Wall Street titans seem to have done particularly well under the final GOP tax plan

Corporations will get the bulk of the direct benefits from the Republican tax overhaul — $1.3 trillion over 10 years — and Wall Street seems to have done particularly well. Next year alone, America's top eight banks will get an extra $15.3 billion, according to an internal Goldman Sachs report obtained by ThinkProgress, including $3.5 billion for Bank of America, $3.3 billion for J.P. Morgan, and $1.4 billion for Citigroup.

But if Wall Street banks got a big bonus, hedge fund managers at Blackstone Group, Carlyle Group, and KKR & Co. arguably scored an even bigger win. Despite explicit pledges from President Trump, the bill he'll sign did not get rid of the carried interest loophole that allows hedge fund and private equity managers to claim their hefty earnings as capital gains, taxed at a significantly lower rate than ordinary income. And it isn't just liberals who are angry the loophole survived.

On Fox Business, Trish Regan slammed Trump and his team for allowing "fat cat private equity investors" to keep lower tax rates "than a New York City cop." America's "founding fathers never, ever anticipated a swamp like the one we have today," she said.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

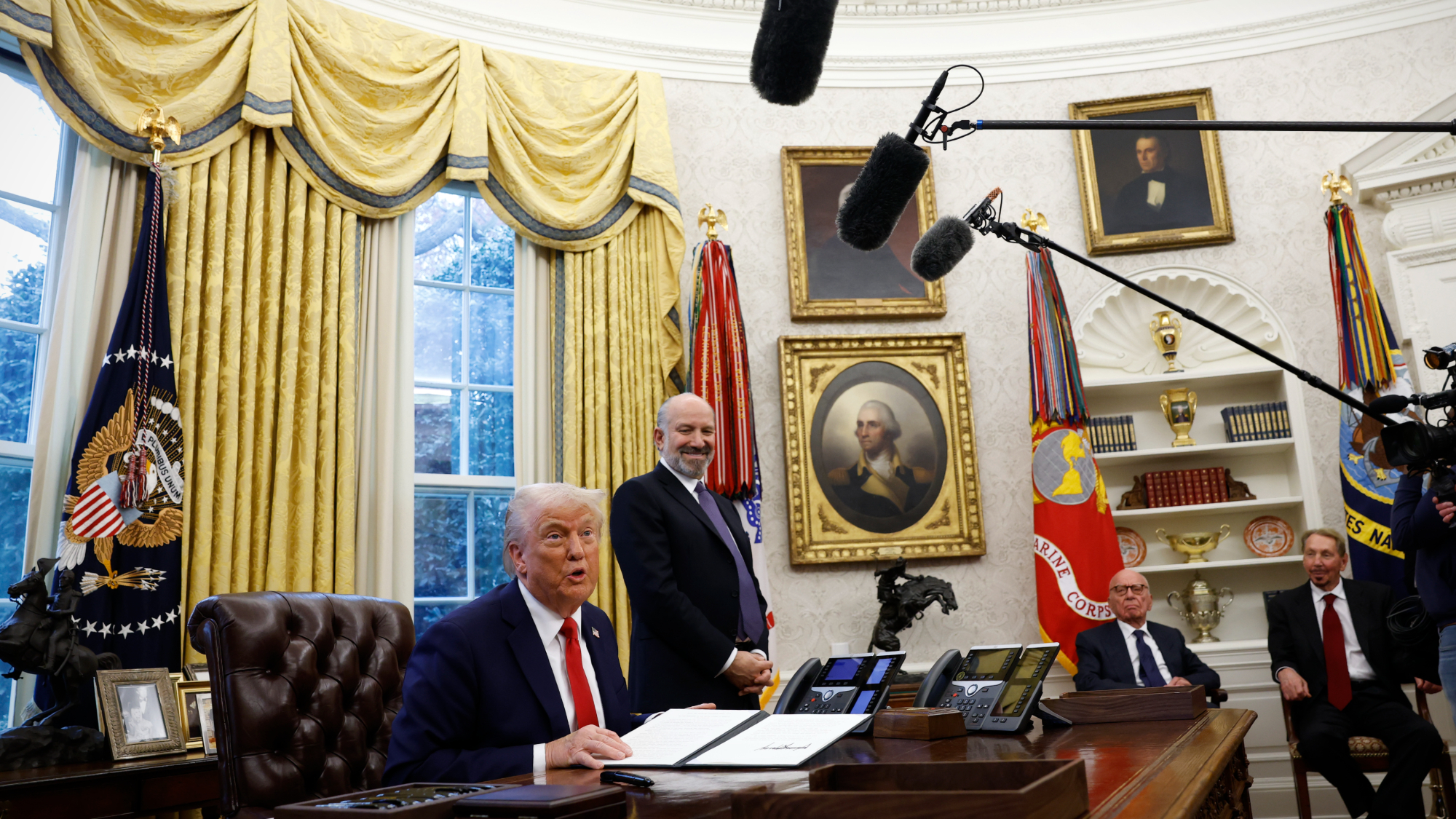

On Wednesday, Trump's top economic adviser Gary Cohn said "we probably tried 25 times" to get congressional Republicans to ax the loophole, and "the president asked just this past Monday if we could still get rid of it." Cohn, formerly the No. 2 at Goldman Sachs, blamed Congress for Trump's failure, and Fox Business reported that Blackstone, Carlyle, and KKR did funnel "massive amounts of campaign cash into the coffers of Republican leaders in the House and the Senate as these same lawmakers voted for a tax bill that preserves the so-called carried interest loophole." But they also cited people "close to the tax bill process" who said "the White House didn't make ending the loophole a priority," citing "Trump's close relationship with Blackstone chief Steve Schwarzman, a key outside economic adviser."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

How does the Clean Air Act work?

How does the Clean Air Act work?The Explainer The law makes the air healthier. Will what we breathe stay that way?

By Joel Mathis, The Week US Published

-

Inside the Israel-Turkey geopolitical dance across Syria

Inside the Israel-Turkey geopolitical dance across SyriaTHE EXPLAINER As Syria struggles in the wake of the Assad regime's collapse, its neighbors are carefully coordinating to avoid potential military confrontations

By Rafi Schwartz, The Week US Published

-

US Treasuries were a 'safe haven' for investors. What changed?

US Treasuries were a 'safe haven' for investors. What changed?Today's Big Question Doubts about America's fiscal competence after 'Liberation Day'

By Joel Mathis, The Week US Published

-

Markets notch worst quarter in years as new tariffs loom

Markets notch worst quarter in years as new tariffs loomSpeed Read The S&P 500 is on track for its worst month since 2022 as investors brace for Trump's tariffs

By Peter Weber, The Week US Published

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

By Justin Klawans, The Week US Published

-

Crafting emporium Joann is going out of business

Crafting emporium Joann is going out of businessSpeed Read The 82-year-old fabric and crafts store will be closing all 800 of its stores

By Peter Weber, The Week US Published

-

Trump's China tariffs start after Canada, Mexico pauses

Trump's China tariffs start after Canada, Mexico pausesSpeed Read The president paused his tariffs on America's closest neighbors after speaking to their leaders, but his import tax on Chinese goods has taken effect

By Peter Weber, The Week US Published

-

Chinese AI chatbot's rise slams US tech stocks

Chinese AI chatbot's rise slams US tech stocksSpeed Read The sudden popularity of a new AI chatbot from Chinese startup DeepSeek has sent U.S. tech stocks tumbling

By Peter Weber, The Week US Published

-

US port strike averted with tentative labor deal

US port strike averted with tentative labor dealSpeed Read The strike could have shut down major ports from Texas to Maine

By Peter Weber, The Week US Published

-

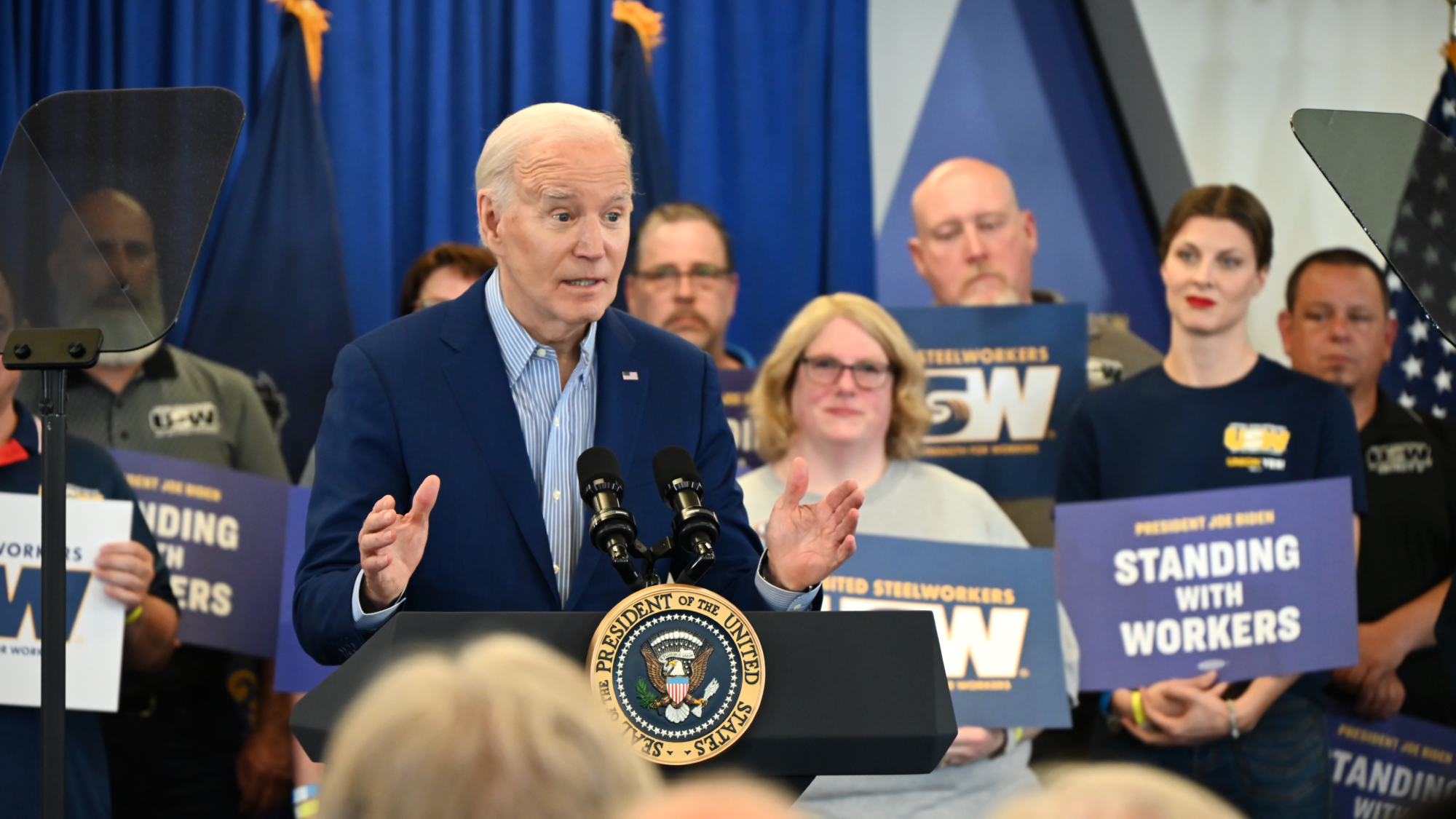

Biden expected to block Japanese bid for US Steel

Biden expected to block Japanese bid for US SteelSpeed Read The president is blocking the $14 billion acquisition of U.S. Steel by Japan's Nippon Steel, citing national security concerns

By Peter Weber, The Week US Published

-

Judges block $25B Kroger-Albertsons merger

Judges block $25B Kroger-Albertsons mergerSpeed Read The proposed merger between the supermarket giants was stalled when judges overseeing two separate cases blocked the deal

By Peter Weber, The Week US Published