The GOP tax bill will actually add $2 trillion to the national debt, Trump's alma mater predicts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

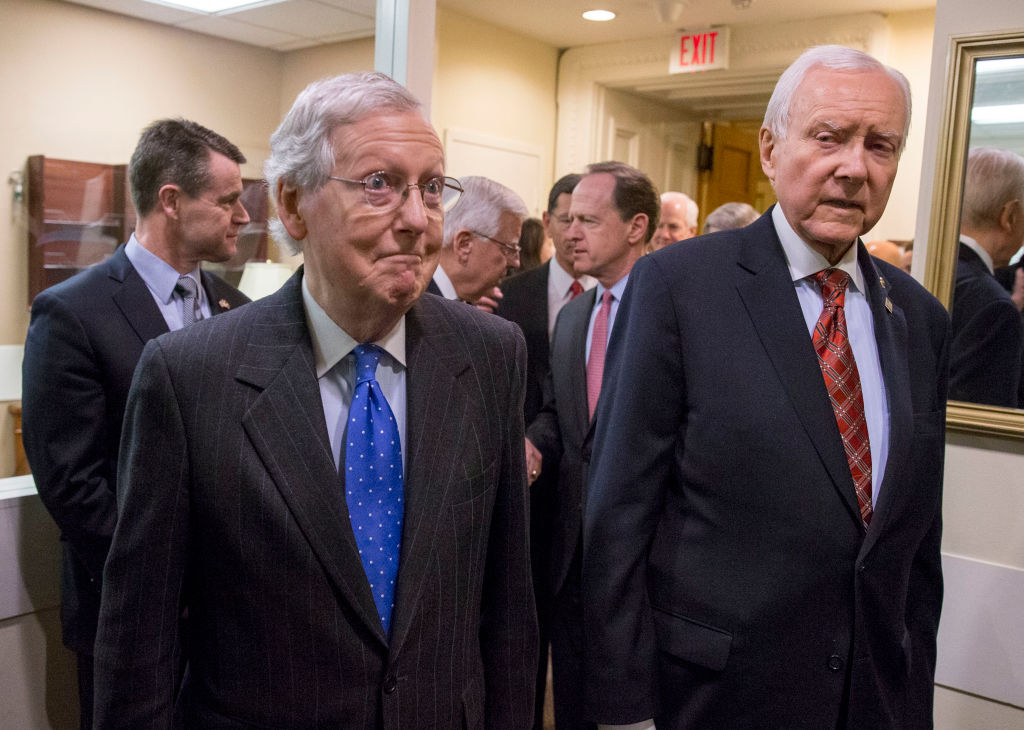

The key moment in the Republican Party's mad dash to passing a sweeping tax bill was when Republicans abandoned revenue neutrality and Sens. Pat Toomey (R-Pa.) and Bob Corker (R-Tenn.) agreed in September that the package could add up to $1.5 trillion to the federal deficit, Senate Majority Leader Mitch McConnell told Bloomberg on Monday. "Without that there would've been no tax bill." Republicans have maintained that the deep tax cuts for businesses would juice the economy enough that the tax bill would pay for itself, but no economic analysis has borne that out.

The Congressional Budget Office projects that the GOP tax bill will add $1.46 trillion to the federal deficit over 10 years, while the official tax analysts at Congress' nonpartisan Joint Committee on Taxation said it will add $1 trillion, accounting for economic growth, as Republicans requested. The right-leaning Tax Foundation estimated Monday that the tax bill will increase the deficit by $448 billion, also factoring in economic growth.

Meanwhile, the tax analysts at the Wharton School at the University of Pennsylvania — where President Trump, as he likes to remind people, got his bachelor's degree in economics — project the bill will add $1.9 trillion to $2.2 trillion in federal debt over the next decade, including growth. That's largely because the Penn Wharton Budget Model projects that the tax bill will increase GDP growth by a modest 0.06 to 0.12 percentage points a year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

To prevent the defection of deficit hawks, "Republicans walled themselves off from criticism, convincing one another that unfavorable economic analyses of their bill were wrong," The New York Times reports. Not every Republican believed the bill would pay for itself — Sens. John McCain (R-Ariz.) and Susan Collins (R-Maine) both met with conservative economist Douglas Holtz-Eakin, who said he told McCain "it's going to have some deficits, no matter what you hear." McCain decided it was worth it. Collins, the Times says, "came away with the impression that the bill would pay for itself."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.