America's reluctant septuagenarian workforce

U.S. companies have been eliminating traditional pensions for decades, but many Americans can't afford to retire on Social Security and savings alone

Tom Coomer has retired twice: once when he was 65, and then several years ago. Each time he realized that with just a Social Security check, "you can hardly make it these days."

So here he is at 79, working full-time at Walmart. During each eight-hour shift, he stands at the store entrance greeting customers, telling a joke and fetching a "buggy." Or he is stationed at the exit, checking receipts and the shoppers that trip the theft alarm.

"As long as I sit down for about 10 minutes every hour or two, I'm fine," he said during a break. Diagnosed with spinal stenosis in his back, he recently forwarded a doctor's note to managers. "They got me a stool."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The way major U.S. companies provide for retiring workers has been shifting for about three decades, with more dropping traditional pensions every year. The first full generation of workers to retire since this turn offers a sobering preview of a labor force more and more dependent on their own savings for retirement.

Years ago, Coomer and his co-workers at the Tulsa plant of McDonnell-Douglas, the famed airplane maker, were enrolled in the company pension, but in 1994, with an eye toward cutting retirement costs, the company closed the plant. Even though most of them found new jobs, they could never replace their lost pension benefits, and many are facing financial struggles in their old age. A review of those 998 workers found that 1 in 7 has in their retirement years filed for bankruptcy, faced liens for delinquent bills, or both, according to public records.

Those affected are buried by debts incurred for credit card payments, used cars, health care, and sometimes the college educations of their children. Some have lost their homes. And for many of them, even as they reach beyond 70, real retirement is elusive. Although they worked for decades at McDonnell-Douglas, many of the septuagenarians are still working, some full time.

Lavern Combs, 73, works the midnight shift loading trucks for a company that delivers for Amazon. Ruby Oakley, 74, is a crossing guard. Charles Glover, 70, is a cashier at Dollar General. Willie Sells, 74, is a barber. Leon Ray, 76, buys and sells junk.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"I planned to retire years ago," Sells says from behind his barber's chair, where he works five days a week. He once had a job in quality control at the aircraft maker and was employed there 29 years. "I thought McDonnell-Douglas was a blue-chip company. But then they left town — and here I am still working. Thank God I had a couple of clippers."

Likewise, Oakley, a crossing guard at an elementary school, said she took the job to supplement her Social Security. "It pays some chump change — $7 an hour," Oakley said. She has told local officials they should pay better. "We have to get out there in the traffic, and the people at the city think they're doing the senior citizens a favor by letting them work like this."

Glover works the cash register and does stocking at a Dollar General store outside Tulsa to make ends meet. After working 27 years at McDonnell-Douglas, Glover found work at a Whirlpool factory, and then at another place that makes robots for inspecting welding, and also picked up some jobs doing AutoCAD drawing.

"I hope I can quit working in a few years, but the way it looks right now, I can't see being able to," Glover said recently between customers. "I had to refinance my home after McDonnell-Douglas closed. I still owe about 12 years of mortgage payments."

For some, financial shortfalls have grown acute enough that they have precipitated liens for delinquent bills or led people to file for bankruptcy. None were inclined to talk about their debts.

"It's a struggle, just say that," said one woman, 72, who filed for bankruptcy in 2013. "You just try to get by."

The notion of pensions — and the idea that companies should set aside money for retirees — didn't last long. They really caught on in the mid–20th century, but today, except among government employers, the traditional pension now seems destined to be an artifact of U.S. labor history.

The first ones offered by a private company were those handed out by American Express, back when it was a stagecoach delivery service. That was in 1875. The idea didn't exactly spread like wildfire, but under union pressure in the middle of the last century, many companies adopted a plan. By the 1980s, the trend had profoundly reshaped retirement for Americans, with a large majority of full-time workers at medium and large companies getting traditional pension coverage.

Then corporate America changed: Union membership waned. Executive boards, under pressure from financial raiders, focused more intently on maximizing stock prices. And Americans lived longer, making a pension much more expensive to provide.

The average life expectancy in 1950 was 68, meaning that a pension had to pay out only three years past the typical retirement age of 65. Today, average life expectancy is about 79, meaning that the same plan would have to pay out 13 years past typical retirement age.

Exactly what led corporate America away from pensions is a matter of debate among scholars, but there is little question that they seem destined for extinction, at least in the private sector. Even as late as the early 1990s, about 60 percent of full-time workers at medium and large firms had pension coverage. But today only about 24 percent of workers at midsize and large companies do, according to the data, and that number is expected to continue to fall as older workers exit the workforce.

In place of pensions, companies and investment advisers urge employees to open retirement accounts. Once they reach retirement age, those accounts are supposed to supplement whatever Social Security might pay. (Today, Social Security provides only enough for a bare-bones budget, about $14,000 a year on average.)

The trouble with expecting workers to save on their own is that almost half of U.S. families have no such retirement account, according the Fed's 2016 Survey of Consumer Finances. Of those who do have accounts, moreover, their savings are far too scant to support a typical retirement. The median account, among workers at the median income level, is about $25,000.

"The U.S. retirement system, and the workers and retirees it was designed to help, face major challenges," according to an October report by the Government Accountability Office. "Traditional pensions have become much less common, and individuals are increasingly responsible for planning and managing their own retirement savings accounts." The GAO further warned that "many households are ill-equipped for this task and have little or no retirement savings."

The GAO recommended that Congress consider creating an independent commission to study the U.S. retirement system. "If no action is taken, a retirement crisis could be looming," it said.

Employees at McDonnell-Douglas in the early '90s enjoyed one of the more generous types of pensions, known as "30 and out." Employees with 30 years on the job could retire with a full pension once they reached age 55.

But, as the employees would later learn, the generosity of those pensions made them, in lean times, an appealing target for cost cutters.

Those lean times for McDonnell-Douglas began in earnest in the early '90s. Some plants closed. But for the remaining employees, including those at the Tulsa plant, executives said, there was hope: If Congress allowed the $6 billion sale of 72 F-15s to Saudi Arabia, the new business would rescue the company. In fact, the company said in its 1991 annual report, it would save 7,000 jobs.

To help win approval for the sale, Tulsa employees wrote letters to politicians. They held a rally with the governor of Oklahoma. And eventually, in September 1992, President George H.W. Bush approved the sale. It seemed that the Tulsa plant had weathered the storm.

The headline in The Oklahoman, one of the state's largest newspapers, proclaimed: "F-15 Sale to Saudi Arabia Saves Jobs of Tulsa Workers."

But it hadn't. Within months, executives at the company again turned to cost cutting. They considered closing a plant in Florida, another in Mesa, Arizona, or the Tulsa facility. Tulsa, it was noted, had the oldest hourly employees — the average employee was 51 and had worked there for about 20 years. Many were close to getting a full pension, and that meant closing it would yield bigger savings in retirement costs.

"One day in December '93 they came on the loudspeaker and said, 'Attention, employees,'" Coomer recalled. "We were going to close. We were stunned. Just ran around like a bunch of chickens."

A few years later, McDonnell-Douglas, which continued to struggle, merged with Boeing. But the employees had taken their case to court, and in 2001, a federal judge agreed that McDonnell-Douglas had illegally considered the pensions in its decision to close the plant. The employees' case, presented by attorneys Joe Farris and Mike Mulder, showed that the company had tracked pension savings in its plant-closure decisions. The judge found McDonnell-Douglas, moreover, had offered misleading testimony in its defense of the plant closing. The judge blasted the company for a "corporate culture of mendacity."

Employees eventually won settlements — about $30,000 was typical. It helped carry people over to find new jobs. But the amount was limited to cover the benefits of three years of employment — and it was far less than the loss in pension and retiree health benefits. Because their pension benefits accrued most quickly near retirement age, the pensions they receive are only a small fraction of what they would have been had they worked until full eligibility.

"People went to work at these places thinking they'll work there their whole lives," Farris said, noting that the pensions held great appeal to the staff. "Their trust and loyalty, though, was not reciprocated."

The economic effects were, of course, immediate. The workers, most of them over 50, had to find jobs. Some enrolled in classes for new skills, but then struggled to find jobs in their new fields. Several found jobs at other industrial plants. One started a chicken farm for Tyson. Another took a job on a ranch breaking horses.

In interviews with more than 25 former employees, all but a handful said their new wages were only about half of what they had been making. Typically, their pay dropped from about $20 per hour to $10 per hour.

The pay cut was tough, and it made saving for retirement close to impossible. In fact, it has made retirement itself near impossible for some — they must work to pay the bills. A few said, though, they work because they detest idleness, and persist in jobs that would seem to require remarkable endurance.

Combs, for example, works the graveyard shift, beginning each workday at 1:30 a.m. His days off are Thursday and Sunday. He worked 25 years at McDonnell-Douglas, and more than 20 loading trucks.

He shrugs off the difficulty. "I don't want to sit around and play checkers and get fat," Combs says. "I used to pick cotton in 90-degree heat. This is easy."

Coomer, too, even if he would have preferred to retire, seems to genuinely enjoy his work. At Walmart, his natural cheerfulness is put to good use.

When he sees someone looking glum, he tells them a joke. Why does Santa Claus have three gardens? So he can hoe, hoe, hoe. "People really like that one," he says.

Along with his Walmart check, he gets $300 a month from the McDonnell-Douglas pension. Had he been able to continue working at McDonnell-Douglas, he calculates, he would have gotten about five times that amount. "After they shut the plant down, I would dream that I was back at McDonnell-Douglas and going to get my pension," Coomer recalled. "In the dream, I would try to clock in, but I couldn't find my time card. And then I'd wake up."

In the dream, he would have retired years ago.

Excerpted from an article that originally appeared in The Washington Post. Reprinted with permission.

-

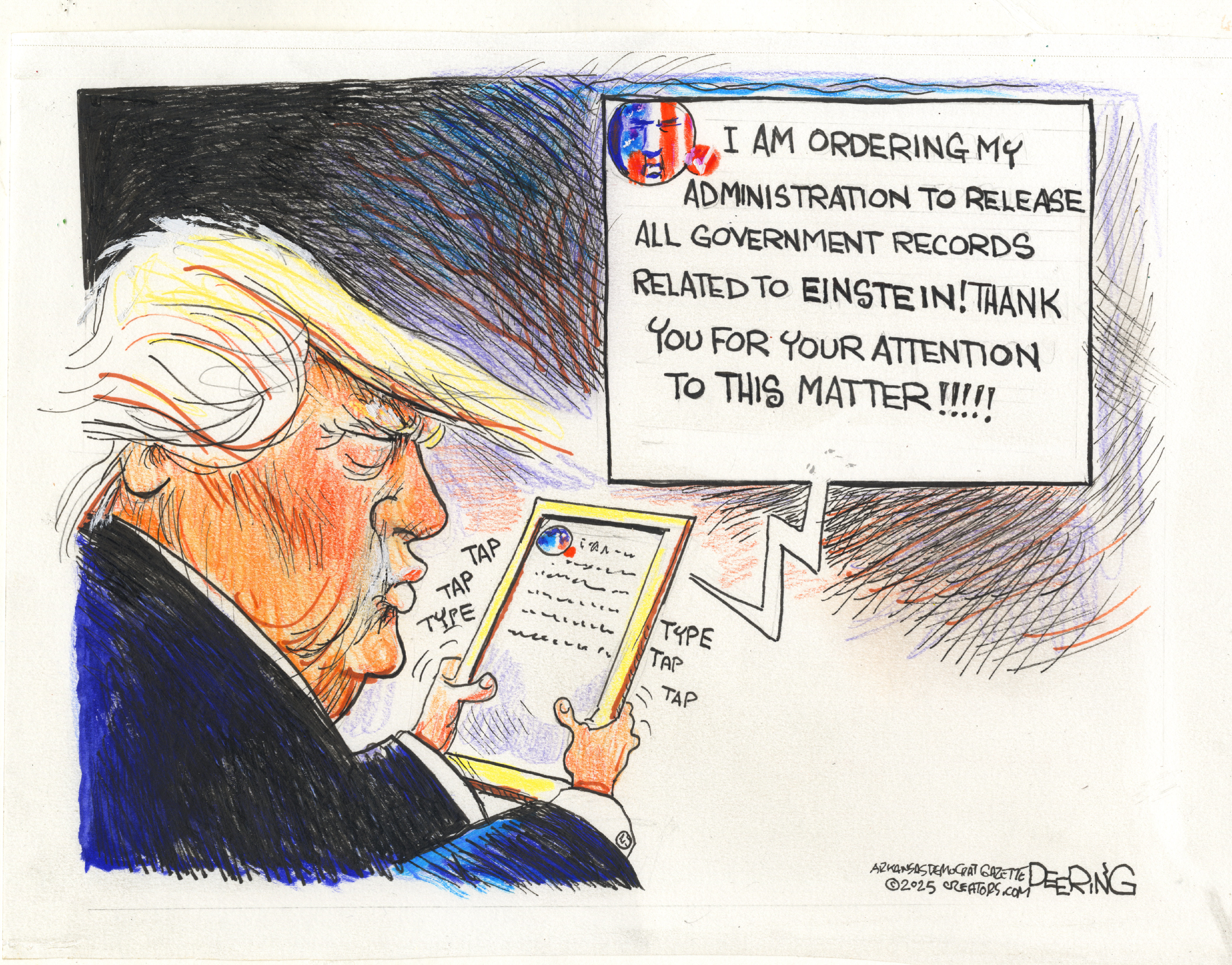

October 4 editorial cartoons

October 4 editorial cartoonsCartoons Saturday's political cartoons include the Einstein files, defunding the police, and an odd tribute to Jane Goodall

-

Mustardy beans and hazelnuts recipe

Mustardy beans and hazelnuts recipeThe Week Recommends Nod to French classic offers zingy, fresh taste

-

Under siege: Argentina’s president drops his chainsaw

Under siege: Argentina’s president drops his chainsawTalking Point The self-proclaimed ‘first anarcho-capitalist president in world history’ faces mounting troubles