The daily business briefing: September 21, 2023

The Fed leaves rates unchanged, Biden cancels debts for University of Phoenix borrowers, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Fed leaves rates unchanged but keeps door open to another hike

The Federal Reserve left its benchmark short-term interest rate unchanged on Wednesday, but kept the door open to another hike later this year to continue fighting inflation. The central bank has raised rates 11 times since March 2022, the fastest pace in four decades. The Fed also indicated at the end of its two-day policy meeting that it would likely keep rates high for longer than previously hoped to prevent prices from rising too much, indicating that households shouldn't expect relief from high borrowing costs anytime soon. The Fed projected that inflation should fall below 3% next year and return to its 2% target by 2026, suggesting that a "soft landing" for the economy is possible, Bloomberg reported. CNBC, Bloomberg

2. Biden administration cancels debt for University of Phoenix borrowers

The Biden administration announced Wednesday it would cancel nearly $37 million of federal student loan debt for more than 1,200 people who borrowed money to attend the University of Phoenix. The decision came after the Department of Education found that the for-profit school misled students about its graduates' job prospects. The Biden administration is continuing to cancel student debt for narrow groups of borrowers under existing programs after the Supreme Court blocked its broad proposal to forgive up to $20,000 for low- and middle-income borrowers, CNN reported. In August, the Education Department canceled $72 million in debt for 2,300 borrowers from another for-profit school, Ashford University in California. CNN

3. US provides $600 million to Covid test manufacturers

The Biden administration announced Wednesday that the federal government would offer Americans a fifth round of free Covid-19 tests ahead of the viral season. The program will help Americans spot infections but also boost a domestic testing industry struggling with plummeting demand. The federal government will release the tests from the Strategic National Stockpile and invest $600 million to help 12 domestic test manufacturers increase capacity for rapid test production for Covid and other potential health threats. Demand for rapid tests was high early in the pandemic but manufacturers scaled back production starting in 2021 as vaccines became widely available. Stat News

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

4. Report: Writers, producers near deal to end strike

Hollywood writers and producers met Wednesday and neared a deal to end the Writers Guild of America strike, CNBC reported, citing people close to the negotiations. The two sides will meet again Thursday and hope to reach a final agreement, CNBC reported, but the strike could continue through the end of the year if the union and the Alliance of Motion Picture and Television Producers fall short of a deal. More than 11,000 film and TV writers have been on strike for more than 100 days. Actors joined them in July. The strikes have halted production on high-profile shows, from Netflix's "Stranger Things" to Marvel's "Blade." Warner Bros. Discovery warned earlier this month that the strike was chipping away at its expected earnings. CNBC

5. Stock futures fall after Fed meeting

U.S. stock futures fell early Thursday and Treasuries rose after the Federal Reserve held interest rates steady but indicated it expected to keep rates higher for longer to contain stubborn inflation. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 0.5% and 0.6%, respectively, at 7 a.m. ET. Nasdaq futures were down 0.8%. The three major indexes all closed lower on Wednesday after the Fed released its statement following a two-day policy meeting. The Dow and the S&P 500 dropped 0.2% and 0.9%, respectively, while the tech-heavy Nasdaq plunged 1.5%. The 10-year Treasury yield rose by several basis points to 4.43%, a 16-year high. Investor's Business Daily

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

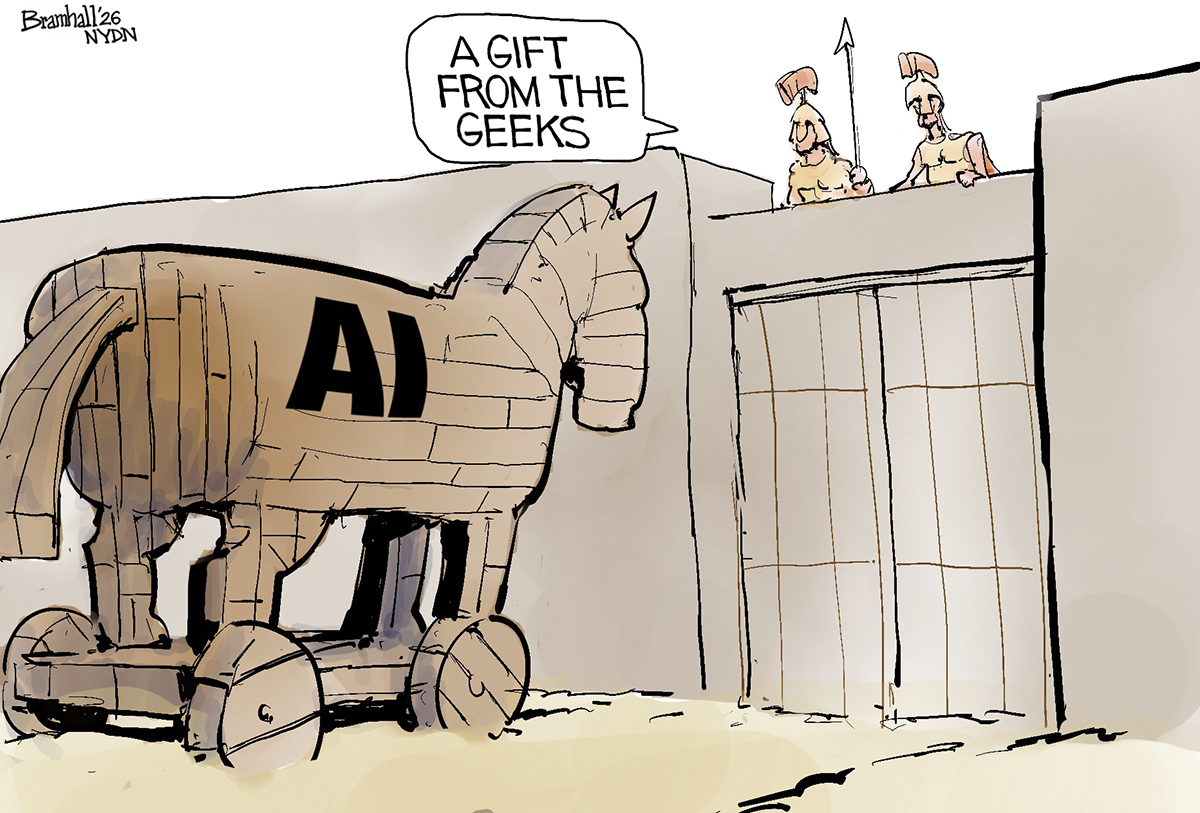

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low