Is a recession inevitable?

The sharpest opinions on the debate from around the web

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

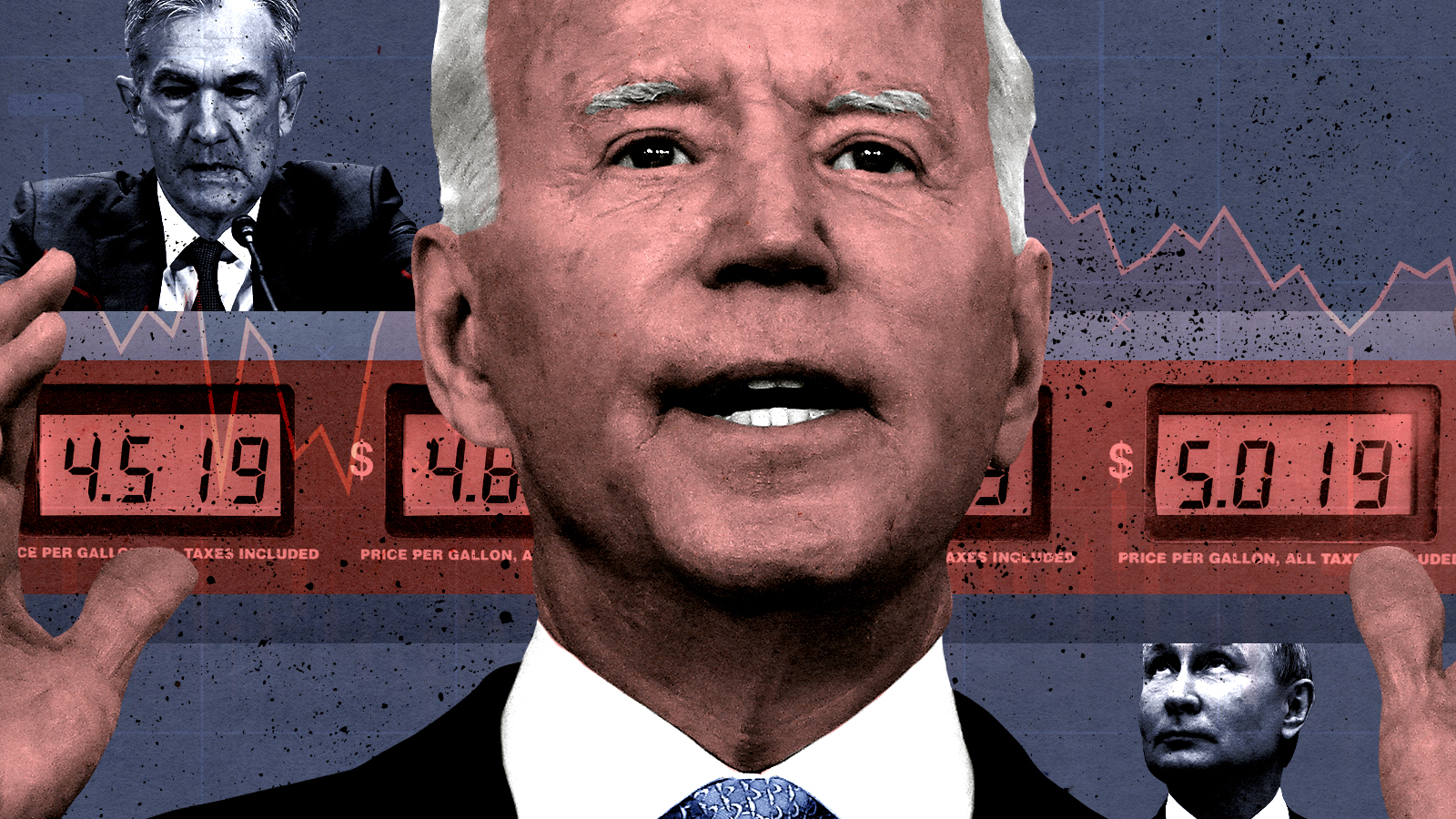

President Biden wrote a Wall Street Journal op-ed this week spelling out his plan to bring down the highest inflation the United States has seen in four decades. Biden said his plan has three parts: Supporting the Federal Reserve in its effort to control inflation, fighting rising fuel costs worsened by Russia's Ukraine invasion and fixing disrupted supply chains, and reducing the federal deficit by winding down any emergency programs that are no longer necessary and reforming the tax code. Biden said the U.S. is in better economic shape than most of its allies, with family savings up, and manufacturing jobs growing at their fastest pace in 30 years. "With the right policies," Biden wrote, "the U.S. can transition from recovery to stable, steady growth and bring down inflation without giving up all these historic gains."

But the war in Ukraine and supply disruptions caused by the coronavirus pandemic will probably result in stagflation — with low growth and high inflation — "for at least the next 12 months," said Simon Baptist, global chief economist at the Economist Intelligence Unit, according to CNBC. A growing number of Wall Street executives warn that the Federal Reserve's aggressive plan to hike interest rates and unwind the asset purchases it used to boost the recovery from the coronavirus crisis is bound to tip the economy into a recession, defined as two consecutive quarters of contraction. Is a recession inevitable, or is there a less painful path to recovery?

The Fed's rate hikes make a recession likely

The Fed's tightening of monetary policy is sending the economy toward a recession, says Lee Spieckerman at The Hill. "With one exception, the Fed has brought on recessions with every tightening cycle that continued for over a year." Longer and steeper Fed interest rate hikes resulted in "longer and deeper" recessions. And it's not necessary. Pumping money into the economy fuels innovators like Amazon, which now tamps down inflation more than any company in history. "The 'conventional wisdom' that the Fed must choke the economy to contain inflation is an orthodoxy that should go the way of the ancient medical practice of bloodletting," argues Spieckerman.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A recession is not inevitable

Fed tightening does often trigger a downturn, says Heather Long at The Washington Post, but a recession isn't inevitable. Consumers, not the Fed, will determine whether the economy shrinks. And despite the gloom prompted by the Ukraine war, supply-chain bottlenecks, COVID-19 "flare-ups," and the end of $5 trillion in federal pandemic aid, consumers have increased spending every month this year. It's "unusually easy to get a job — and a pay raise." Oxford Economics estimates households have saved an extra $2.5 trillion during the pandemic, and spent just $40 billion of it. That's "an extra cushion against rising prices." Walmart shoppers have started cutting back. Hourly workers are hit hardest by rising food and pump prices. But "as long as the rich and upper-middle class continue to spend, there probably won't be a recession," even if "the economy will feel good to many, if not most, Americans."

A recession is coming. Get ready

The economy is heading into a recession as soon as this year, say Lakshman Achuthan and Anirvan Banerji, co-founders of the Economic Cycle Research Institute, at CNN. U.S. economic growth slowed from 12.2 percent in the second quarter of 2021 to 3.5 percent in the first quarter of this year, and we're facing "a toxic brew of external economic headwinds, including the war in Ukraine and COVID lockdowns in China, resulting in supply shocks that boost inflation and slow growth." Americans need to prepare — by cutting non-essential spending, maybe moving some investments into inflation-protected Treasury bonds — "to avoid taking too much of a financial hit."

The danger is that the Fed will go too far

Federal Reserve Chair Jerome Powell has said he was prepared to do what it takes to tame inflation, which "almost sounds like he's ready to bear another downturn as the price for bringing down inflation," says Daniel Moss at Bloomberg. The danger now, some economists say, is that the Fed could zoom past what would be a sustainable level for interest rates, if it misses red flags like it did when warning signals started flashing about inflation last year. Everybody in Washington wants to fight inflation, but nobody wants a recession we could have avoided. "We may be approaching a point where a damned-if-you-do, damned-if-you-don't dynamic requires deciding on the least unattractive version of hell."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Is $140,000 the real poverty line?

Is $140,000 the real poverty line?Feature Financial hardship is wearing Americans down, and the break-even point for many families keeps rising

-

Who will be the next Fed chair?

Who will be the next Fed chair?Today's Big Question Kevin Hassett appears to be Trump’s pick

-

Fast food is no longer affordable for low-income Americans

Fast food is no longer affordable for low-income AmericansThe explainer Cheap meals are getting farther out of reach

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.