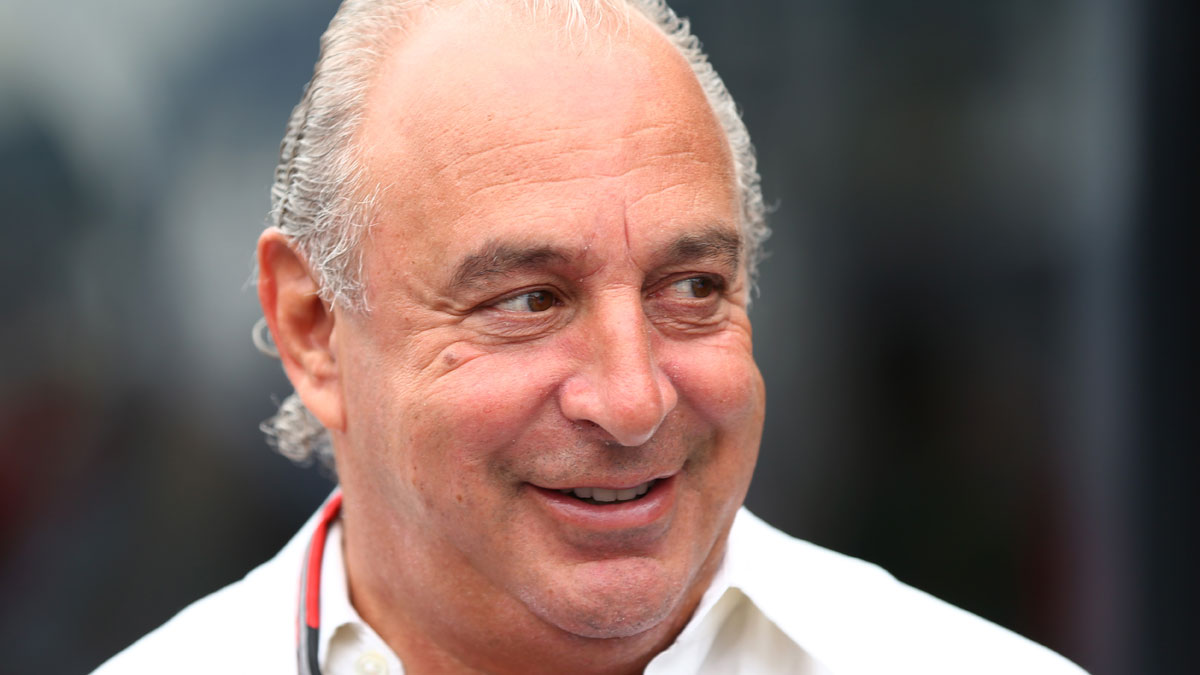

Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

BHS pensioners still face 12% hit to payouts

1 March

"Do not run away with the idea that Sir Philip Green has suddenly been overcome by the spirit of generosity," says Nils Pratley in The Guardian, following the news that that businessman will pay out £363m to the stricken BHS pension scheme.

The payment is the full amount the Pension Regulator was seeking and prevents many members' payouts being immediately cut by ten per cent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, Pratley writes, there is a "critical sentence" in the watchdog's statement which says: "Broadly speaking, on average, the new scheme will offer members benefits of around 88 per cent of the value of their full BHS scheme benefits."

The journalist adds: "That 88 per cent figure includes assumptions about future inflation rates and the 'on average' clause covers differences in pensioners' age, length of service and when that service occurred."

Essentially, a majority of members are likely to either take a lump-sum payout, which caps the liability for the scheme, or join a new fund offering a lower rate of inflation protection.

According to The Guardian, the deal will see Green pay £343m to offer a lump sum to the 9,000 members with smaller pots and fund top-ups for those among the remaining 10,000 members who join a new scheme.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The remaining £20m is to cover administration costs related to the payouts and the new scheme.

Members will also have the option of staying in the Payment Protection Fund, which took on the BHS pension scheme when the company collapsed last year. But those who are not yet at retirement age will see payouts cut by ten per cent.

Moneywise says lump sums will be offered to those whose pension fund is worth currently less than £18,000. If all of those offered this option take it, Green could receive a £15m rebate.

However, the 88 per cent is still a better deal than pensioners were likely to get in the PPF, as the upfront cuts and removal of inflation linking would have meant an eventual payout of 75 to 79 per cent.

Pensions expert John Ralfe said: "This is not Sir Philip Green as the all-conquering hero. This is Sir Philip making the best of a bad job."

Sir Philip Green agress £363m BHS pension deal

28 February

Sir Philip Green has finally laid the ghost of the BHS pension scheme to rest and will make a "voluntary contribution of £363m" into the 20,000-member strong fund after striking a deal with the Pension Regulator.

Under the agreement, "workers will get the same starting pension that they were originally promised", says the BBC.

BHS collapsed last year with a pension deficit estimated at £571m and the scheme was set to be picked up by the Pension Protection Fund (PPF), which would have cut payouts by ten per cent for many members.

In late January, when it was reported Green was "days away" from agreeing a rescue, it was thought any deal would involve lump sum payments to those members with small pots and a separate fund to top-up payouts to others.

The Pension Regulator will now stop its investigation into the businessman, which could have led to legal action to force him to provide additional funds – Green is thought to have originally offered £250m, a sum the watchdog considered too small.

Green said: "The settlement follows lengthy, complex discussions with the Pensions Regulator and the PPF, both of which are satisfied with the solution that has been offered.

"To achieve a significantly better outcome than entering the PPF, the contribution required to achieve this long-term solution was arrived at by the actuaries for both The Regulator and the trustees.

"All relevant notices, including legal matters and claims from the regulator, have been withdrawn bringing this matter to a conclusion."

Green and BHS's last owner, Dominic Chappell, who bought the chain for £1 in 2015, are also the subject of a separate investigation into whether they breached their duties as directors.

Chappell has also launched a £14m legal action against the businessman in relation to an alleged promise to share proceeds of the sale of the company's head office, Marylebone House.

Chappell sues Green for £14m over BHS building sale

24 February

BHS's last owner, Dominic Chappell, is suing its most famous former owner, Sir Philip Green, in what is turning into an increasingly ugly fallout from the retailer's collapse last year.

Chappell is seeking £14m from the controversial chief of Arcadia Group, which sold the high street chain to his Retail Acquisitions for a nominal £1 in March 2015, after a decade and a half in charge.

The former racing driver claims his firm had been promised a share of the proceeds from the sale of BHS's London headquarters, Marylebone House.

"It is understood… Chappell was promised he could buy Marylebone House for £35m, and then keep the proceeds if he sold it for £45m and invest the cash in BHS," says the Daily Mail.

Instead, adds the Daily Telegraph, "Marylebone's House was transferred within the Green family's investments… at a purchase price of £53m".

Retail Acquisitions is the subject of a winding-up petition amid "overwhelming evidence it is insolvent", says BHS administrator Duff & Phelps, although Chappell says that claim is simply an attempt to ensure the company is no longer able to bring the legal action against Green.

Administrators say that once they have wound up Retail Acquisitions, they will be better able to "investigate the transfer of money" from BHS and Arcadia to it.

Retail Acquisitions took a £8.4m loan from BHS and a £3.5m loan from Arcadia ahead of its purchase of BHS, says the Telegraph.

Those loans prompted MPs to say Green was "both sides of the transaction" when BHS was sold and are part of the reason he is held primarily responsible for its subsequent collapse.

Aside from this legal action, investigations are ongoing into both Chappell and Green over whether they breached their duties, which could lead to them being barred from acting as company directors in the future.

The Pensions Regulator is also investigating if either man should be formally fined to cover a shortfall in the BHS pension scheme.

BHS inquiry into former directors 'beefed up'

10 February

An inquiry into the conduct of BHS directors, including former owners Sir Philip Green and Dominic Chappell, has engaged "forensic accountants and senior lawyers", says The Times.

In a letter to parliamentary pensions committee chairman Frank Field, the Insolvency Service confirmed it has brought in "specialist services" and IT equipment.

Sarah Albon, chief executive of the service, said the moves were to "ensure that any possible disqualification action stands up to the legal process".

The government called in the Insolvency Service to run a "fast-track" inquiry last year, breaching a convention that would normally see it wait three months for administrators to complete their own investigations.

The service has since "received 37 million electronic records and 1.4 million [have] been identified for review", says the Daily Telegraph.

Investigators were still "seeking detailed explanations from parties of interest", Albon's letter said, but she was confident they would easily meet the April 2019 deadline for "disqualification action" to begin if found necessary.

If the BHS directors are found to have failed to live up to their obligations and contributed to the collapse of the retailer, which cost 11,000 people their jobs, the Insolvency Service can disqualify them for between two and 15 years.

Green is also facing calls to be stripped of his knighthood, a move backed by a non-binding vote in parliament.

The parliamentary forfeiture committee that would have to make that decision has said it will await the outcome of any investigations before it takes any action.

Green is also still locked in negotiations with the Pension Regulator over the BHS pension scheme, despite claims last month that a £350m deal was just days away.

The watchdog is running its own investigation into Green and Chappell and could yet issue an order for them to repay hundreds of millions of pounds to cover the cost of bailing out the retirement funds.

Sir Philip Green 'to give in on £350m BHS pension demand'

30 January

Sir Philip Green is about to give in to a demand for more than £350m to plug a black hole in the BHS pension scheme, reports suggest.

According to Sky News, sources say the tycoon "could be just days away" from securing a deal with the Pension Regulator.

Under the terms of the agreement, Green will fork out more than £350m, which includes lump-sum payments to "thousands of former BHS workers with smaller pension pots".

A separate fund will be set up to make ongoing payments to those with larger pensions.

When BHS collapsed last year, its pension scheme was said to have a deficit of £571m. "[This] is thought to have increased substantially as ultra-low interest rates have depressed gilt yields," says Sky.

That's the cost for a full buyout of the scheme. The Pensions Regulator is seeking a deal that will simply make up costs incurred if the pensions have to be bailed out by the industry lifeboat, the Pension Protection Fund.

It was widely reported late last year that the regulator was demanding a sum in excess of £350m, while Green had offered around £250m.

MP Frank Field, chairman of the parliamentary pensions committee, which has been highly critical of Green, told the Daily Telegraph the "key test" is whether pensioners get "the pensions they expected before Sir Philip took ownership of BHS".

On that test, however, it seems the deal could fall short.

The agreement "could leave BHS pensioners continuing to face modest cuts", says Sky, although this is still likely to involve better terms than the ten per cent cut if the scheme fell into the Pension Protection Fund.

Field said: "The committee will be very pleased if there is a deal but will carefully analyse it to assess whether existing and future pensioners have been disadvantaged and we may well call Sir Philip and the Pension Regulator back to give evidence."

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions