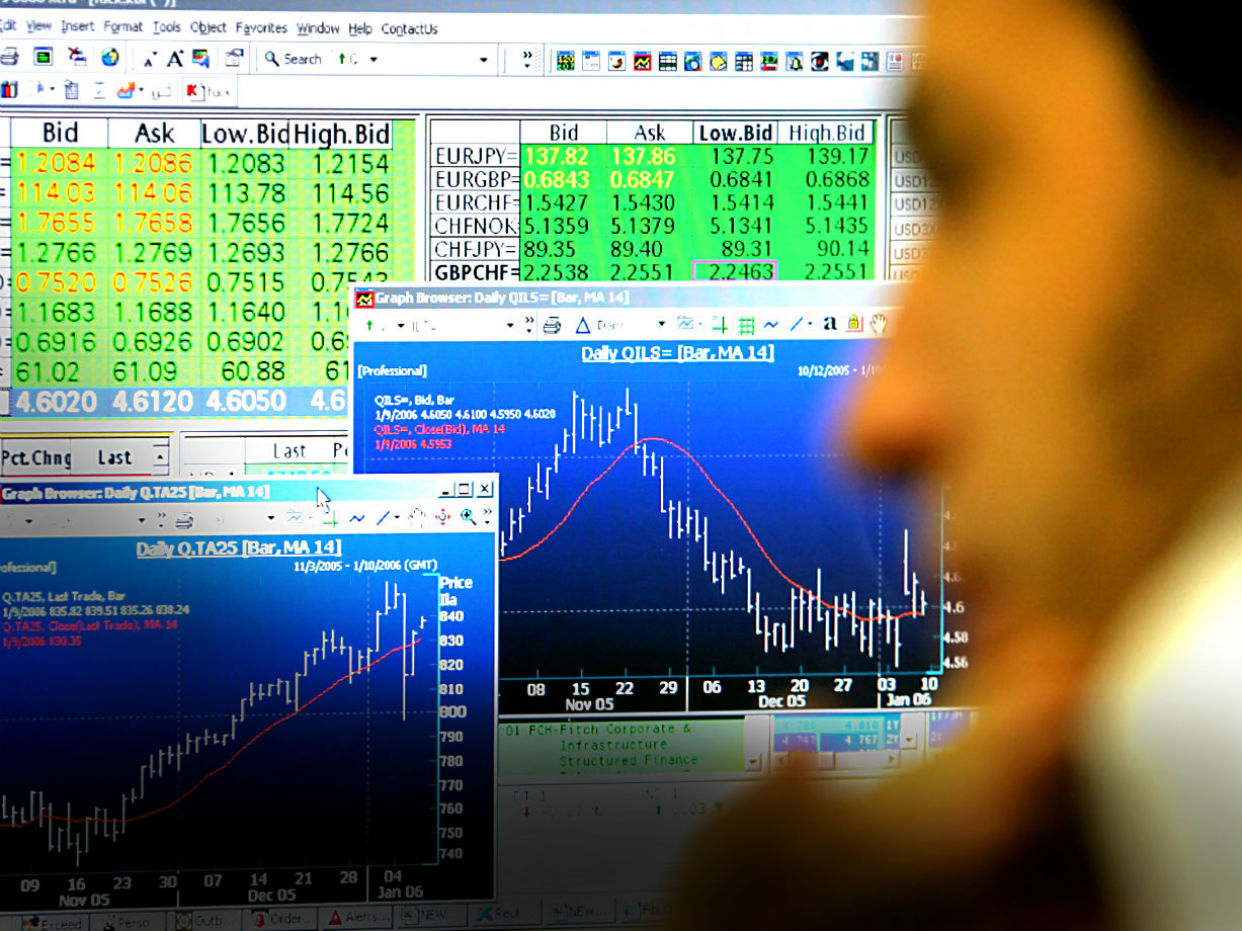

2020 stock market predictions

Will this year see global markets consolidate 2019’s record gains?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Financial markets bucked widespread political turmoil and mounting fears the global economy could be overheating to post record highs in 2019.

Looking ahead to the next twelve months, “investors are expecting 2020 to bring further rising asset prices and lively merger activity” says Graeme Wearden in The Guardian “but Brexit, the US presidential election and the US trade war with China could all spring nasty surprises over the next 12 months and give the long-running bull market a jolt.”

“For the professional prognosticators and market mavens of Wall Street and beyond, there is at least one easy prediction to make about the next 12 months: Investors are going to earn less. A lot less, probably” says Bloomberg.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“’The double-digit returns of 2019 will be hard to repeat’ is a phrase littering almost every investment outlook for global markets in 2020” says the financial wire service, and “despite the trade war, political turmoil and more, virtually all major assets just posted a once-a-decade performance, and even uber-bulls know the chances of repeating the feat are slim”.

Listen to The Week discussing investing in 2019 in our podcast

On Wall Street, stocks “face several obstacles to growth in the new year” says CNN. “The Federal Reserve has stopped cutting interest rates. The economic jolt from tax cuts has run out. Despite some progress, the United States still doesn't have a trade deal with China” reports the news networking meaning stocks are entering 2020 “with a bit less of a tailwind than they had in 2019”.

“Investors still have plenty to be optimistic about, though” it adds.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In the UK, warnings about continued economic stagnation in 2020 have not stopped stock market experts from predicting the FTSE 100 could break through the 8,000 mark for the first time.

“With Boris Johnson pledging to take Britain out of the EU on January 31, the US presidential election in November, and trade tensions ebbing and flowing, it looks set to be an eventful year” says This is Money but having surged by 12.1% in 2019 and 39.3% in the last decade, “analysts believe the blue-chip benchmark will break records”.

“Investors will realise UK shares trade are at low valuations and flock back to sectors that performed poorly in 2019 – utilities, banks, insurers” says Helal Miah, analyst at The Share Centre.

AJ Bell’s Russ Mould says “Brexit must still be resolved and doubts hover over the health of the global economy. Were the UK to strike a trade deal with the EU, Washington and Beijing to settle their differences and governments abandon austerity, the outlook for next year could look very different.’

Yet The Daily Telegraph warns that “when consensus emerges among experts about the direction of stock markets – it is often a signal that something unexpected is about to happen”.

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––