China's pork battle with the EU

Beijing hits EU pork products with anti-dumping investigation while domestic market battles oversupply and falling demand

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

China is facing a "pork in the road", said the Daily Pnut newsletter.

The country has opened an investigation into pork imports from the EU, in its "first retaliatory move" against Brussels' latest tariffs on Chinese electric vehicles, said Semafor. The EU had been "bracing for Beijing's tit-for-tat response" amid escalating trade tensions.

The Commission said it was "not worried" by Beijing's announcement, denying the accusation that the bloc was exporting pork at a lower price through unfair subsidies last year. But the anti-dumping probe is expected to hit Denmark, the Netherlands and Spain (the largest supplier of pork to China) particularly hard. Last year, pig meat accounted for 17% of EU agri-food exports to China, said Euractiv.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The impact on China's gargantuan meat market would be limited, one Hong Kong-based analyst told Reuters. Imports of EU pork make up just 5% of China's total consumption. But China is already battling domestic pork woes: an oversupply of pigs is pushing down prices and driving the deflation that is crippling its economy.

China's pork glut

With a population of more than 1.4 billion, China is "by far the world's largest pork producer, consumer and importer", said Statista in December. Pork "dominates" the Chinese meat market, accounting for more than 50% of domestic meat consumption in 2022.

And between 2018 and 2021, China's pig herds were "devastated" by multiple outbreaks of African swine fever, said the Financial Times. The fatal disease killed about 60% of the nation's herd – along with a quarter of the world's pig population – and sent consumption of pork plummeting, and prices rising over 100%.

In the years since, higher prices and "a push for more production" led to China's pig numbers recovering – to "the point of overcapacity". Last year, its pig population was 434 million, up from a low of 310 million in 2019, despite labour shortages during the pandemic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The price of pork – the "most important component" of China's consumer price index – has "fallen drastically as a result", exacerbating the deflation that has "pressured Beijing for the past six months".

"Aside from falling real estate prices and price cutting across consumer goods, the biggest reason for China being on the verge of deflation is falling pork prices," China Market Research Group's managing director Shaun Rein told CNBC in December.

"China's pork story is one denoted by a prolonged period of oversupply and weak domestic consumption," said the news site.

Now, when it comes to per capita consumption of pork, China "lags well behind most of the developed countries", said Statista. Although as "disposable income and nutritional knowledge increase, meat products are becoming an increasingly critical part of the Chinese diet", red meat consumption has decreased in the past five years.

And unseasonably warm weather in November last year "delayed the traditional surge in cured meat demand" in winter and new year, Erica Tay, Maybank's director of macro research, told CNBC.

'Potential nightmare scenario' for the EU

There has, however, been a "significant uptick" in EU exports of some pork products to China, said Politico's China Watcher newsletter. "But but but: EU exports of animal products dropped to a four-year low in 2023."

In other words, said Ksenija Simovic, senior policy adviser for trade at EU farm lobby Copa-Cogeca, "we have no choice now but to take part in this investigation". It will be a "costly process" and likely to lead to "loss of market in China".

Any restrictions on EU exports could benefit suppliers from the Americas, while Russia, "increasingly a close trading partner of China" and since February its latest pork supplier, could also "step up meat shipments", said Reuters.

The investigation will run for a year, until June 2025 – but China has warned it could be extended by a further six months. It will focus on pork intended for human consumption – i.e. whole cuts – as well as offal, "products that are especially interesting to for the EU pork industry since there is hardly any market for them in Europe", said Pig Progress.

"A full suspension of EU pork exports to China would be a potential nightmare scenario for the pork supply chain, said Justin Sherrard, global strategist animal protein at Rabobank, "with implications across the EU."

Harriet Marsden is a senior staff writer and podcast panellist for The Week, covering world news and writing the weekly Global Digest newsletter. Before joining the site in 2023, she was a freelance journalist for seven years, working for The Guardian, The Times and The Independent among others, and regularly appearing on radio shows. In 2021, she was awarded the “journalist-at-large” fellowship by the Local Trust charity, and spent a year travelling independently to some of England’s most deprived areas to write about community activism. She has a master’s in international journalism from City University, and has also worked in Bolivia, Colombia and Spain.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

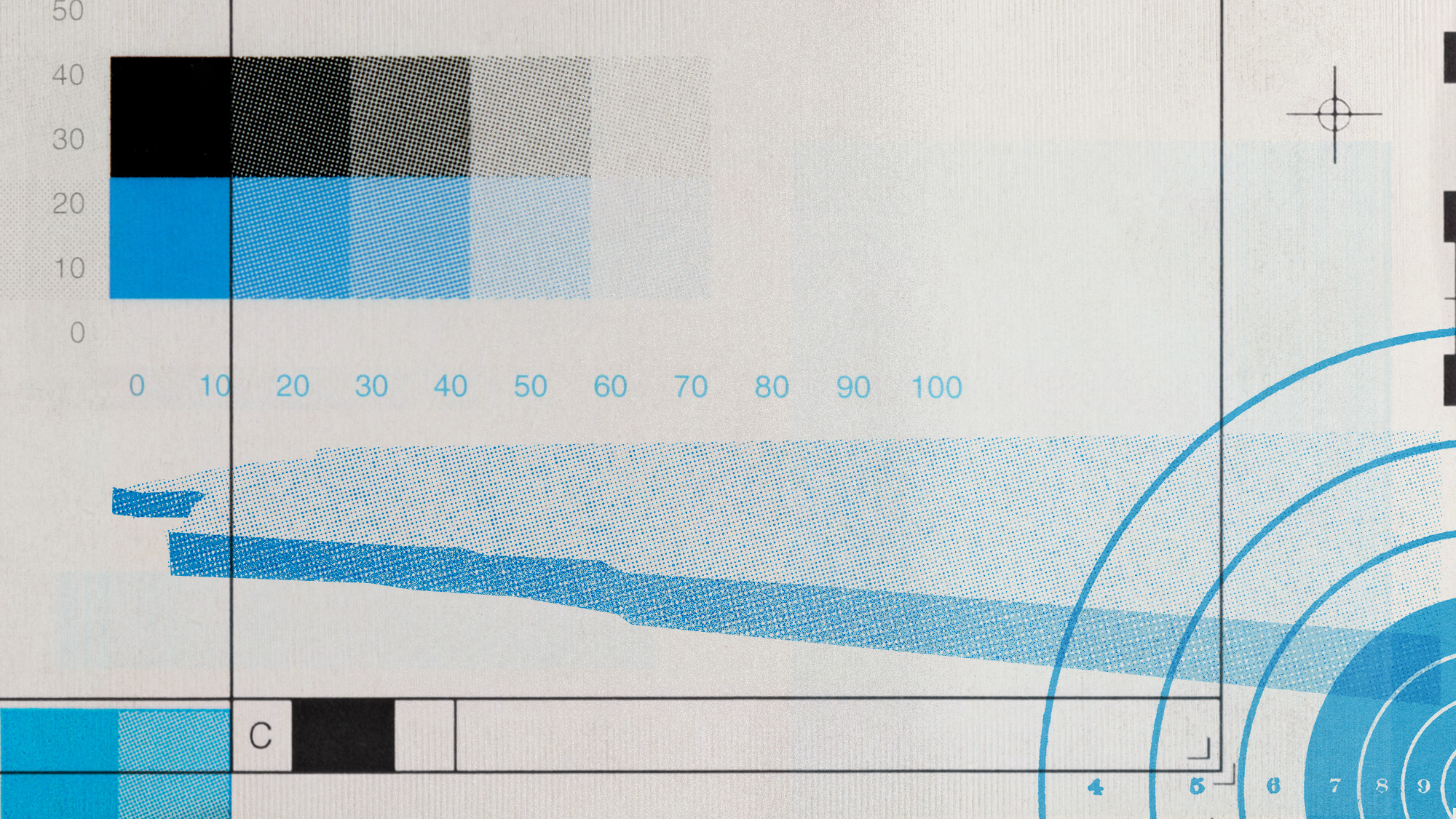

As temperatures rise, US incomes fall

As temperatures rise, US incomes fallUnder the radar Elevated temperatures are capable of affecting the entire economy

-

Climate change could lead to a reptile ‘sexpocalypse’

Climate change could lead to a reptile ‘sexpocalypse’Under the radar The gender gap has hit the animal kingdom

-

Why scientists want to create self-fertilizing crops

Why scientists want to create self-fertilizing cropsUnder the radar Nutrients without the negatives

-

The former largest iceberg is turning blue. It’s a bad sign.

The former largest iceberg is turning blue. It’s a bad sign.Under the radar It is quickly melting away

-

How drones detected a deadly threat to Arctic whales

How drones detected a deadly threat to Arctic whalesUnder the radar Monitoring the sea in the air

-

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming Arctic

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming ArcticUnder the radar The species is adapting to warmer temperatures

-

Crest falling: Mount Rainier and 4 other mountains are losing height

Crest falling: Mount Rainier and 4 other mountains are losing heightUnder the radar Its peak elevation is approximately 20 feet lower than it once was

-

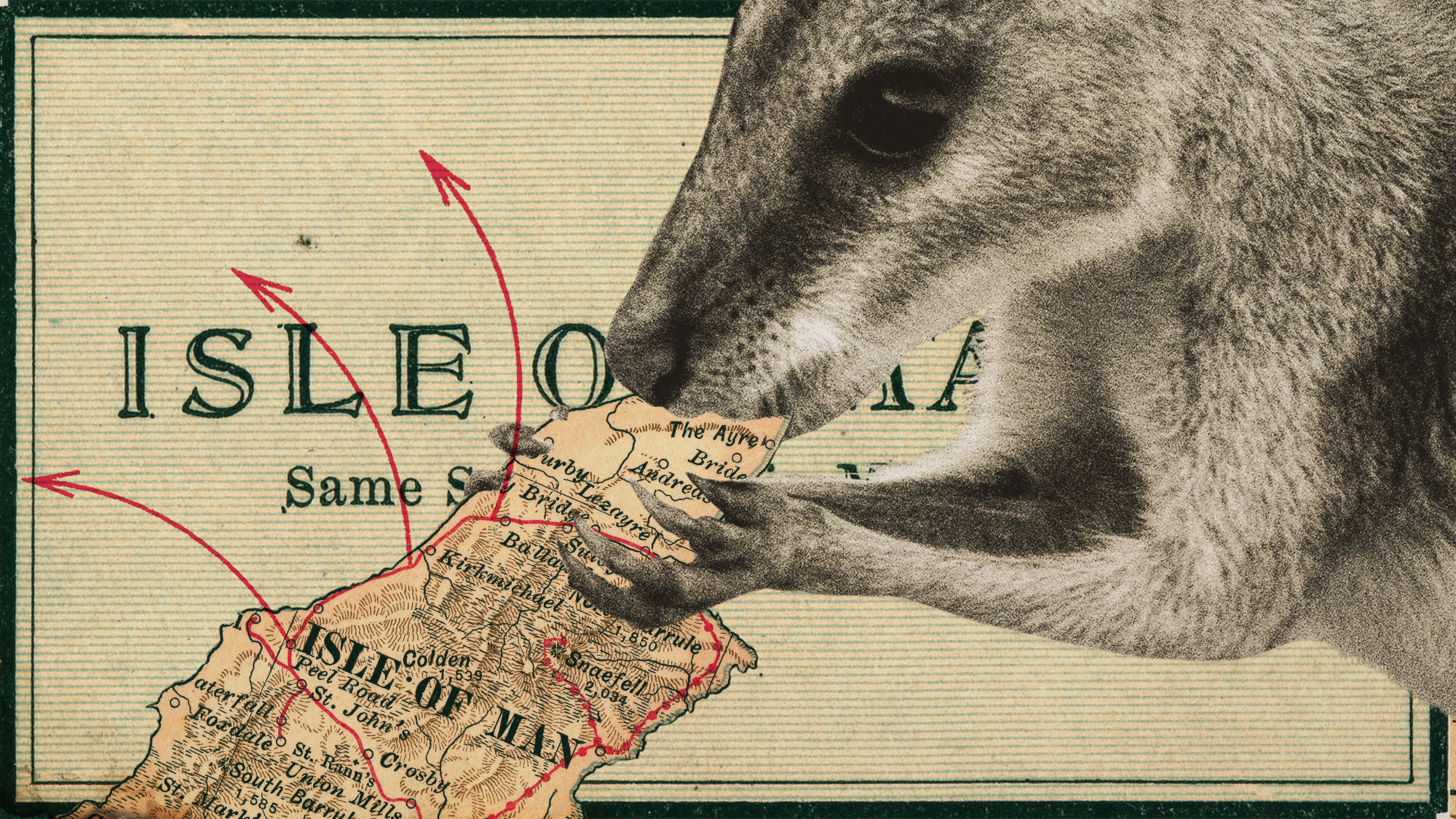

The UK’s surprising ‘wallaby boom’

The UK’s surprising ‘wallaby boom’Under the Radar The Australian marsupial has ‘colonised’ the Isle of Man and is now making regular appearances on the UK mainland