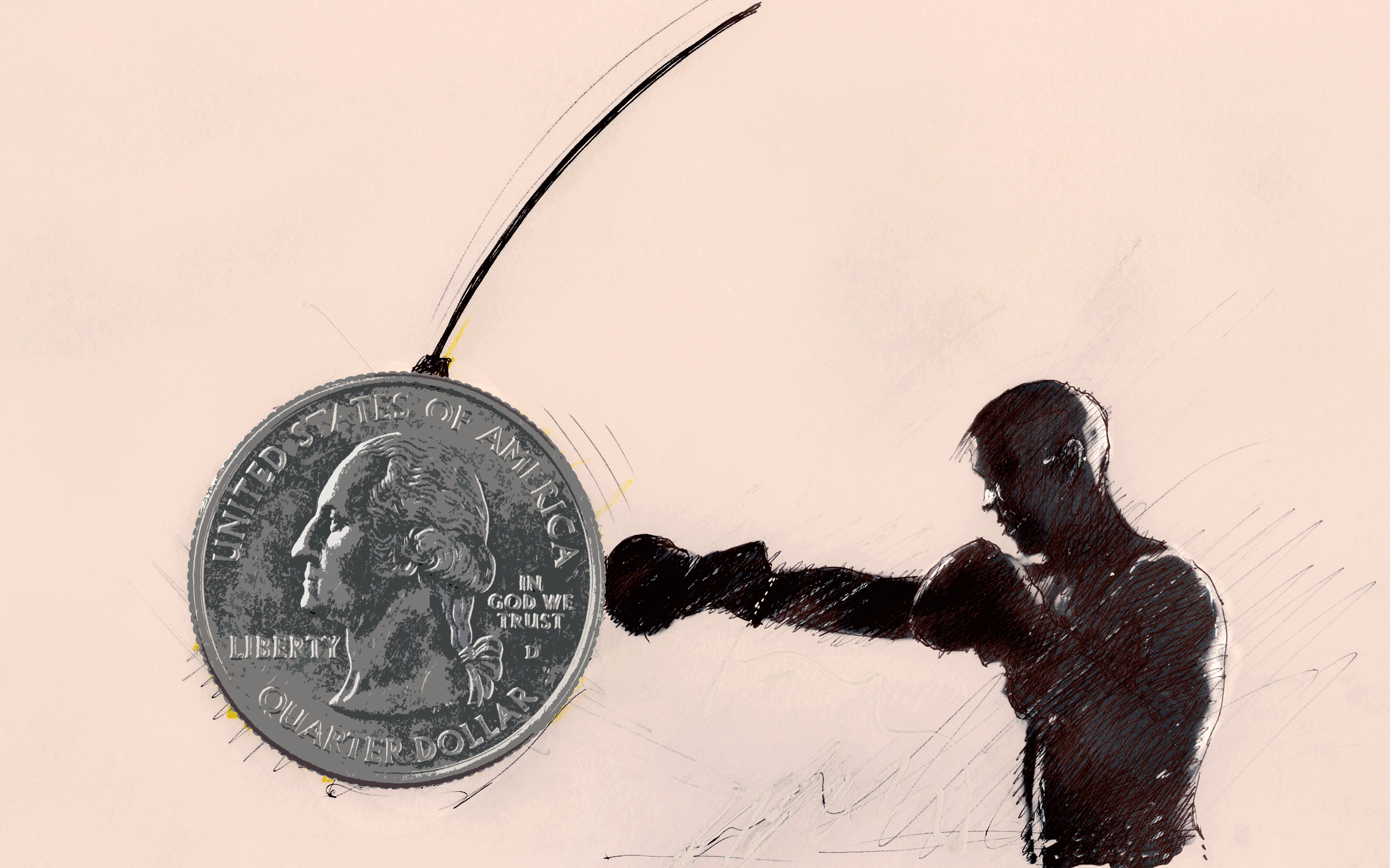

The wrong way to attack Trump's economic policy

Hey, deficit scolds! You're not helping.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Analysts are already gaming out how President-elect Donald Trump's economic policy could unfold, from mildly unpleasant scenarios to the truly disastrous. But some observers have settled on a particularly odd worry: That Trump will create too many jobs.

"If he does $6 trillion in deficit-financed tax cuts plus infrastructure spending right away it would be a short-term boost but a much bigger hit in the longer run in terms of a spike in deficits and interest rates," Mark Zandi, the chief economist at Moody's Analytics, told Politico when asked about Trump's plans. The outlet described it as "a possible sugar high followed by a potentially devastating sugar crash."

How absurd is this concern? Let us count the ways.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If Trump does drive up interest rates and inflation, it will be because his tax cuts and gargantuan deficit-financed infrastructure spending create an enormous boost to aggregate demand. That would then create so many jobs that employers wind up competing for workers, rather than workers competing for scarce work opportunities. Employers would be forced to hike wages, filtering into price increases, thus driving up inflation.

Meanwhile, the boom in job creation would open up lots of investment opportunities for rich people looking to park their surplus cash somewhere. That would lower demand for U.S. debt as a safe harbor for storing money, driving up interest rates.

In other words, we'd get higher inflation and interest rates because the economy would be booming!

Yet Zandi wants to characterize this scenario as dangerous. And frankly, so does much of the economics establishment and the center of the Democratic Party, both of whom have long fear-mongered about the debt and deficits.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

I hope it's self-evident that this would be an absolutely madcap critique to pursue against Trump — one guaranteed to drive his working-class supporters ever further into his corner.

But just to make it absolutely clear: As long as productivity rates keep pace, we can run the economy hot without inflation taking off. (And there's reason to think insufficient aggregate demand is the cause of lagging productivity growth, too.) As long as inflation doesn't get too high, the Federal Reserve can keep interest rates down by monetizing the debt. The "sugar crash" that the Fed will have to suddenly drive interest rates way up and induce a recession is based on one fluke event from the 1970s, unlikely to ever be repeated.

But what if inflation does rise too high, forcing the Fed to raise interest rates and the government to raise taxes to pay for the higher debt service? Well, that would mean the economy is overheating. In which case, we should raise taxes to cool it down.

What Zandi is describing as a potential crisis is merely the way government finances interact with the economy to keep it in a Goldilocks state of equilibrium: neither too hot nor too cold.

Now, the chances that Trump pulls off this massive economic expansion are very low.

He rode the Republican Party to the White House, and the GOP is viciously opposed to Keynesian-style stimulus. Trump's proposed tax cuts, while enormous, would shower the majority of their benefits on the wealthy, where their stimulative potential would be wasted. His infrastructure plan, as currently designed, is a corporate giveaway with little-to-no stimulative potential as well. Should Trump pass House Speaker Paul Ryan's budget, the massive cuts to Medicaid, ObamaCare, public investment, and the rest of the welfare state would drag the economy into the gutter rather than build it up.

If Democrats commit to deficit reduction now, they'll be poorly positioned to tear Trump apart if he chooses austerity and wrecks the economy.

At the same time, Trump is nothing if not mercurial, with little loyalty to GOP orthodoxy. It's possible, however unlikely, that he goes for an old-fashioned Keynesian infrastructure program by borrowing the money and paying for the projects directly. Maybe he further boosts jobs by dumping even more money into America's already massively bloated military.

The result would be what Mike Konczal, a senior fellow at the left-leaning Roosevelt Institute, described as "Reactionary Keynesianism." Trump increases inequality by handing the already-rich far more money, he guts regulations that protect the environment, he jacks up American military belligerence abroad, and he deports tons of immigrants. But he also creates a roaring economy with his deficit and infrastructure spending. And all those things become linked together in voters' minds as one big package deal.

This is one nightmare scenario the Democrats will need to avoid. But to do so, they'll need to pick apart Trump's policies the right way.

Do not criticize him for infrastructure spending or for his deficits — all those critiques implicitly condemn job creation as well. Pound home the point that an aggressive jobs agenda can create more than enough employment and wage growth for everyone, native-born or immigrant, documented or not. Admit the trade deficit should be closed if possible, even if Trump's proposed tariffs aren't always the best way to do it. And if the trade deficit can't be closed, say that the country needs even more government borrowing to offset its drag on the economy. The Democrats should always be able to outbid the GOP when it comes to big-ticket spending.

But do go after Trump for needlessly and wastefully fattening the wallets of the wealthy with his tax cuts to the top. Point out that Ryan's safety net cuts are harming the poor and the vulnerable and sucking money out of the economy. Nail Trump and the GOP for leaving Americans defenseless against big corporate interests that wreck their health and poison their communities, and for spending money on bombs and tanks and stoking the possibility of more destructive wars.

Finally, the Democrats should put all those critiques together with an admission of what Trump did right to create an alternative package deal they can sell the American people. And then barnstorm the country with it.

But before they can do that, the Democrats will have to kill the deficit fear-mongering in their own ranks.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Political cartoons for February 3

Political cartoons for February 3Cartoons Tuesday’s political cartoons include empty seats, the worst of the worst of bunnies, and more

-

Trump’s Kennedy Center closure plan draws ire

Trump’s Kennedy Center closure plan draws ireSpeed Read Trump said he will close the center for two years for ‘renovations’

-

Trump's ‘weaponization czar’ demoted at DOJ

Trump's ‘weaponization czar’ demoted at DOJSpeed Read Ed Martin lost his title as assistant attorney general

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred