The daily business briefing: August 13, 2019

Bolton says the U.S. is ready to negotiate a post-Brexit deal, trade tensions and Hong Kong protests continue to rattle markets, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Bolton says U.S. ready to discuss post-Brexit trade deal

National Security Adviser John Bolton said Monday that the U.S. is ready to negotiate a post-Brexit trade deal with Britain. Bolton said after meeting with the new British prime minister, Boris Johnson, in London that the U.S. and the U.K. could pull together an agreement "in pieces" to get it done faster as Britain pushes to exit the European Union on October 31. "I think here we see the importance and urgency of doing as much as we can agree on as rapidly as possible," Bolton said. Bolton added that the two allies could start with areas where they could agree easily, and move on from there, with touchy topics such as U.S. sanctions on Iran and a ban of Chinese tech giant Huawei delayed until after the U.K.-EU divorce.

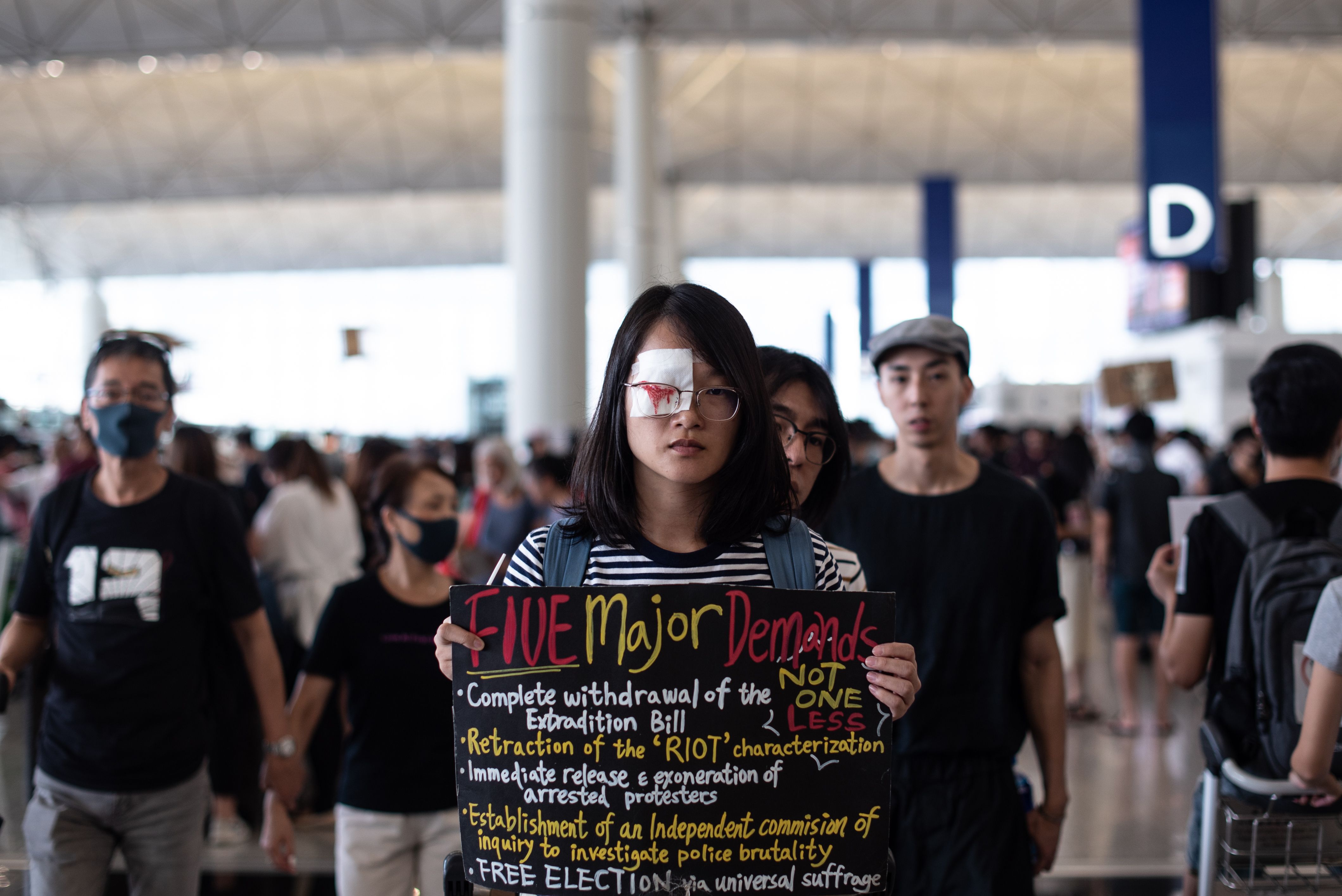

2. Trade war, Hong Kong tensions drag down stocks

U.S. stocks plunged on Monday, with the Dow Jones Industrial Average, the S&P 500, and the Nasdaq all dropping by 1.2 percent or more as the U.S.-China trade war continued to stoke fears of a global economic slowdown. "Trade and the concern that as this escalates it continues to wear on confidence to a point that this actually causes a recession, that's what people are wrestling with," said Ben Phillips, chief investment officer at EventShares. U.S. stock index futures fell further early Tuesday as ongoing protests in Hong Kong and a crashing Argentine peso drove investors to the relative safety of U.S. bonds, gold, and the Japanese yen. Futures for the Dow and the S&P 500 were down by 0.2 percent, while those of the Nasdaq fell by 0.3 percent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Federal deficit increases by 27 percent

The Treasury Department reported on Monday that the U.S. budget deficit grew to $867 billion for the first 10 months of the fiscal year, an increase of 27 percent compared to this time in 2018. The deficit for fiscal year 2018 was $779 billion. The fiscal year ends on September 30, and the White House's Office of Management and Budget predicts by that point, the deficit will reach $1 trillion for the year. Experts say the 2017 Republican tax plan, which included $1.5 trillion in tax cuts, is one reason why the deficit is growing so much. Spending is also up, and while tax revenue increased by 3 percent since October 1, federal spending is up 8 percent. Spending is only going to continue to increase, as a two-year budget deal signed into law by President Trump this month will raise spending by $320 billion.

4. Verizon to sell Tumblr to WordPress owner Automattic

Verizon has agreed to sell its blogging platform Tumblr to WordPress owner Automattic Inc. at a huge loss. Verizon got Tumblr as part of its 2017 acquisition of Yahoo, which bought Tumblr in 2013 for $1.1 billion. Axios said one source familiar with the deal put the price under the new deal "well below" $20 million, while another said it was less than $10 million. Still, the acquisition is Automattic's biggest ever. Tumblr's roughly 200 staffers reportedly will make the switch to work for the new owner. Tumblr is not profitable but it hosts more than 450 million blogs. Tumblr lost some users last year when Verizon banned adult content. Automattic chief executive Matt Mullenweg said that ban would stay but no new changes were coming.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Morgan Stanley predicts Fed rate cuts in September, October

Morgan Stanley analysts said Monday they expect the Federal Reserve to cut interest rates further in September and October as trade tensions cast a cloud on the economy. "Trade's 'simmer' has begun to boil, business sentiment and capex (capital expenditures) have softened further, global growth remains weak, and inflation expectations have fallen," the investment bank's analysts wrote in a note to clients. Previously, Morgan Stanley experts were forecasting just an October cut, predicting the U.S. central bank would "wait for further evidence that downside risks are weighing on the economy" before stepping up the pace of rate cuts and other policies intended to provide an economic boost. Goldman Sachs recently said it considered September and October rate cuts likely.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultra-conservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections.

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

‘States that set ambitious climate targets are already feeling the tension’

‘States that set ambitious climate targets are already feeling the tension’Instant Opinion Opinion, comment and editorials of the day

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military