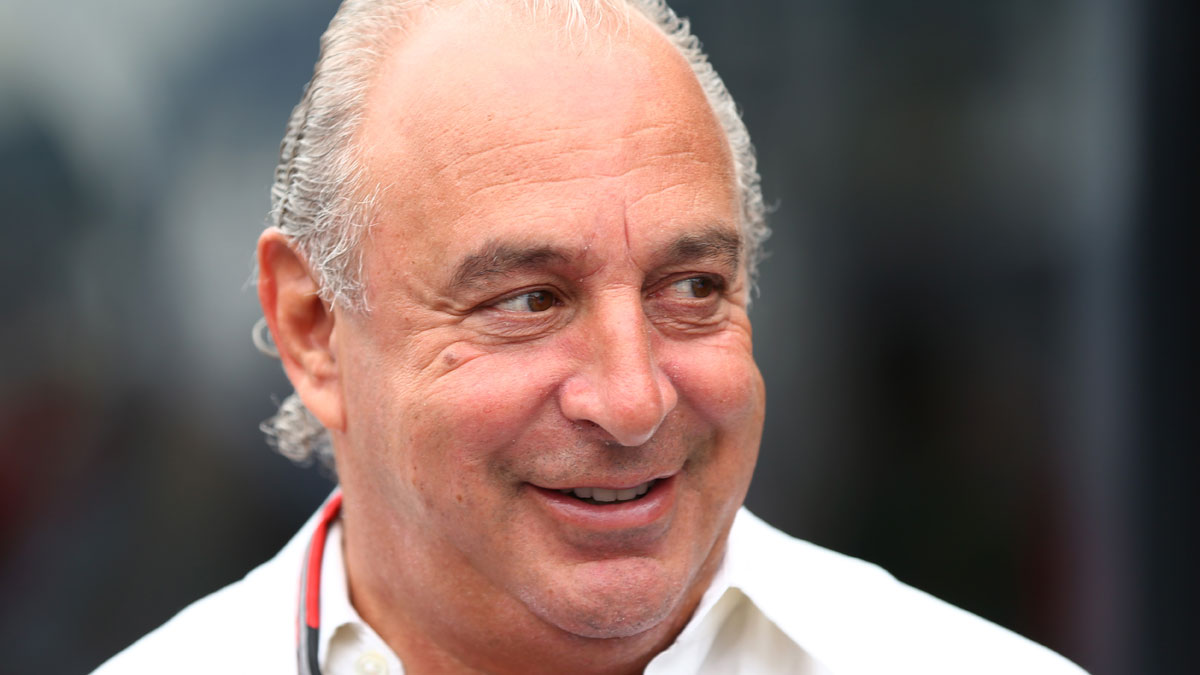

Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

BHS's £570m pension deficit is 'sword of Damocles'

23 March

A huge funding deficit in BHS's two staff pension schemes could yet bring the company down, even if the embattled retailer's landlords back a last-ditch survival deal today.

BHS has traded unprofitably since the financial crisis and made losses of £21m in the last financial year, after which it was offloaded by former owner, Sir Philip Green, reports Sky News. It has proposed a creditor's voluntary agreement in the High Court that would slash its rental costs and, bosses hope, trigger a more far-reaching turnaround.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Under the terms of the plan, which is effectively a managed insolvency that avoids the need to appoint external administrators or liquidators, as many as half of its 164 stores would see rent reduced by as much as 75 per cent. Around 40 of the least profitable shops could eventually be closed after ten months.

The BBC notes that BHS needs 50 per cent of its landlords and 75 per cent of its creditors to agree to the deal.

Julie Palmer, a retail analyst at insolvency experts Begbies Traynor, says the company is confident it will get an agreement.

"It is passing the buck essentially to the landlords with promise of a reduced but continued rental income for the next ten months," she said.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But the BBC's business editor Simon Jack points out that the Pension Protection Fund (PPF), an industry bailout fund for troubled pension schemes, is "by far the biggest creditor". It is currently reviewing the two BHS schemes, which, based on their current buyout value, have a combined deficit of £571m, and could take them on permanently.

This is the outcome that BHS bosses want – but it may come at a cost. Jack says the PPF "has secured to right to call in its debt in six months' time if it's not happy with the way the pension liabilities are dealt with". That means if past and current bosses do not stump up an agreeable amount of cash, it could demand a payment that would "bankrupt" the business.

"[It] is essentially a sword of Damocles hanging over the company".

As the company is essentially filing for liquidation, the PPF payout restrictions are already in place. This means scheme members are entitled to a maximum of 90 per cent of their previous pension up to a cap of around £30,000. The cuts would apply to both current and former employees including a minority who are already retired, where they have not yet reached the scheme's normal retirement age.

BHS pensioners face immediate ten per cent payout cut

10 March

Thousands of former employees of British Home Stores, including a number who have retired, are to have their pension payouts cut by 10 per cent within months.

Last week, the struggling chain submitted a proposal for a "creditors voluntary agreement" at the High Court, a form of insolvency procedure that requires the agreement of creditors, in this case BHS's landlords, to reduce their bills in an attempt to avoid the business having to be put into administration or liquidated.

One of the knock-on effects of the move, however, is to put restrictions on the trustees of associated pension schemes limiting them to payout levels set out by the industry rescue scheme, the Pension Protection Fund. This means, says the Financial Times, that pensions would be "cut by at least ten per cent and capped at about £30,000".

Cuts and caps apply only to those who are not already at normal retirement age, as defined by the scheme. The Guardian estimates that around 13,000 members will be affected, including a minority of the 6,700 that are already in receipt of a pension.

In principle, this is a temporary measure while the PPF undertakes a review of the schemes, which can take up to two years. If it decides they are not viable, the measures may become permanent and the cuts would remain in place.

In the case of the BHS schemes, based on the last valuation three years ago, they have assets to fund about 60 per cent of liabilities. According to the CVA documents, the company has a current deficit of £571m based on the assumed value if it were to be acquired by a third party.

Chris Martin, the chairman to the trustees of two BHS pension funds, said there was unlikely to be "a future for the schemes outside the PPF", even if the CVA is successful. At the time BHS's application for insolvency was reported, it was also noted that BHS was in talks with the PPF about the fund taking the schemes on.

Writing in the Daily Telegraph, Ben Marlow says the likelihood of the CVA saving BHS is remote, saying the option is a "last throw of the dice" and that its track record for turning businesses around is "pretty poor".

BHS could collapse within three weeks

08 March

BHS's 88-year history could come to an end in three weeks unless the company can come to agreement with creditors.

Founded in 1928 by a group of US entrepreneurs, the chain has traded at a loss for eight years and was bought by a group of financiers from long-term backer Sir Philip Green last year for just £1 – a transaction that apparently cost Green £217m in written-off loans. It has continued to trade poorly and endured another sales decline over the festive period.

Now its new backers, via accountant KPMG, has submitted a proposal for a creditor's voluntary agreement (CVA) at the High Court that would slash the huge rental bill on its 154-strong store estate. A CVA requires the approval of the creditors – BHS's landlords – to pass, but would avert the nuclear option of administration or liquidation.

The documents state the chain would be "unable to trade in its current form beyond 25 March, when its next rent payments are due", reports the Daily Telegraph.

BHS is asking the landlords of its 40 least viable stores – some of which it warns could close within ten months - to take as much as a 75 per cent discount on their bills, while those of a further 47 stores would see a reduction of between 50 and 75 per cent. Another 77 stores are profitable and would not see a rent reduction, although the company does want to change from paying quarterly to monthly.

If the deal is not accepted, losses of anywhere up to £1.3bn could be accrued in the event that administration failed to save any part of the business. This includes a £571m deficit on BHS's pension scheme, based on its value if it was to be bought out by an insurer.

The BBC notes the company is trying to offload the scheme to the Pension Protection Fund, which is funded by levies on financial services companies and provides some support to members of failed pension schemes.

Even if the CVA is successful, The Guardian says BHS has already signalled substantial staff cuts in a further bid to cut costs. Last Friday, the company announced redundancies to 220 staff across its stores and 150 at its head office.

Another 100 roles are to be cut from the head office workforce, reducing the headcount by around a third eventually.

BHS raises £65m and could leave Oxford Street

14 September 2015

BHS has taken the next step on what is likely to be a long turnaround journey, after its owners announced it had completed a £65m fundraising to invest in a major overhaul of its stores across the country.

Retail Acquisitions, the holding company which acquired the department store brand for just £1 earlier this year, said it had secured the funds from the lending arm of UK investment group Grovepoint Capital. The Financial Times reports that despite hints in press reports, the new capital is not needed to meet hefty rental bills that fall due this month. Instead, they will contribute to a plan to "modernise all of its stores in the next three years".

The revival plan includes a refit of its outlets and the addition of in-store restaurants, a new investment in online shopping facilities and distribution centres, and expansion in the Middle East. It will also be rebranded, dropping the initials and returning to its original British Home Stores name.

Those changes will be accompanied by extensive cost savings, including renegotiated leases and the sale of stores "where it has too much space". City AM reports that the chain could sell the lease on its flagship Oxford Street location, bringing in as much as £60m, or else seek to share the building with another retailer. Its main store in Liverpool, which is near the central railway station, is already on the market with an asking price of around £17m.

Sir Philip Green had owned the business for 15 years before he sold it for a nominal sum in March, with company filings later revealing that he had written off loans worth around £200m. BHS currently has 171 stores, and made pre-tax losses of around £85m for the year ended August 2014.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions