Is Pizza Hut stuffed?

Restaurant franchise in talks to refinance some of its £73m debt as cost of living and food inflation bite

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Pizza Hut UK is fighting to avoid the fate that has befallen many once-beloved high street chains as it grapples with mounting debts brought on by soaring food inflation and the cost-of-living crisis.

After opening its first restaurant in the UK in Islington, north London in 1973, Pizza Hut “took the UK by storm”, said The Times. At its height in the 1980s it was opening an average of one restaurant a week in the UK.

Forty years on and PwC, the company’s auditors, have fired “a warning shot” over the restaurant chain’s future as it seeks to restructure some of its £73 million of debt, The Telegraph reported.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How bad is it?

Pizza Hunt’s accounts for the 12 months to December 2022 show revenues “bounced back after the pandemic” to £161 million from £130 million a year before.

However, costs have jumped even more rapidly over the same period, pushing the company to an operating loss of just over £3 million and a pre-tax loss of £3.6 million last year.

Heart With Smart Group, which runs the restaurant arm of the business in the UK, employing more than 4,000 workers across 152 outlets, is now locked in negotiations to refinance almost £31m of its £73 debt pile due to be repaid to lenders in April 2024.

What are the causes?

There are several factors at play, said the Daily Mail, “as people spend less on eating out due to the cost-of-living crisis while it grapples with significant rises in energy and food prices”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Pizza Hut UK said: “Just as the omicron impacts began to ease, the outbreak of the war in Ukraine caused unprecedented and sustained inflation of energy, food and transportation costs.”

Electricity prices peaked at around 12 times the historical level last year, it said, while food price inflation rose from 8% to 22%. The franchise claimed it has also been hit by a shortage of workers and demands for higher wages.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, told the Mail that Pizza Hut UK outlets had also been affected by their locations in shopping centres or near offices. These are “areas that have seen footfall decrease since the pandemic, which when coupled with the fact that consumers have less money in their pocket, creates a potent and difficult situation”.

Higher interest rates have also had a knock-on effect on the company’s bottom line, with Pizza Hut UK being charged up to 14% interest on its debts.

What next?

Despite the company securing “relaxed terms on its loans with banking partners”, according to The Telegraph, Pizza Hut UK still warned there was a chance it could breach its loan agreements in a “severe but plausible downside scenario”.

This has led auditor PwC to issue a warning that the company faced a “material uncertainty which may cast significant doubt about the company’s ability to continue as a going concern”.

It is not the first time the chain has been on the brink of collapse. In 2020 it was saved from going bust after landlords agreed to reduce rents on restaurant branches.

The problems faced by Pizza Hut UK mirror those of many other legacy high street chains, with the likes of Wilko, Paperchase and Cath Kidston all going into administration over the past six months. The British Retail Consortium revealed recently that 6,000 retail outlets have closed in the last five years and the overall vacancy rate has increased since the start of the year.

Things could get even worse, said The Times, with UK lenders “bracing for defaults next year as debts taken out during the pandemic fall due for repayment”. The process of refinancing loans will be “complicated by higher interest rates, which risk making legacy debts unaffordable”, the paper said.

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

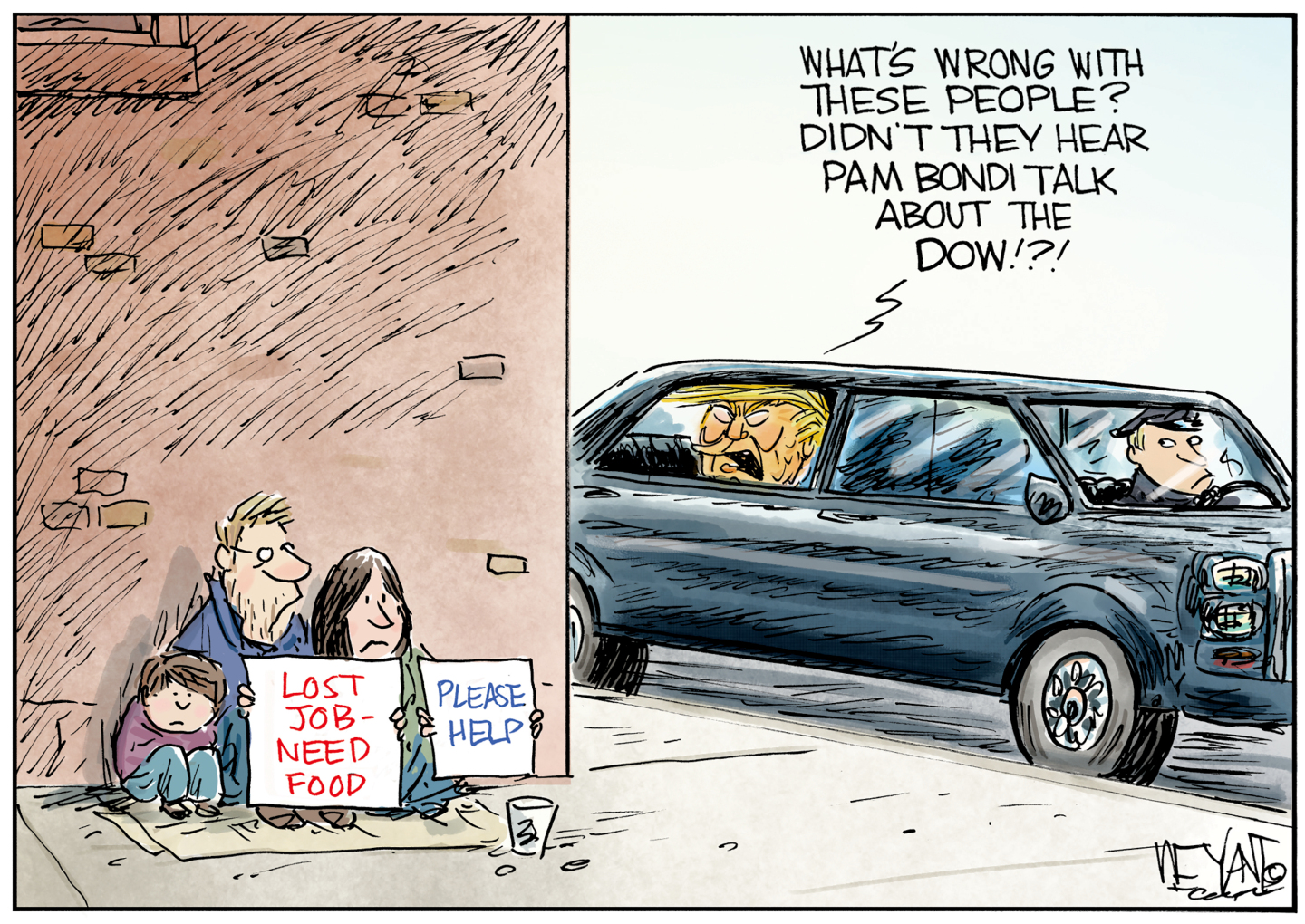

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more