Did Biden forgive student loans?

The Supreme Court's decision isn't the end of the administration's loan relief efforts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

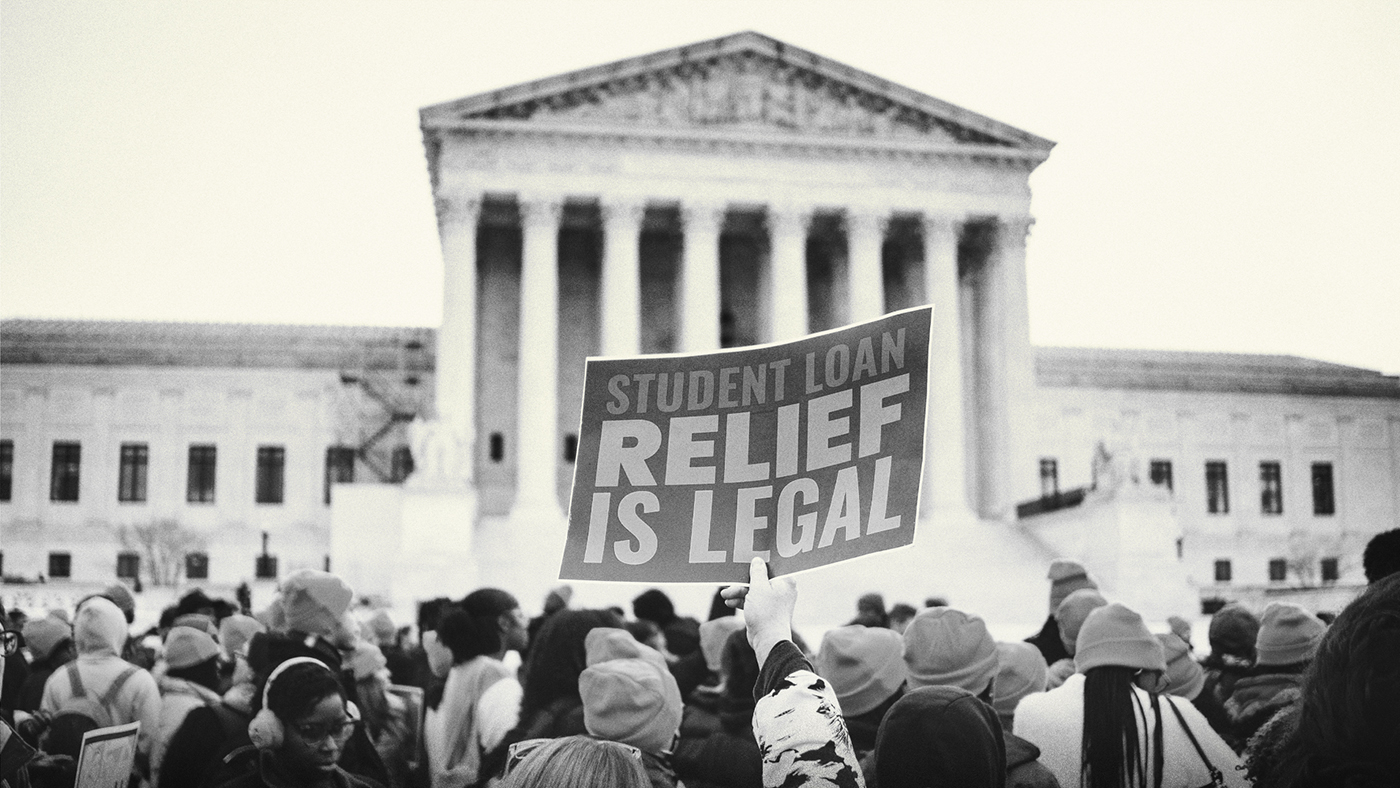

The Supreme Court at the end of June struck down President Biden's controversial student loan forgiveness program. The program aimed to forgive up to $10,000 in federal student loans for borrowers earning less than $125,000 a year, and up to $20,000 for Pell Grant recipients. The decision will soon end a yearslong repayment pause first enacted under the Trump administration, and represents a huge blow to Biden's platform for reelection.

What did the Supreme Court decide?

In a 6-3 decision along party lines, the court's conservative majority ruled that the Department of Education is not authorized to cancel student debt, rendering the student loan forgiveness program moot. "The authority to 'modify' statutes and regulations allows the Secretary to make modest adjustments and additions to existing provisions, not transform them," Chief Justice John Roberts wrote in the majority opinion. "The question here is not whether something should be done; it is who has the authority to do it."

In her dissent, Justice Elena Kagan took issue with the majority's focus on the so-called "major questions doctrine," a legal theory that says Congress must first authorize the executive branch to take actions of "economic or political significance." The ruling "moves the goalposts for triggering" this doctrine, Kagan wrote. "Who knows – by next year, the Secretary of Health and Human Services may be found unable to implement the Medicare program under a broad delegation because of his actions' 'economic impact.'"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In trying to cancel student debt, Biden was relying on authority pulled from the 9/11-era HEROES Act, which gives the education secretary the power to relieve student loan requirements during periods of wartime or national emergency (the national emergency in this instance being COVID-19). But because the president used an executive order and circumvented Congress to enact his program, lawsuits followed.

How did the administration respond?

"I believe that the court's decision to strike down our student debt relief plan is wrong," Biden wrote in a statement issued in the wake of the ruling. "But I will stop at nothing to find other ways to deliver relief to hard-working middle-class families."

The president announced an alternate loan relief strategy that is "going to take longer" but is "legally sound," he said in remarks alongside Education Secretary Miguel Cardona. The administration plans to invoke the 1965 Higher Education Act, which will allow Cardona to "compromise, waive or release loans under certain circumstances."

In mid-July, the administration also unveiled a plan to automatically cancel loan debt for thousands of borrowers as a result of changes to income-driven repayment plans. Under such plans, a borrower's debt was automatically canceled by the government after he or she had made payments for 20 or 25 years, depending on certain aspects of the loan. But by the White House's estimation, past "payments that should have moved a borrower closer to being debt-free were not accounted for," CNBC summarized. Now, the administration's fixes will automatically cancel debt for 804,000 individuals, amounting to $39 billion in relief. "For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness," Cardona said in a statement.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When will payments restart?

Interest will resume beginning Sept. 1, but payments will not restart until the following month. According to studentaid.gov, "Your first payment will be due in October 2023. You'll get your bill in September or October — at least 21 days before your payment due date — with your payment amount and due date."

Why is debt relief such a contentious issue?

Those in favor of widespread loan forgiveness claim that student debt delays and prevents borrowers from starting their lives — whether that means buying a house or having children — and weighs more heavily on Black and Hispanic families, NerdWallet reported. Proponents also typically emphasize that "not all borrowers have degrees that boost earnings."

Those who argue against student debt cancellation often claim it is unfair to those who have already paid off their loans or didn't go to college. They posit that forgiveness tends to disproportionately benefit wealthy borrowers (those with the most debt often have a graduate degree or higher, leading to higher earnings) and fails to solve the underlying student debt crisis, per NerdWallet. Critics also worry about inflation, which they fear might worsen under Biden's policy. According to the Congressional Budget Office, the relief plan will cost roughly $400 billion over the next 30 years.

Has the administration done anything else in the way of debt relief?

As another piece of its broader relief plan, the Education Department also introduced what it has described as a "student loan safety net" intended to keep borrowers from drowning in debt. The program revised the income-driven repayment plan known as REPAYE — under which borrowers' monthly payments are fixed to their income and household size, and loans are forgiven after a set number of years — in at least three big ways: (1) it adjusted down from 10% to 5% the amount of discretionary income borrowers must pay on their balance each month; (2) borrowers with original loans under $12,000 will be required to make monthly payments for just 10 years before cancellation, instead of the usual 20; and (3) unpaid interest will not accrue so long as borrowers meet their monthly payment.

Updated July 18, 2023: This article has been updated throughout.

Brigid Kennedy worked at The Week from 2021 to 2023 as a staff writer, junior editor and then story editor, with an interest in U.S. politics, the economy and the music industry.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

What happens next if you receive student loan forgiveness?

What happens next if you receive student loan forgiveness?the explainer Four things to be on the lookout for

-

What to know about Biden's new student loan plan

What to know about Biden's new student loan planfeature

-

A guide to cashing out your retirement accounts

A guide to cashing out your retirement accountsSpeed Read Does order matter? What's the best strategy for taxes?

-

4 REITs to watch

4 REITs to watchSpeed Read A selection of real estate investment trusts with "exceptional pricing power"

-

What is 'lifestyle inflation' and how does it limit wealth?

What is 'lifestyle inflation' and how does it limit wealth?Speed Read More money, more problems? Not necessarily.

-

How to get a mortgage if you're retired

How to get a mortgage if you're retiredSpeed Read If you're considering applying for a mortgage in retirement, here's a look at what to expect, as well as some tips for making the process less painful

-

How to free yourself from credit card debt

How to free yourself from credit card debtSpeed Read Has your balance gotten out of control? Personal finance experts have some solid tips and tricks to help you get on top of your credit card debt.

-

Renters' rights, explained

Renters' rights, explainedSpeed Read The Biden administration announced new federal actions to protect tenants as rent prices continue to climb. What rights do renters have already?