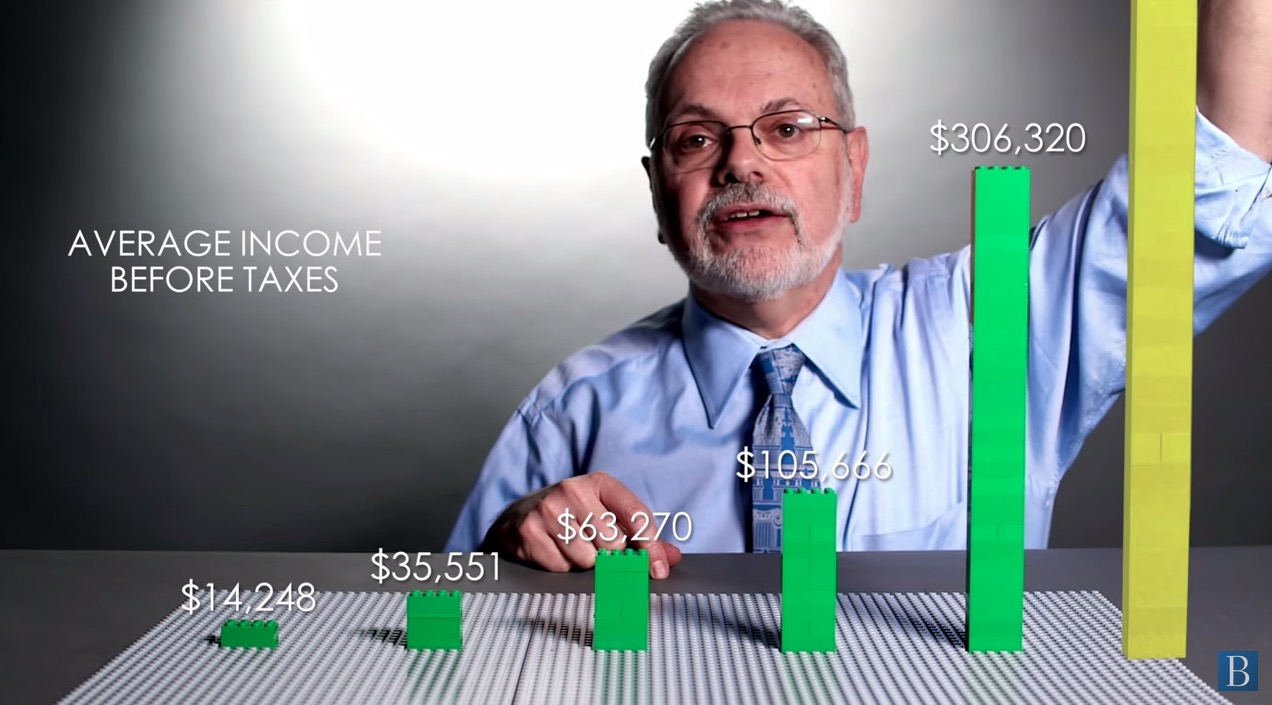

Wednesday is Tax Day in America, and if you're wondering how much the government is collecting from your economic peers and those in higher and lower income brackets, the Brookings Institution has you covered. In the video below, David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy, uses Legos to quantify how much each quintile of taxpayers earns, how much they send to Uncle Sam, and how much they have left over.

America's progressive tax system shrinks the gap between the wealthy and the poor "some," Wessel says, "but even after taxes, the distribution of income in the United States remains substantially unequal." Whether or not you think it fair that the IRS takes 70 Legos from people in the richest 1 percent of the population but only one thin brick from the bottom 20 percent, this is a pretty helpful way to visualize a fairly dry data set with important policy implications. Watch below. —Peter Weber

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

6 fantastic homes with fun rooms for kids

6 fantastic homes with fun rooms for kidsFeature Featuring an organic modern house in Austin and historic Chicago abode

-

Democrats seek calm and counterprogramming ahead of SOTU

Democrats seek calm and counterprogramming ahead of SOTUIN THE SPOTLIGHT How does the party out of power plan to mark the president’s first State of the Union speech of his second term? It’s still figuring that out.

-

Climate change is creating more dangerous avalanches

Climate change is creating more dangerous avalanchesThe Explainer Several major ones have recently occurred

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting