Drugmakers paid pharmacy benefit managers to avoid restricting opioid prescriptions

The middlemen and gatekeepers of insurance coverage have been pocketing money in exchange for working with Big Pharma

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

There have been many entities accused of being the culprits for the spread of opioid abuse across the country during the last few years. One group had not been held accountable — until a recent New York Times investigation exposed how Big Pharma incentivized pharmacy benefit managers not to restrict painkiller prescriptions. This information has added a new layer of blame to a convoluted crisis.

Prioritizing profit over safeguards

For years, pharmacy benefit managers "took payments from opioid manufacturers," including Purdue Pharma, in return for "not restricting the flow of pills," The New York Times said in its exposé. As tens of thousands of Americans succumbed to overdoses and the opioid crisis raged on, "the middlemen collected billions of dollars in payments."

The benefit managers "exert extraordinary control over what drugs people can receive and at what price," the Times said. Express Scripts, CVS Caremark and Optum Rx, the three top companies, "oversee prescriptions for more than 200 million people" and are "part of health care conglomerates that sit near the top of the Fortune 500 list." Insurers and employers often enlist these companies to "control their drug costs by negotiating discounts with pharmaceutical manufacturers." However, a Times investigation from earlier this year found that they often "pursue their own financial interests in ways that increase costs for patients, employers and government programs."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The benefits managers operate as gatekeepers, essentially controlling which drugs insurance plans will cover, and "drugmakers compete for position on those lists by offering rebates." Documents that the Times reviewed showed that time and again the benefits managers "bargained away safeguards in exchange for rebates."

Even as the opioid epidemic swept the nation, these companies "collected ever-growing sums." The largest companies bought out smaller competitors and "used their increasing leverage not to insist on safeguards but to extract more rebates and fees." For example, between 2003 and 2012, the amount of money Purdue paid benefit managers in rebates "roughly doubled to about $400 million a year, almost all of it for OxyContin."

'Pressure to crack down on PBMs is intensifying'

In the public reckoning of who is to blame for the opioid epidemic, the benefit managers have "largely escaped notice," said the Times. Drugmakers, distributors, pharmacies and doctors have shelled out billions of dollars to "resolve lawsuits and investigations." More recently, larger PBMs have also "been in the legal crosshairs."

The companies have also drawn the ire of President-elect Donald Trump, who has singled them out, "blaming them for high drug prices," said The Wall Street Journal. "We're going to knock out the middleman," Trump told reporters at a recent press conference. He pointed out that "the horrible middleman" rakes in more "money frankly than the drug companies, and they don't do anything." His comments follow a similar remark in a "Meet the Press" interview after a dinner with pharma executives and Robert F Kennedy Jr earlier this month.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This week's stocks were down for CVS Health, UnitedHealth and Cigna, the three insurance companies that own the country's three largest benefit managers. These three stocks were "already sharply down over the past month amid widespread public anger with the insurance industry," ire prompted in part by pushback on the industry in the wake of the fatal shooting of a UnitedHealth Group executive. With the "pressure to crack down" on benefit managers "intensifying," some investors are "choosing not to stick around," said the Journal.

Theara Coleman has worked as a staff writer at The Week since September 2022. She frequently writes about technology, education, literature and general news. She was previously a contributing writer and assistant editor at Honeysuckle Magazine, where she covered racial politics and cannabis industry news.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

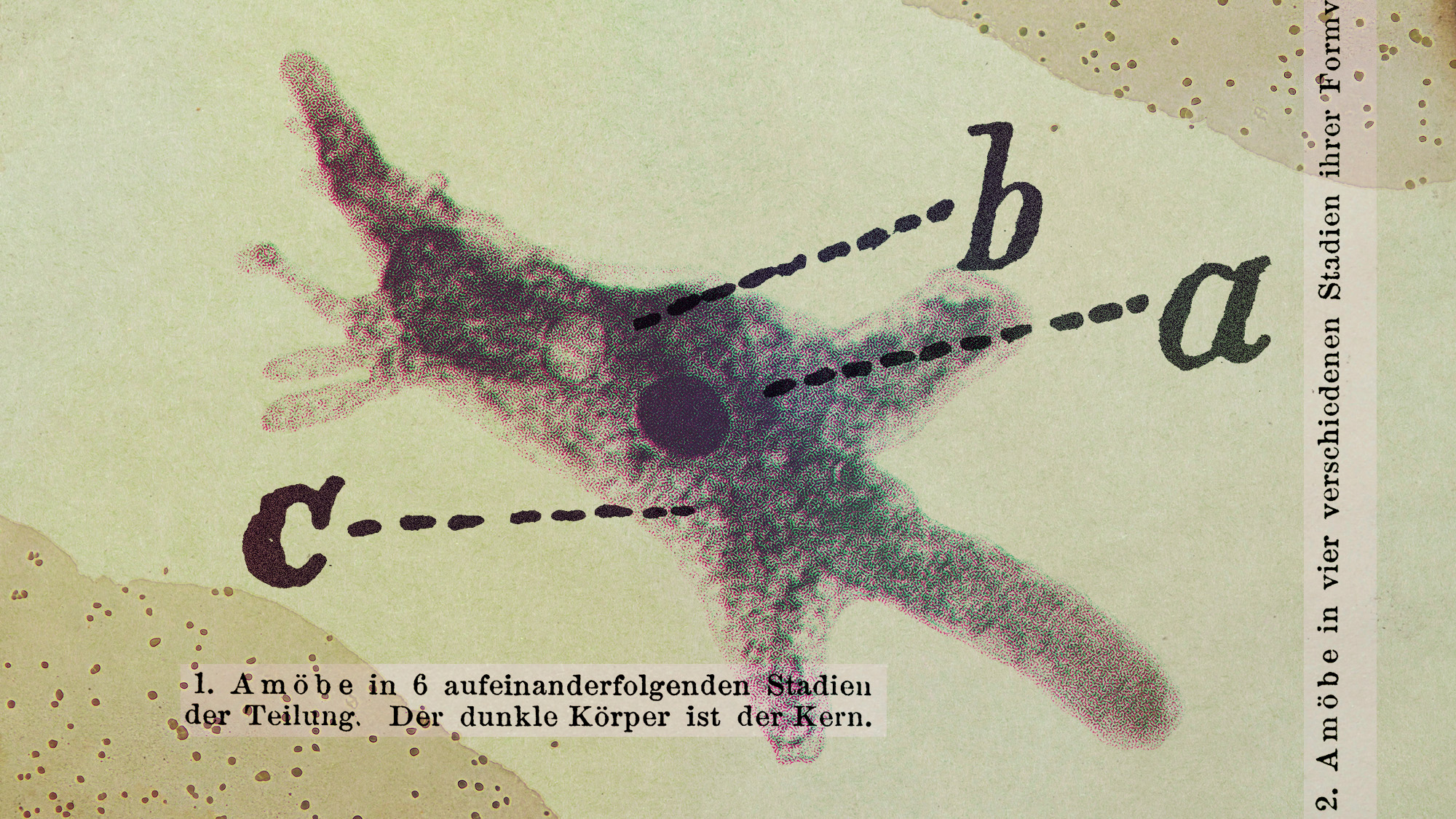

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Metal-based compounds may be the future of antibiotics

Metal-based compounds may be the future of antibioticsUnder the radar Robots can help develop them

-

A Nipah virus outbreak in India has brought back Covid-era surveillance

A Nipah virus outbreak in India has brought back Covid-era surveillanceUnder the radar The disease can spread through animals and humans

-

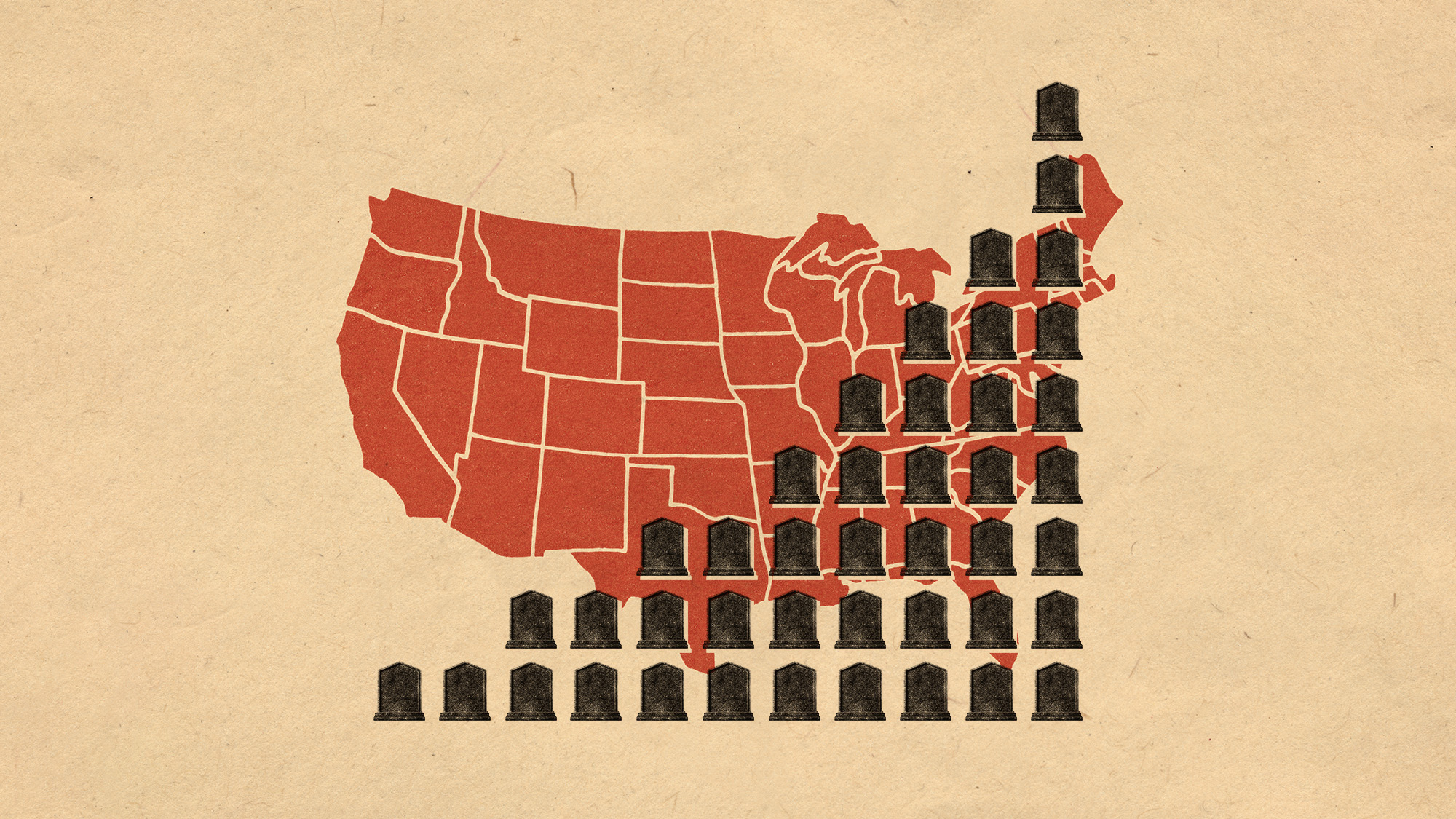

Deaths of children under 5 have gone up for the first time this century

Deaths of children under 5 have gone up for the first time this centuryUnder the radar Poor funding is the culprit

-

A fentanyl vaccine may be on the horizon

A fentanyl vaccine may be on the horizonUnder the radar Taking a serious jab at the opioid epidemic

-

Nitazene is quietly increasing opioid deaths

Nitazene is quietly increasing opioid deathsThe explainer The drug is usually consumed accidentally

-

More adults are dying before the age of 65

More adults are dying before the age of 65Under the radar The phenomenon is more pronounced in Black and low-income populations

-

Scientists have developed a broad-spectrum snake bite antivenom

Scientists have developed a broad-spectrum snake bite antivenomUnder the radar It works on some of the most dangerous species