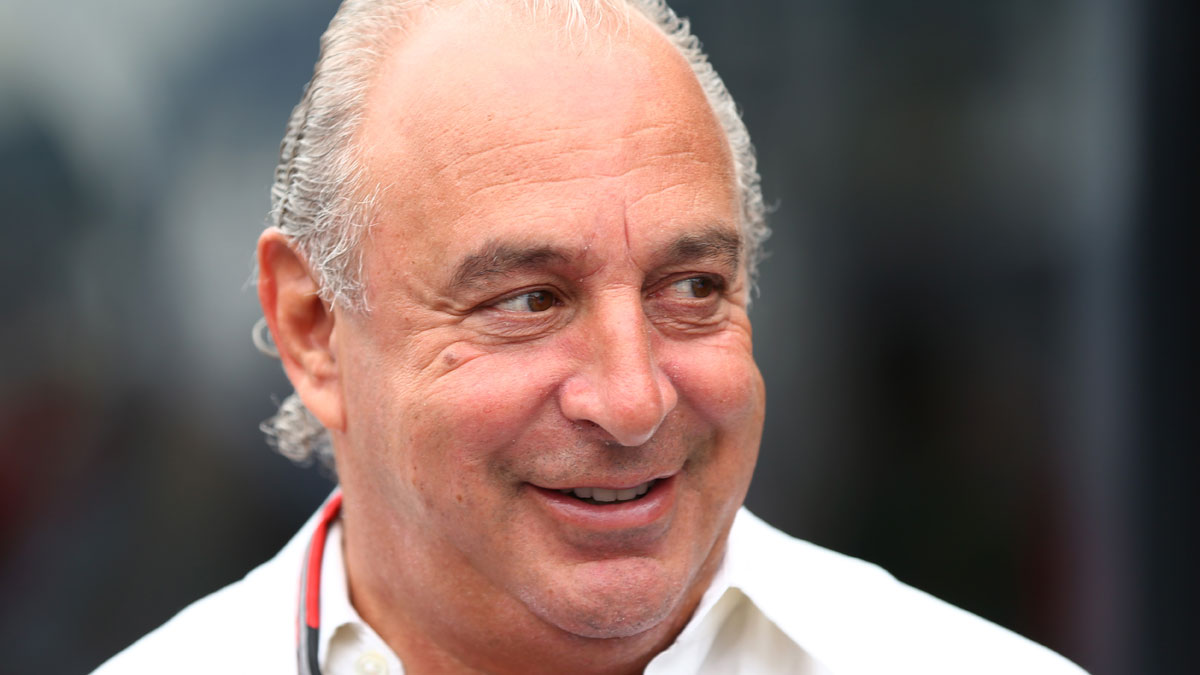

Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

More BHS stores close as hopes fade of rescue

22 July

Liquidators winding down BHS are to close another 32 stores, bringing the total number of closures to more than 50 and putting a further 700 jobs at risk.

The first 20 stores closed at the weekend, The Guardian reports. They will be joined at the end of this month of this month by outlets in Barnstaple, Chesterfield, Crewe, Derby, Falkirk, Poole, Torquay and Livingston.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Dave Gill, of the shopworkers’ union Usdaw, said: "Our hope is that other retailers, including Sir Philip Green’s Arcadia Group, will offer employment to these experienced, dedicated and loyal staff who suddenly find themselves unemployed."

But in a statement to City AM, the union said it is becoming "increasing concerned" that a buyer for the remaining 110 or so BHS branches may not be found.

Sports Direct founder Mike Ashley was reportedly among a number of bidders who had been in talks to acquire the whole of BHS and remained interest in buying some of the more viable sites when these discussions broke down.

Agreeing a suitable price for the assets has proved difficult, however, and as stocks run low, the Guardian says "hopes… are fading" that many of the remaining 10,000 staff can be saved.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

MPs are preparing to report on where blame lies for the collapse, with Green likely to face criticism for taking money out of the business before sanctioning its sale to Dominic Chappell, a retail novice who had twice been declared bankrupt.

Green last week issued a robust defence, saying he had personally invested £413m into BHS during his 15 years in charge, almost completely offsetting the £423m he is said to have taken from the company.

In total, £580m is thought to have been withdrawn from the company between 2000 and 2015.

Green has also pledged to rescue the pension scheme to avoid 20,000 members having their payouts cut. But the plan could cost £400m and MPs have demanded the Topshop tycoon stops dithering and brings forward concrete proposals.

BHS: MPs demand Sir Philip Green fix pension deficit

15 July

Former BHS owner Sir Philip Green must carry out his promise to rescue the collapsed retailer's stricken pension scheme, says Frank Field, the chairman of the parliamentary committee examining the demise of the chain.

In a letter to the chairman of the trustees of the BHS pension fund, the veteran Labour MP demanded that Green, who owned BHS between 2000 and 2015, guarantee the benefits for the scheme's 20,000 members.

The Guardian reports Field as saying: "Green came in to parliament huffing and puffing and saying he would fix it, but where's the fixing weeks later?"

The Topshop tycoon, during his parliamentary evidence session around a month ago, claimed to have no knowledge of the pension scheme's problems until at least 2012 and denied accusations his Arcadia Group had turned down requests for extra funding.

Despite refusing to accept responsibility for the problems, he claimed to be working on a rescue plan to ensure pensioners would not lose out.

The BHS scheme was said to be £571m in the red on a private sector buyout basis when the firm fell into administration in April. Buying out smaller pot-holders and topping up the payments for others would cost as much as £400m, experts estimated.

Since then, the Brexit vote has hit the government bond yields on which the fund relies and the pension black hole could have "soared by several hundred million pounds", says the Guardian.

The paper adds that talks regarding a rescue plan are still thought to be "at an early stage".

A spokesperson for Green's Arcadia Group reacted angrily to the latest intervention, saying: "Frank Field's continued interference in this matter is deeply unhelpful. He is not the regulator and he should mind his own business."

MPs on Field's pension committee, along with their colleagues on the business select committee, are compiling their official report on the collapse of BHS, which could assign blame to specific individuals and is expected to make recommendations designed to better protect pensions in future mergers.

Green has written to the committee to reject allegations he blocked a rescue deal with Sports Direct's Mike Ashley, saying he pledged to stump up £5m to support it.

This "can now put an end to the suggestion that I tried to block a sale of the business", he wrote.

Field, who is chairman of the two committees of MPs investigating BHS's failure, told the London Evening Standard: "Sir Philip is aware we are writing our report and is suddenly volunteering all manner of last-minute assistance."

Chappell: The £2.6m I took from BHS didn't lead to its collapse

15 July

BHS's final owner, Dominic Chappell, has said he is not to blame for the retailer's demise.

But the twice-bankrupt former racing driver did admit he took "a lot" of money out of the business, confirming reports that he took £2.6m in fees and wages.

"We live in a risk reward society, that's the way companies are built and fail. Did I take a lot of money out? Yes I did. But did the business fail because of the amount of money I took out? No it didn't," he told the BBC's Newsnight.

"This was just a drip in the ocean compared to the money that was needed to turn around BHS."

Chappell also admitted using company funds to provide a £1.5m loan to his parents, but said this "had no impact whatsoever on BHS".

He added: "I needed to help my parents, which I did".

Chappell's Retail Acquisitions consortium bought BHS from Sir Philip Green's Arcadia Group, which had owned the business for 15 years, in March 2015 for a nominal £1.

The company was placed into administration this April, after a failed rescue attempt at a managed insolvency process that would have cut rental bills. It is now being liquidated after no suitable buyer for the whole company came forward.

Chappell lays responsibility for the collapse of the company firmly at Green's door, arguing the tycoon took out hundreds of millions of pounds during the first years of his ownership without re-investing in the business.

"You only need to go and look at some of the stores that were in terrible condition," he said. "Some of them didn't have air-conditioning or heating. Some had water pouring through the roof, some had two or three floors… closed for two or three years because they were hazardous, asbestos, God knows what else."

Green has been accused of taking as much as £480m out of BHS, although he says this was dwarfed by the £600m Arcadia pumped into the business. He denies blame for the collapse but has pledged to bring forward plans to rescue the pension fund, which has a deficit of as much as £600m.

A parliamentary investigation into the sequence of events that has left 11,000 BHS facing losing their jobs and 20,000 pension scheme members facing payout cuts is ongoing.

BHS crisis leads to call for merger-blocking powers

4 July

BHS's pensions crisis shows the need to give the regulator tough new intervention powers, according to one industry grandee.

Lady Barbara Judge, who stood down as chair of the Pension Protection Fund on June 30, says the workplace pension watchdog should have the power to block takeovers that put pensioners' retirement schemes at risk.

"The regulator should have the right to approve or disapprove any corporate transaction that might disadvantage pensioners," Judge told the Financial Times. "If they had had the power, we would not be in this situation."

Questions over the running of BHS and its pension scheme have been raised since the company collapsed into administration in April. The store was sold last year by Sir Philip Green's Arcadia to a consortium led by the two-time bankrupt Dominic Chappell for a nominal £1.

MPs investigating the case have heard evidence that Chappell was not aware of the scale of the pension deficit, which is running at as much as £600m, when he bought the firm. Green has also said he did not know of the shortfall until 2012.

A joint business and pensions committee is expected to give a verdict on where blame lies for the retailer's collapse and the pension black hole. Green is very much in the spotlight and likely to be told to inject a substantial sum to fill the deficit.

The committee is expected to make recommendations on how to prevent the situation arising again, especially with regard to the potential losses now facing 20,000 BHS pension-scheme members.

Green says he is working on a plan to ensure members do not lose out but is facing criticism that weeks after giving evidence to MPs, nothing has yet been done. A rescue plan could cost him as much as £400m, according to ex-City minister Lord Myners.

Elsewhere, BHS's administrators have made the first sale of its assets since deciding to wind down the firm, The Times reports.

The store's website and international operations, spread across "15 franchise partners operating 72 stores in 19 countries", have been acquired for an undisclosed sum by the Qatari firm Al Mana, which is already a BHS franchise operator.

Talks are still ongoing over a possible sale of some of the BHS's 164 UK stores, with Sports Direct's Mike Ashley said to be among the interested parties.

BHS: Field accuses Green's family of 'nicking money'

30 June

Frank Field and Sir Philip Green have locked horns once more after the MP appeared to accuse the businessman of "nicking money".

In a second evidence hearing in front of MPs investigating the collapse of BHS and its pension woes, Field told executives of Green's Arcadia Group, including finance director Paul Budge, that what was needed was "a big cheque from the Green family".

In a stinging rebuke, the work and pensions select committee chair added: "If Sir Philip was serious, he could today settle the pension issue. We are fed up with hearing, 'I'm about to fix it.' He does not fix it.

"What is required is a very large cheque from the Green family, that have done so well out of the whole of this exploitation.

"The City is furious with your behaviour, the image you have put over. That business is not about creating jobs, about spreading wealth, it's about nicking money off other people," he added.

Green has been accused a number of times of taking as much as £580m out of the BHS during his time in charge of the company, but has always maintained that Arcadia paid more money into the business than it ever took out.

In response, the businessman issued a statement about the MP's "outrageous outburst", saying: "Accusing me and my family of theft is totally false and unacceptable," reports Sky News.

He added: "Mr Field needs to apologise for his shocking and offensive behaviour."

The two previously locked horns shortly after BHS collapsed, when Field called for Green to lose his knighthood if he failed to bring sufficient cash to the table to ensure the firm's pension scheme members did not lose out.

At the time, Green demanded that the pension committee chair stood down before he would appear to give evidence. He eventually relented and attended a session earlier this month, during which he pledged to rescue the pension fund.

Former City minister Lord Myners said it could cost the tycoon as much as £400m to ensure pensioners are not forced to accept reduced payouts.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions