Will the UK be hit by the EU-Japan 'cars-for-cheese' deal?

With his rallying cry of a 'Global Europe', Jean-Claude Juncker appears to be mocking Britain's Brexit hopes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Brexiters have been keen to trumpet the potential for the UK to become a free-trading global force once freed from the shackles of a protectionist European Union in economic decline.

However, yesterday, it was European Commission President Jean-Claude Juncker's turn to boast about the EU's latest move towards a "Global Europe", says the Financial Times.

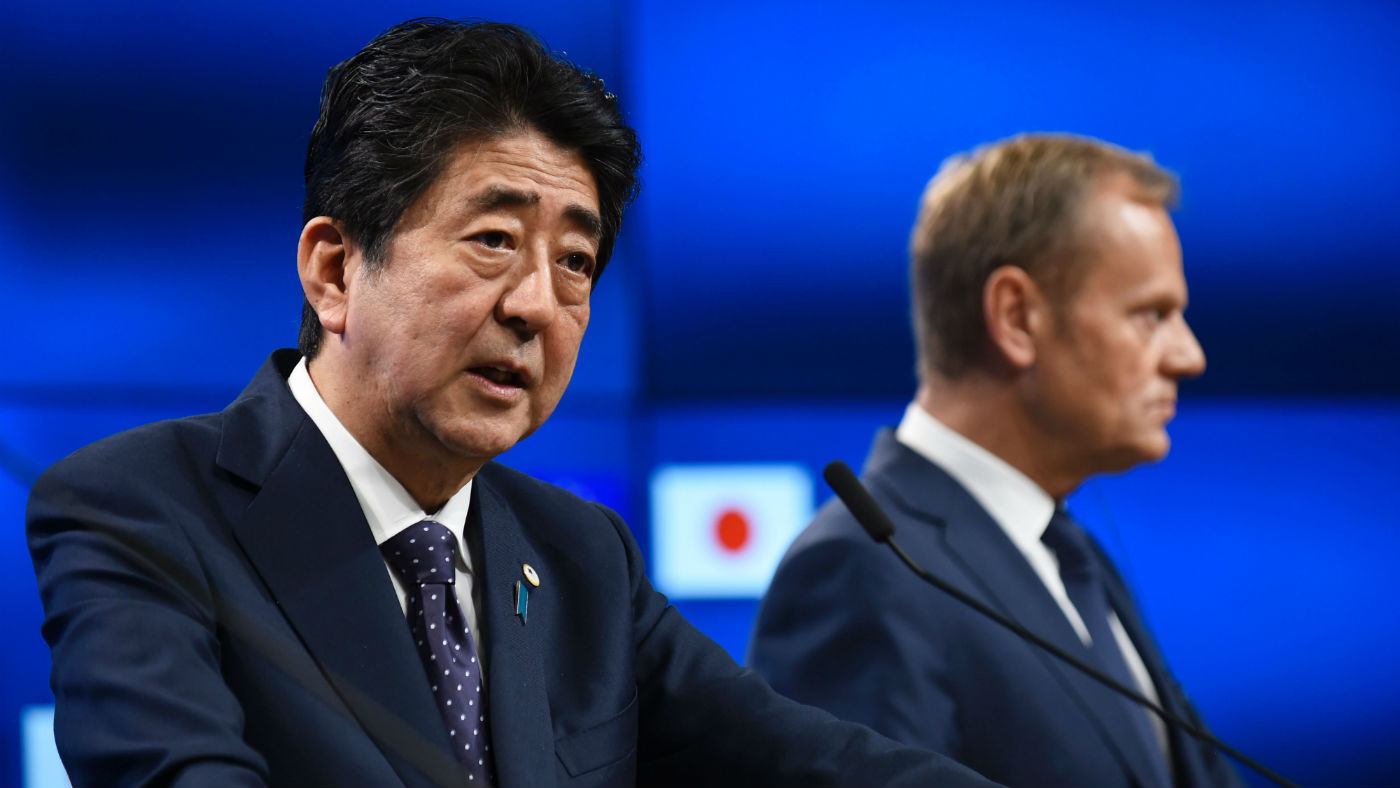

Juncker used those words - "a barely-disguised jab at Theresa May’s ambition to leverage Brexit to create a 'Global Britain'" - in a Twitter message celebrating the signing of a free trade deal between the EU and Japan.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Former government adviser Mats Persson, head of international trade at EY, said the agreement was "fantastic news" for global free trade - but warned: "Britain is not on the right side of this one."

Brexiters argue, however, it is just the latest example of the sort of bespoke free trade arrangement the EU has with various countries around the world and one the UK could soon enjoy with the bloc.

Here's everything you need to know.

What is the EU and Japan deal?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It is a plan to open up free trade between the remaining 27 member states of the EU, the world's largest single market, and the world's third-largest single economy, Japan.

When does it come into force?

Here's the thing, it's only an "outline" or "in principle" deal, says the BBC, which means the basic tenets of the formal agreement have been agreed informally, giving a platform for talks to move forward.

It is hoped the final deal will be secured in early 2019, but there are a lot of knotty issues to be worked through before that.

As with all these sorts of deals, there will be transitional arrangements to help firms adjust, which could in some cases apply for ten to 15 years, says the Japan Times.

What does the deal cover?

Basically, the EU wants to reduce or eliminate tariffs and harmonise rules on food and drink to boost exports, especially on wine and dairy products. In return, it offers to do the same for cars and consumer electronics produced in Japan.

"So it's a cars-for-cheese agreement, the first stage towards a free trade deal," says Fraser Nelson in The Spectator.

Is the timing significant?

Yes, and not just because of Brexit. In relation to the UK's impending departure from the EU, the provisional date of early 2019 for the final deal to be signed means it could come into force just as we leave the bloc.

It's notable the provisional agreement has been signed on the eve of the G20 summit and in the wake of Donald Trump decrying some of the deals his country has struck in recent years.

In January, the US President actually scrapped an arrangement that would have opened up free trade with Japan and other Pacific ring countries.

According to Nelson, the EU-Japan deal is merely an attempt by both sides to "embarrass America".

Will the UK lose out?

It could do, especially if it fails to agree any sort of arrangement with Japan quickly. Carmakers with a big UK presence, such as Nissan, Toyota and Honda, might find they are best served moving to the continent.

Whether the UK will be able to agree its own deal could be a matter of timing: if it is still in the EU before the Japan agreement is signed, it might be able to "grandfather" the deal into domestic law "with some tweaks", said EY's Persson.

Even then it could face challenges - for example, free trade arrangements typically require at least 50 per cent of a product to originate from a country for it to qualify for reduced tariffs.

That is easy within the EU customs union as this applies across the bloc. Once outside the EU, however, UK manufacturers could find they fall foul given such a large share of component parts for industrial goods are shipped in from abroad, says the FT.

Could it provide a Brexit template?

In principle, yes, but it's important to note where this deal is more limited than being a member of the EU single market and customs union.

Basically, it probably won't remove all trading tariffs, nor apply to all sectors. The BBC says [5] trading in services is typically not covered by these sorts of deals, neither, as non-tariff barriers such as rules and regulations are harder to overcome.

As the UK economy is dominated by services - and especially finance - that is a big deal.

There's also the issue of time: this deal has been in the works for four years and is still two years from completion. A deal with Canada took seven years and has hit new snags.

Could the other EU member states block the deal?

That is a very complicated question. According to a recent ruling on a deal with Singapore, all EU countries must approve any agreement that includes inward investment.

As some countries have requirements that national deals must be approved by regional parliaments, that means the likes of Belgium's socialist Wallonia could block it.

A post-Brexit trade deal might be able to avoid this if it excludes investment or is signed as part of the formal exit process, meaning it would only need majority approval by 20 countries.