Royal Mail shares rebound after strong Christmas

Direct deals with retailers helped boost parcel volumes six per cent over the festive period

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Royal Mail profits up 12% but competition to get tougher

22 May

Royal Mail's annual operating profits have jumped by 12 per cent to £671m, from £598m a year ago. The company, which was listed in a historic privatisation last October, announced its first full-year set of results today since floating on the stock market.

Sales rose two per cent in the year, from £9.15bn to £9.46bn. And the company's parcel deliveries service overtook its letters business to become the biggest contributor to revenue for the first time, with parcel revenues rising by seven per cent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It was revealed this week that Royal Mail will trial a Sunday delivery service for parcels to addresses within the M25 motorway. It also plans to open around 100 offices on a Sunday afternoon to allow customers to pick up their parcels.

However, the BBC's John Moylan points out that rival firms, including Hermes and DPD, have already announced plans to deliver on Sundays and that some have been undercutting Royal Mail.

Chief executive Moya Greene acknowledged this concern today and said the company was taking steps to ensure it keeps up with rivals.

Another concern is that Royal Mail is legally obliged to deliver letters anywhere in the country, says City AM. "The worry is that smaller, private companies will take the more convenient and popular routes, leaving it with the harder to reach places – the Shetland Islands, for example," says the newspaper.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It has been a turbulent 12 months, in which government ended its 350 years of state ownership. The Daily Telegraph warned earlier this month that a jump in profits could reignite the row over the valuation the government received for its stake in the organisation. Traders said that profits of as much as 12 per cent would confirm the Royal Mail's market value at around 70 per cent more than the government's sale price.

Cameron and Miliband trade barbs over Royal Mail sell-off

2 April

DAVID CAMERON and Ed Miliband clashed today over the Royal Mail sell-off during a rowdy session of Prime Minister’s Questions.

Cameron insisted the taxpayer had benefitted from the £2bn sale, despite yesterday's scathing report from the National Audit Office, which said undervaluing the share sale had cost the taxpayer £750m in a single day. Shares were originally sold at 330p but are today trading at 563p.

Miliband told Cameron he had gone "as red as a post box" because he knew he had lost millions of pounds for the taxpayer, reports the Evening Standard.

He accused the PM of selling a "national asset at a knock down price" and added: "It is not so much the Wolf of Wall Street, but the Dunce of Downing Street."

The Labour leader also pointed out that one third of shares were sold to just 16 City investors, with a "gentleman’s agreement" that it would be a long-term investment. But within weeks almost half had been sold off. "It was mate's rates for his friends in the City," said Miliband.

Cameron hit back, taking a swipe at the Labour leader and shadow chancellor Ed Balls for their role in the sale of British gold reserves during the last Labour government. "I will take a lecture from almost anyone in the country on selling the Royal Mail, but not from the two Muppets who advised on the sale of gold," he said.

The Prime Minister also pointed out that when Labour was in power the Royal Mail lost £500m. "It's now in private hands making profits, paying taxes, and it's working hard for our country," he said.

However, Cameron was quickly disproved when he tried to claim that the privatisation of the Royal Mail was in Labour's 2010 manifesto. The Labour press office tweeted the real line, which said: "For the future, continuing modernisation and investment will be needed by the Royal Mail in the public sector."

Royal Mail: botched sale lost taxpayers £750m in one day

1 April

The Government's "cautious" approach to last year's Royal Mail sell-off led to the taxpayer being short-changed, according to the National Audit Office (NAO).

The spending watchdog has today published a damning report into the privatisation of the Royal Mail, accusing the Government of prioritising a quick sale over achieving value for money for the taxpayer.

Shares in the Royal Mail rocketed 38 per cent on their first day of trading in October 2013, recalls The Guardian, representing a value loss to the taxpayer of around £750m in a single day. The shares, which originally went on sale for 330p, opened at 564p today and at their highest point have reached 618p.

The audit office said that Business Secretary Vince Cable ignored warnings that the flotation price was too low because of fears that it would put off investors. A planned postal workers' strike, which was eventually cancelled, also affected the Government's sale price.

The NAO acknowledged that the Department for Business, Innovation and Skills was successful in getting the company listed on the FTSE 100 but said its approach "was marked by deep caution, the price of which was borne by the taxpayer".

The report showed that a small number of "priority investors" were allocated a larger proportion of shares with the expectation that they would remain long-term investors. However, the NAO found that almost half of these shares were sold at a substantial profit within a few weeks of the stock market launch.

The audit office also noted that the Government could have retained 110 million more shares worth £363m at the offer price, while still achieving the policy objective of reducing the government's ownership to below 50 per cent.

Margaret Hodge, chair of the Public Accounts Committee, said the sharp rise in shares showed "the department had no clue what it was doing".

The Government has insisted it achieved its key objectives in the privatisation and welcomed the NAO's finding that the Royal Mail was now a profitable business and would be less likely to need taxpayer support in the future.

Royal Mail: strike action 'not ruled out' over 1,600 job cuts

25 March

UNITE has refused to rule out strike action after the newly privatised Royal Mail announced plans to cut 1,600 jobs.

The move, which the company hopes will save around £50m a year, comes just five months after the postal delivery service made its stock market debut in October.

The company says the net effect will be 1,300 job losses, mainly managerial, as it plans to create 300 new roles at the same time.

The cuts are necessary to "compete in the letters and parcels market" effectively, says Royal Mail chief executive Moya Greene, but they are not expected to affect postmen or the services provided to customers.

Unite, which represents around 7,000 Royal Mail managers, described the cuts as "ruthless" and said the company was "now about making profits, rather than serving the nation".

The union's Royal Mail officer Brian Scott told The Independent: "First the Government sells off Royal Mail on the cheap and now the newly privatised service is ruthlessly sacrificing jobs.

"We do not believe that it's a coincidence that this announcement has been made just before the company prepares to announce its first full set of accounts since privatisation."

Royal Mail will begin consultations on the planned cuts with Unite and the Communication Workers Union (CWU) today.

Unite will be demanding a commitment to no compulsory redundancies "and an effective method for redeployment within the restructured organisation". It has warned: "If Royal Mail refuse, we will have no alternative than to consider a ballot for industrial action."

The announcement comes just three months after Royal Mail struck an agreement with union leaders on pay, pensions and other issues linked to the privatisation.

The CWU has said the plans are "deeply concerning" and pledged to "fight to protect as many jobs as possible" but is waiting to see how its members will be affected before commenting further.

Royal Mail sale 'botched' by government, says Labour

10 Jan

LABOUR has accused the government of "botching" the privatisation of the Royal Mail and short-changing taxpayers by hundreds of millions of pounds.

Business secretary Vince Cable initially dismissed claims that the Royal Mail had been undersold, despite shares rocketing on the first day of trading in October, and said the share price should only be judged three months after the privatisation.

Now that the three months has elapsed, Cable's "dismissal of the sharp rise in share price as 'froth' has been demolished", said shadow business secretary Chuka Umunna. "Increasingly it looks like the taxpayer has been left short-changed at a time when services are being cut and families are struggling with David Cameron's cost of living crisis."

Shares are trading around 561p, 70 per cent higher than the original price of 330p and have consistently been above 500p ever since the Royal Mail was sold, said Umunna.

Billy Hayes, general secretary of the Communication Workers Union, claimed taxpayers have been "left with a bad taste as hundreds of millions of pounds have been lost".

He added: "The British public were against the sale of this great public service as consumers and now they know for sure they got a bad deal as taxpayers too."

However, business minister Michael Fallon denies shares were sold too cheaply. He told BBC Radio 4's Today programme that the Royal Mail could not have been sold for more because the long-term investors he was targeting had told him they would not pay more and that it was a risky sale because the company was less profitable than its competitors.

Joe Rundle, head of trading at ETX Capital, defends the government's decision. If the sale had failed to attract sufficient demand, the government would have faced an even worse backlash, he told City AM today. He added that a more expensive Royal Mail sale might have deterred big institutional shareholders and foreign investors.

Royal Mail shares 'no longer compelling' as investment

8th January

ROYAL MAIL shares are “no longer compelling” as an investment, according to analysts at Cantor Fitzgerald.

The investment bank advised customers to sell shares in the company, which was privatised in October last year, and set a target price of 500p per share - more than 10 per cent below the current level.

After floating at 330p, shares climbed to a peak of 607p in December, but have since sunk back to about 560p.

In a note to investors, Cantor Fitzgerald analyst Robin Byde said that Royal Mail “still faces significant challenges” despite progress in restructuring the company.

"Core letter volumes continue to decline sharply and many other operators are fighting for share in the packets and parcels market,” he wrote. "Costs are being contained and productivity is rising, but Royal Mail still needs to invest heavily in automation to lift service quality, efficiency and margins.

“Following its spectacular post-IPO performance, Royal Mail's valuation and dividend yield are no longer compelling."

The Daily Mail reports that the postal company is “expected to pay a dividend yield – the percentage of its individual share price the company pays as a dividend to shareholders – of 3.2 per cent versus the wider FTSE 100 average of 3.8 per cent.”

Although the prospect of a falling share price will disappoint the thousands of small investors who took advantage of the privatisation, it may come as a relief to ministers accused of undervaluing the company.

Vince Cable, the cabinet minister who oversaw the flotation, has consistently dismissed the early price gains as “froth”.

Royal Mail shares: Higher price 'threatened daily delivery'

11 December

VINCE CABLE has defended the valuation of Royal Mail, claiming that daily postal deliveries would have been put at risk if the price had been set any higher.

Shares in Royal Mail opened at 591p this morning, up 79 per cent on their launch price of 330p.

Opponents of the privatisation have claimed that shares were underpriced in order to stoke public interest in the sell-off, but the Business Secretary has dismissed the allegation.

“As the Cabinet minister ultimately responsible for the sale I believe it was right and successful,” Cable told the Daily Mail. “But I recognise the need to answer the critics.

He told the paper that shares were priced to appeal to “a core of high-quality investors who would be there in good times and bad, interested in Royal Mail and the universal service it provides for consumers over the long term.”

“We were told if we sought a higher price, these investors would have walked away, leaving the company exposed to short term hedge funds with different objectives,” he said.

Cable’s comments come as Royal Mail looks set to join the FTSE 100 listing of Britain’s leading shares.

“With a market value of £5.97bn, it is certain to enter the FTSE 100,” the Guardian reports. “Its promotion will also fuel demand for the shares from index tracking funds.”

Royal Mail shares: Goldman Sachs sets 610p target

28 November

GOLDMAN SACHS has said that shares in Royal Mail could reach 610p, almost double the price recommended by the bank when the postal service was privatised last month.

Along with UBS, Goldman Sachs advised the government to set the share price at 330p, valuing the company at £3.3bn.

Shares in Royal Mail surged as soon as they went on sale, and have continued to rise. They opened this morning at 568.5p, a gain of 72 per cent on their initial value.

Analysts at Goldman Sachs now expect the price to scale new heights.

“In its research note,” the International Business Times reports, “Goldman said it thinks Royal Mail's heavy exposure to the high-growth parcels market, the firm's existing core network across the UK ... and the potential for productivity improvements will all drive up profit.”

Vince Cable yesterday defended the initial valuation against charges that the government had underpriced Royal Mail. He repeated his insistence that short-term price rises were “froth” that did not necessarily reflect the underlying value of the company.

Cable and his minister Michael Fallon, told MPs that they decided against increasing the share price before the flotation because of market fears about a potential US debt default.

Royal Mail profits leap as Cable faces questions

27 November

Online shoppers have driven Royal Mail profits up to £233m for the six months to the end of September, up from £94m for the same period last year. That figure excludes a one-off windfall resulting from pension reform, which led to overall pre-tax profits of £1.6bn.

Shares in Royal Mail rose sharply on the news, opening at 550p, up 9 per cent on last night’s closing price

The rise in profits came despite a 4 per cent drop in revenue from letter deliveries, which was offset by a 9 per cent rise in parcel revenues.

"Our first-half financial performance was in line with our expectations of delivering low single-digit revenue growth and margin expansion," said Royal Mail chief executive Moya Greene, quoted by the BBC.

The Telegraph suggests that the strong performance of the newly privatised Royal Mail will “fuel accusations that Royal Mail has been sold on the cheap”.

Vince Cable, the Business Minister, whose department oversaw the sell-off, will be questioned by a parliamentary select committee later today, along with his key adviser from the investment bank Lezard.

Individuals who invested £750 in the offering would now be sitting on shares worth £1,250 at this morning's opening price of 550p.

Cable has previously dismissed the early gains as “froth” and said the true value of the shares would not emerge for six months.

Royal Mail shares: price rise 'was expected'

25 November

The Government expected shares in Royal Mail to rise after privatisation, according to a report seen by Sky News, fuelling claims that the company was deliberately underpriced.

"Nearly £2bn was raised for the Exchequer, and the Government still holds a 30 per cent stake in a company that has, as expected, increased in value following the introduction of private sector ownership," says the report from the Shareholder Executive, which manages public shares in state-owned businesses.

High public demand led Royal Mail shares to surge as soon as they went on sale. Individual investors were allowed to buy just £750 worth of shares, which would be worth £1,211 at this morning's opening price of 533p.

Vince Cable will be questioned about the Royal Mail sell-off by the Business, Innovation and Skills Select Committee tomorrow. He has previously dismissed the early gains as “froth” and said the true value of the shares would not emerge for six months.

Royal Mail shares: banks could lose millions

10 November

The banks that valued Royal Mail shares at 330p could have their fees docked for undervaluing the company, the Daily Mail reports.

The paper says that "ministers are ready to use powers to claw back up to £4m from their advisers if the price does not settle closer to the original offer."

High public demand led Royal Mail shares to surge as soon as they went on sale. Individual investors were allowed to buy just £750 worth of shares, which would be worth £1,236 at this morning's opening price of 544.5p.

The Observer had predicted on Sunday that the banks might come in for criticism. "Goldman Sachs and UBS were the lead bookrunners on the float, meaning they essentially conjured up the price," the paper reported, "and while the sniping has died down a tad, the coming days offer the potential for renewed hostilities."

The government took advice from the investment bank Lazard in setting the Royal Mail's value at £3.3b before the sell-off, but the Guardian recently reported that another bank, JP Morgan, had valued the company at £10b.

"The US bank declined to comment but well-placed sources confirmed the figure of £10bn," the paper reported. "Others pitching to sell the Royal Mail on behalf of the government had also priced the mail company as high as £7bn."

Vince Cable, the Business Secretary, has described the early gains as "froth" and said the share price would take six months to settle to its true value.

Royal Mail shares: Should you sell or hold?

by Jane Lewis

During the frenzied days of grey market trading ahead of Royal Mail's stock market debut, several analysts observed that they hadn't seen such fervour since Facebook's float last year.

You could almost hear the sirens sounding in Whitehall. Facebook's over-hyped IPO has, after all, become notorious for the way small investors were burned by professional Wall Street slickers who immediately flipped the stock, causing shares to crash by a quarter within a fortnight. It was not a comparison that ministers trumpeting the return of a responsible shareholder democracy were keen to promote.

We can see from the IPO data released this week that the Government has done its darnedest to avoid a similar conflagration at Royal Mail: using the share allocation process to weed out those deemed most likely to flip (or in British parlance "stag") shares in pursuit of a quick killing.

The few successful applicants among the 800 or so big institutions who unleashed £28bn to chase £1.4bn worth of shares were all "stable" outfits like pension funds and foreign sovereign wealth funds - neither renowned for their short-term approach. And the same thinking was apparent in the treatment of private investors, which overwhelmingly favoured small timers. Anyone rich or ambitious enough to apply for more than £10,000 worth of shares was ruled out altogether.

That of course didn't prevent a bean-feast at the opening of conditional trading. Shares, sold at 330p (valuing Royal Mail at £3.3bn) rose to an initial high of 459p before settling back to 431p as a number of small investors sold their stake.

But the likely thinking was that if you're sitting on a two hundred quid profit from your initial £750 investment, you're less likely to cash it in when trading proper starts next week than if you'd made a similar percentage gain on £10,000.

The high premium has fuelled the wrath of critics who claim it shows the government severely undervalued Royal Mail - short-changing the taxpayer to the tune of £1bn. The Business Secretary, Vince Cable denies this. "You get an enormous amount of froth and speculation in the aftermath of a big IPO of this kind," he said. "What matters is where the price eventually settles."

That question of what the Royal Mail is really worth is at the heart of the key decision now facing investors: should they bank their profits, or stay in for the long-haul?

The big problem in making the call is that estimates vary so widely. When the offer was announced last month, there were doubts that shares would make 330p, let alone the 450p that Panmure Gordon's Gert Zonneveld, reckons they're worth. Another City player, Canaccord Genuity, has suggested the company is worth nearly £6bn if you factor in the huge property value of its sites in London.

One way of gauging Royal Mail's actual value is to look at what some of its rivals in Europe are worth. Its closest peer is arguably the Belgian postal service, bpost - which also has a monopoly in its core market, similar profit levels, and is facing sliding letter volumes offset by a burgeoning, ecommerce-based parcels business. Bpost is currently trading at seven times earnings. Apply that to Royal Mail and you get a valuation of £2.7bn - considerably below the opening £3.3bn price.

Some have concluded from that that anything above 35op a share "is getting into the realms of irrational exuberance" - particularly when you factor in a highly competitive parcels market and the continuing threat of industrial action. The near universal take-up of free shares by postal workers may help avoid a value-destroying strike. But it can't be ruled out.

Set against those considerations, however, is the sheer volume of demand for Royal Mail shares, the fat dividend, and reports that a good many buyers are tucking shares straight into their Isas. The wider market mood is also a factor. Given a generally benign investment environment for equities, it's arguably a good time to "run your winners" rather than dump a rising share at the first opportunity. That's certainly been the experience of those buying into recent IPOs, including estate agent Countrywide and builder Crest Nicholson - both up by over 50% since launch.

Ultimately, what investors decide to do with their shares must boil down to their own investment priorities. If you view Royal Mail as an income rather than growth stock, you should hang on in there - if only on grounds that the dividend payment, when reinvested, will form a large part of total returns.

But keep a weather eye on the price movement. Perhaps the best advice is to do your own research, and establish a target price in your mind at which to take profits. In a straw poll run by The Daily Telegraph on Friday, most punters placed that well above 400p. Food for thought.

Royal Mail: shares surge as trading begins 11/10/2013

Shares in the newly privatised Royal Mail jumped by 38 per cent in the first few minutes of trading on the London Stock Exchange.

The price, which had been set at 330p per share, reached a peak of 456p before settling back to 437p by 3pm - a rise of 32 per cent. That represents a paper profit of £240 for private investors who took part in the Royal Mail offer.

Investors who applied for up to £10,000 worth of shares - around 690,000 investors - will receive 227 shares worth £749.10. But the 34,500 investors who applied for more than £10,000 worth of shares will get nothing.

In total, more than 270,000 applicants will receive at least half of the shares for which they applied.

Demand for shares in the mail service reached unexpectedly high levels, making it one of the most sought-after privatisations since the 1980s sell-off of state assets.

Critics last night claimed the decision had been made to enable the government to boast that it was a "people's privatisation".

Financial institutions, such as pension funds and hedge funds, took 67 per cent of all shares on offer, leaving the rest to small investors and Royal Mail workers.

Despite the looming postal workers' strike ballot, 99.7 per cent of Royal Mail employees took up their free allocation of shares. Any employees who applied for extra shares also had their applications met for up to £10,000.

Billy Hayes, general secretary of the Communication Workers Union, which is vehemently against privatisation, said he did not expect the take-up to affect the outcome of next week's strike ballot. He told the BBC: "In austerity Britain no one is going to turn down free money. The real test will be next Wednesday, and I am convinced that postal workers will vote for action."

Conditional trading began today at 8am - a process likened to the gap between exchange and completion when buying a home. Any trades agreed will not be fulfilled until full open market trading begins on Tuesday 15 October.

Shares look set to rise from 330p to around 400p by the end of day one, which would give investors with £749.10 of shares a profit of £158.

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

Nuuk becomes ground zero for Greenland’s diplomatic straits

Nuuk becomes ground zero for Greenland’s diplomatic straitsIN THE SPOTLIGHT A flurry of new consular activity in the remote Danish protectorate shows how important Greenland has become to Europeans’ anxiety about American imperialism

-

‘This is something that happens all too often’

‘This is something that happens all too often’Instant Opinion Opinion, comment and editorials of the day

-

Mystery boxes: the companies selling lost parcels and suitcases

Mystery boxes: the companies selling lost parcels and suitcasesUnder The Radar The 'gamble' on what is inside is 'part of the attraction' for some customers

-

Why is Royal Mail failing to deliver?

Why is Royal Mail failing to deliver?Today's Big Question The 507-year-old British institution is facing carve-up and even insolvency with decline of letter writing

-

Do Tory tax cuts herald return of austerity?

Do Tory tax cuts herald return of austerity?Today's Big Question Chancellor U-turns on scrapping top rate tax but urges ministers to make public spending cuts

-

Coronavirus: how Royal Mail is changing its service

Coronavirus: how Royal Mail is changing its serviceIn Depth Postal service announces new opening hours and parcel collection system

-

Royal Mail wins high court battle to stop postal strike

Royal Mail wins high court battle to stop postal strikeIn Depth The vote to strike won by 97%, with a 76% turnout, but the judge ruled there were ‘irregularities’ in the process

-

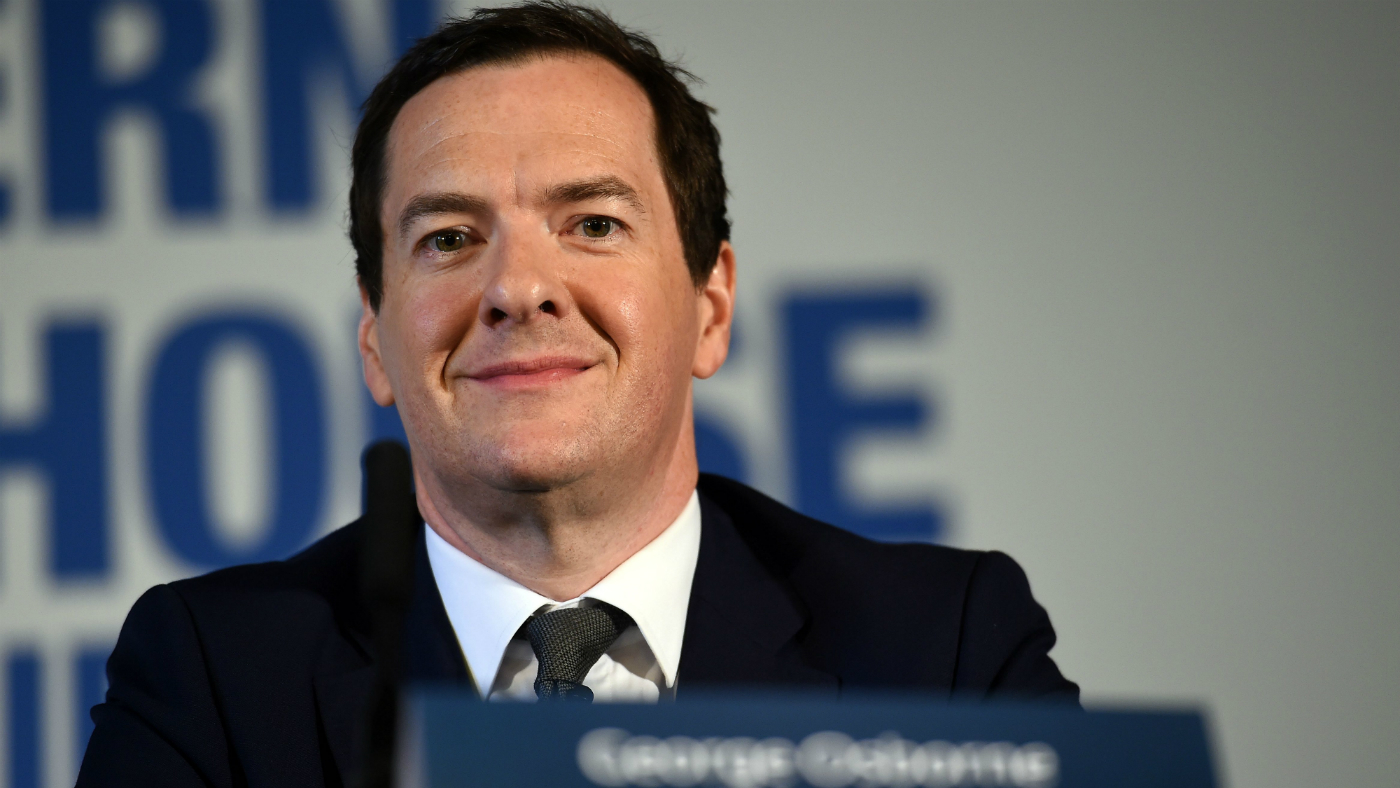

What is the Northern Powerhouse?

What is the Northern Powerhouse?In Depth George Osborne’s think tank was designed to devolve power and boost the North’s economic output

-

Royal Mail faces strike action over pension scheme closure

Royal Mail faces strike action over pension scheme closureSpeed Read Scheme was closed to new members in 2008 but still costs £400m a year

-

Hammond to announce departure from Osborne policies

Hammond to announce departure from Osborne policiesSpeed Read Chancellor to tell Tory conference 'we must change with the times' in move away from predecessor