Why everyone’s talking about Arcadia and Philip Green

Collapse of retail giant puts 13,000 jobs at risk and hits Debenhams rescue hopes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Some of Britain’s biggest retail brands face shutting up shop for good following confirmation that Arcadia had collapsed into administration.

The retail giant - owner of outlets such as Topshop, Burton, Miss Selfridge and Dorothy Perkins - has appointed administrators from Deloitte after sales across the group were “severely impacted” by the Covid-19 pandemic, the BBC reports.

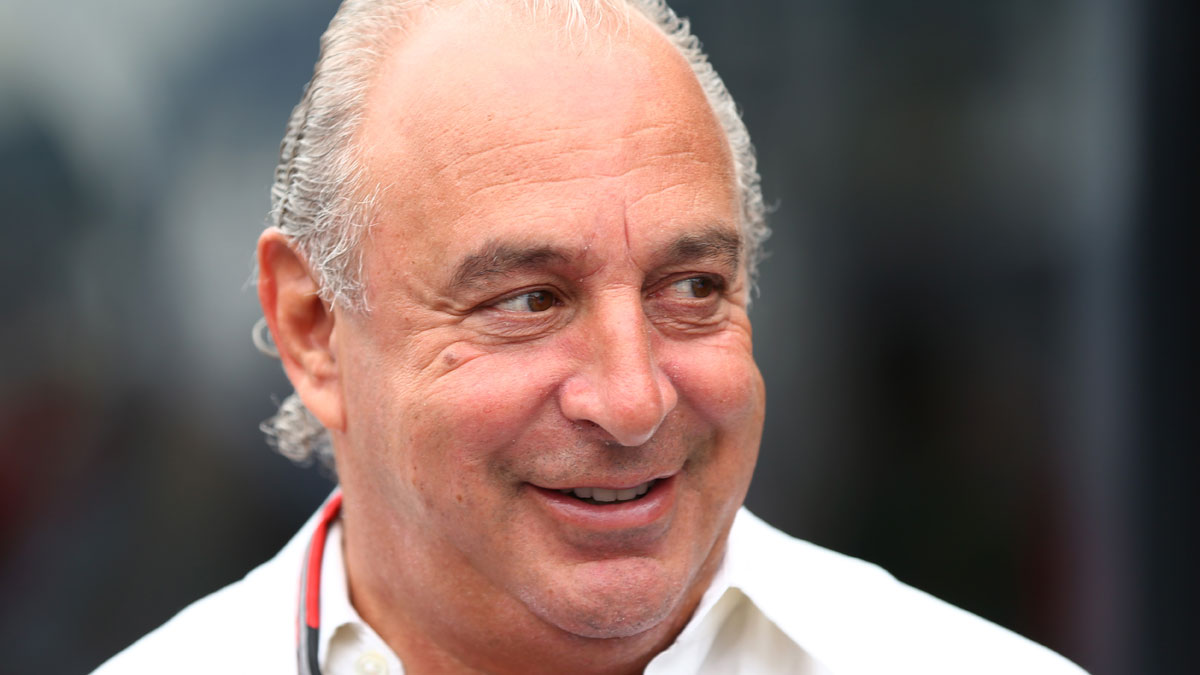

So what does the future holds for Arcadia owner Philip Green and his brands, and for other major UK retailers?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What happened?

With consumers increasingly opting to shop online and outlets forced to close their doors as a result of coronavirus restrictions, the UK’s commercial centres have been described as “ghost towns”.

Arcadia rivals including Debenhams, Edinburgh Woollen Mill Group and Oasis Warehouse have all slid into insolvency since March. And now the pandemic has claimed its “biggest retail scalp so far”, says HuffPost.

Arcadia has 444 stores in the UK and 22 overseas, and employs more than 13,000 people, of whom 9,294 are currently on furlough.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But now all of those jobs are at risk after Sky News revealed on Friday that the group was “on the brink of going into administration following the failure of talks over a £30m loan to help offset a coronavirus cash bleed”. Mike Ashley’s Frasers Group also offered a £50m loan but was rejected.

Arcadia’s subsequent collapse marks the “worst single corporate failure of the Covid-19 crisis to date”, says the broadcaster.

Confirming the “incredibly sad” news, Arcadia chief executive officer Ian Grabiner said: “The impact of the Covid-19 pandemic, including the forced closure of our stores for prolonged periods, has severely impacted on trading across all of our brands.

“Throughout this immensely challenging time our priority has been to protect jobs and preserve the financial stability of the group, in the hope that we could ride out the pandemic and come out fighting on the other side.

“Ultimately, however, in the face of the most difficult trading conditions we have ever experienced, the obstacles we encountered were far too severe.”

What about jobs, orders and pensions?

Arcadia’s staff are now “waiting to hear their fate”, Sky News says. However, bosses say that no redundancies will be announced immediately, and that stores will continue to trade and Black Friday orders will be honoured, while a buyer is sought for all or parts of the company.

Potential rescue packages aside, the collapse of Arcadia is likely to result in a cut in the value of thousands of shopworkers’ pensions.

The retail empire’s pension fund has an estimated deficit of around £350m, triggering calls from MPs and unions for Green and his wife Tina - who run and own the company respectively - to use their private fortune to “make good” the huge shortfall, The Guardian reports.

Rise and fall of Philip Green

While his company was teetering on the brink of collapse, the Croydon-born tycoon appeared “not to have a care in the world” as he was photographed soaking up the sun on his £100m superyacht in Monaco, the Daily Mail reports. Yet “the humbling of Green is one of the most spectacular downfalls in British business history”, the paper continues.

Only he, his wife and their accountants know how much the self-crowned “king of the high street” is actually worth. But one thing is certain, says The Guardian’s wealth correspondent Rupert Neate, the Greens are “far less rich than they once were”, with their estimated fortune falling from £4.9bn in 2006 to about £950m.

And the collapse of Arcadia now appears to mark a “miserable end” to Green’s “glittering retail career”, adds Sky News.

What happens next?

Arcadia executives will still control the business day-to-day, while the administration gives the firm “breathing space” from creditors such as landlords and clothing suppliers, the BBC reports.

Deloitte’s Matt Smith says administrators hope to find “one or more buyers” for the group’s businesses. After previously purchasing struggling brands such as Oasis, Warehouse, Karen Millen and Coast, fashion retailer Boohoo is seen as a potential bidder for some of Arcadia’s big-name assets.

Former Arcadia chief executive Stuart Rose told the BBC Radio 4’s Today programme that breaking up the empire is “the only way” forward. He predicts that other companies will “come and pick over the carcass”, but warns that not all the brands were likely to be sold.

“If you aren’t relevant, you’re probably going to die,” Rose added.

How could the collapse impact Debenhams?

The collapse of Arcadia has “prompted JD Sports to abandon its bid” to buy ailing rival department store chain Debenhams, putting a further 12,000 jobs at risk, The Telegraph reports.

Confirming the termination of the takeover talks, Geoff Rowley of FRP Advisory, joint administrator to Debenhams, said today that “all reasonable steps were taken to complete a transaction that would secure the future of Debenhams. However, the economic landscape is extremely challenging and, coupled with the uncertainty facing the UK retail industry, a viable deal could not be reached.”

As the newspaper notes, the collapse of the rescue bids for both Arcadia and Debenhams sets the stage for a fresh “bidding war that will shape the future of Britain’s ailing legacy fashion retail companies – and the high street itself”.

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.