Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

'BHS is just the beginning – there will be more casualties'

03 June

Rival retailers are "circling over the remains of BHS", while analysts begin an early post-mortem into what led to the store's demise following 88 years of trading.

Administrators announced yesterday that BHS would be wound down and retailers such as Next and Primark are being touted as potential buyers of parts of the store's 160-store strong estate. Some of the parties involved in the rescue bidding process, such as Sports Direct's Mike Ashley, are also said to be interested in buying stores or assets, reports The Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The 163 BHS outlets will hold closing-down sales over the coming weeks, while restructuring company Hilco will lead a liquidation process and look for buyers for the stores and other assets, such as the BHS brand and its online business. Up to 11,000 jobs will be lost.

Blaming the rise in online retailers, as well as the huge growth at the "value" end of the market and the costs of managing a legacy of larger stores in "weak" high street locations, analysts have attributed BHS's collapse over the past ten years to several key factors.

"BHS was a case study in how not to be a retailer in the 21st century, and though few will mourn its inevitable passing, many should learn from it," writes the Daily Telegraph's James Quinn.

"In the end there has to be a reason for going into a shop – either fashion, quality, range, price, service or its 'community'. Unfortunately BHS has ended up with none of these, despite the considerable efforts of its staff and managers," says Tony Shiret, a senior food and retail analyst at Haitong Securities.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"BHS over a decade became more and more out of touch on style, price, merchandising and brand presence," agrees Phil Dorrell, a partner at Retail Remedy. This made them "old hat" and meant they offered "nothing different".

They failed "to keep up with and respond to their changing customer needs while high rent and unprofitable stores were allowed to continue for too long, endangering profit", he added.

Independent consultant Richard Hyman says BHS "tells the story of a retail business struggling to keep pace with faster, better, more relevant competitors" – but he added it was not alone.

BHS and this week's failure of Austin Reed "just the beginning", he warned, and there will "be many more casualties over the coming years".

BHS to be wound down as rescue attempts fall short

02 June

Department store chain BHS is to be wound down after a protracted bidding process ended in failure.

"Despite the considerable efforts of the administrators and BHS senior management it has not been possible to agree a sale of the business," said a statement from administrators at Duff & Phelps. "Although multiple offers were received, none were able to complete a deal due to the working capital required to secure the future of the company."

The administration process had been ongoing since late April - "longer than many, including me, thought likely," writes BBC business editor Simon Jack.

It had been thought that holding company Richess Group, backed by a mystery Portuguese family and fronted by former Mothercare and Burton chief Greg Tufnell, would secure a rescue deal today. But it and others fell short on the "working capital" needed to finance a turnaround, the Financial Times reports.

The London Evening Standard had said a final offer from Richess was "being thrashed out" and that administrators were "seeking assurances sufficient funds [were] in place" for the buyout and turnaround plans. However, the paper added that a liquidation was "just as likely" an outcome.

Jack notes that the team reviewing the bids had a legal obligation to maximise value for creditors and so the 11,000 jobs at stake were "not the first priority". Other bidders, such as Sports Direct's Mike Ashley and Matalan founder John Hargreaves, had apparently dropped their interest after being asked to up the value of their offers.

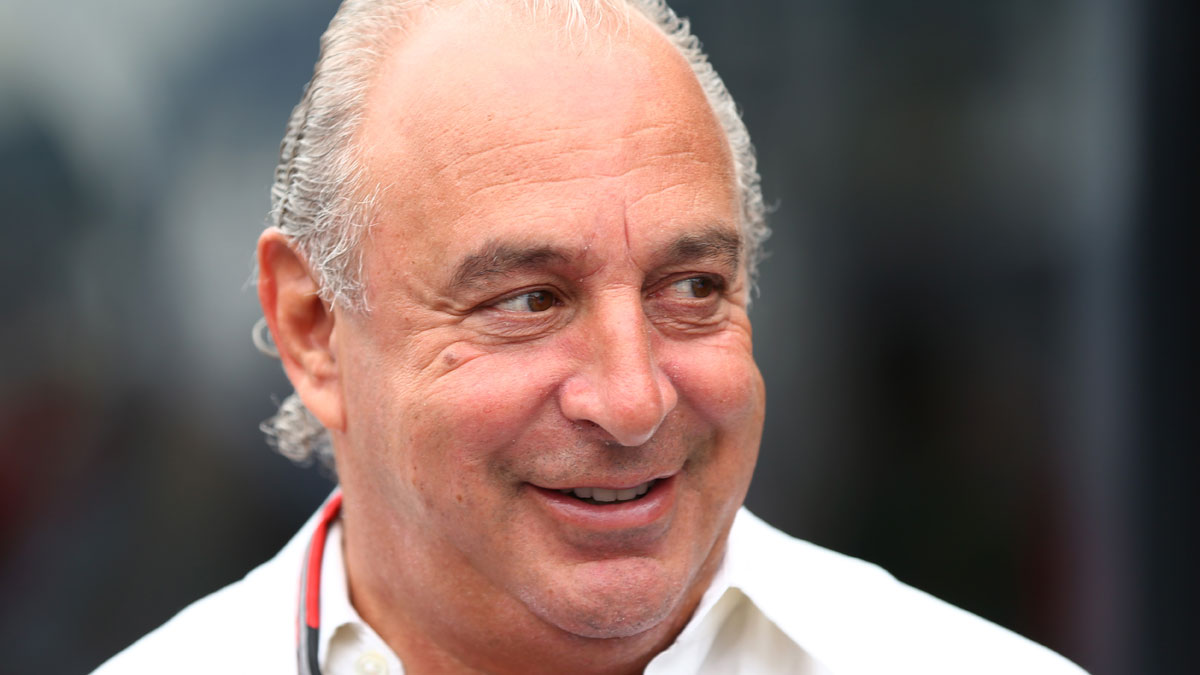

All of this takes place against the backdrop of a parliamentary inquiry into BHS's collapse under the auspices of Dominic Chappell's Retail Acquisitions and its nominal-value buyout of the chain from Sir Philip Green's Arcadia last year.

MPs are particularly concerned at an apparently negligent attitude of either or both parties, as well as the advisers and regulators who were involved, to the chain's pension scheme, which has a deficit in the hundreds of millions of pounds and is now at the mercy of the industry rescue scheme.

Green and Chappell are yet to give evidence to the committees. It "will be a very, very uncomfortable place… against the backdrop of 11,000 redundancies", Jack concludes.

BHS rescue deal – or liquidation – should come this week

31 May

The fate of stricken department store chain BHS – and its 11,000 staff – should be clear by the end of this week, says The Guardian.

Talks are ongoing with the one bidder thought to remain in the running to acquire the brand from administration, a consortium backed by a wealthy Portuguese family and fronted by former Mothercare boss Greg Tufnell.

A competitive process for the business has been ongoing since its collapse at the end of April, but most of the parties that had declared an interest have fallen away. Most recently to pull out of the race was a consortium led by Matalan founder John Hargreaves, which was reportedly being asked to up an offer of between £60m and £75m.

Tufnell and his co-directors in the Richess Group holding company have told administrators at Duff & Phelps that their financial backers are "willing to invest tens of millions of pounds in BHS" to turn around its fortunes.

A deal is expected to be announced on either Wednesday or Thursday – but failure to agree terms by the end of the week would mean "liquidators are likely to be appointed".

Whatever ultimately happens with BHS this week, a joint parliamentary inquiry seeking answers into the collapse, which left its pension fund hundreds of millions of pounds in deficit and adrift in the industry bailout fund, is set to continue when MPS return from their recess next week.

Property tycoons Guy and Alexander Dellal, who control Allied Commercial Exporters, are set to face questions over their role in the takeover of the business by Dominic Chappell last year. They put up the £35m needed to show Sir Philip Green's Arcadia group that the former racing driver was a credible buyer, "then made millions of pounds from a series of property deals and loan agreements with the retailer".

MPs could also summon David Roberts, of the law firm Olswang, and Paul Martin, of accountants Grant Thornton, over their advisory roles, which saw them net millions in fees. Both had been previously asked to appear but provoked anger by sending "stand-ins who did not work directly on the deal and failed to answer many of the questions MPs posed".

BHS collapse brings down Pretty Polly tights firm

26 May

Ripple effects from the collapse of BHS are already being felt, with a key supplier behind the Pretty Polly tights brand going out of business.

Yesterday, Derbyshire-based Courtaulds, along with the CUK Clothing business with which it merged in 2006, "went into administration with the loss of 350 jobs", reports the BBC. The companies, which "traded under the Pretty Polly brand name and also made private-label clothing for retailers", employed 380 people at two sites in Belper and London.

"The administration of BHS has added to the challenge of operating within a fiercely competitive market for seasonal products," administrator Dilip Dattani, at RSM Restructuring Advisory, said.

This may not be the last BHS-related failure if a rescue deal is not forthcoming. In April, shortly after the chain filed for administration, The Guardian reported that as many as "1,000 trade suppliers, from a Lanarkshire biscuit maker to a lighting company in Poole, could be left unpaid to the tune of £52m".

Total debts at BHS amount to £1.3bn. The retailer employs 11,000 staff across 164 stores and administrators at Duff & Phelps are reportedly hoping to announce a buyout before the end of the week, with a bid led by the former boss of Mothercare thought to be in the frame.

The Daily Telegraph has said that "a trio of liquidators – Alteri, Gordon Brothers and Hilco – are lined up if a deal cannot be secured".

The boss of one supplier told the Guardian he was considering legal action to recoup tens of thousands of pounds his firm is owed. He pointed the blame in particular at Dominic Chappell, the twice-bankrupt former racing driver who led the Retail Acquisitions consortium that bought BHS last year and oversaw its demise.

Chappell's plans for BHS were yesterday rubbished during a parliamentary hearing by one financier who had been approached to help back the takeover and subsequent attempted turnaround. Andrew Frangos, of Cornhill Capital, who refused the request and is currently in a dispute with the businessman, described the plan as "a bit of a punt".

Later MPS were told that Chappell's understanding of BHS's huge pension scheme deficit was necessarily limited as he had only a half an hour meeting with trustees prior to buying the firm.

BHS: Ex-Mothercare boss leads last-minute rescue bid

25 May

A last-minute rescue bid backed by a wealthy but unnamed Portuguese family is reportedly set to be given the go-ahead to buy the collapsed high-street chain BHS out of administration.

The offer is thought to represent the "mystery European bidder" who entered the race earlier this month. According to the Evening Standard, the holding company set up to execute the deal, Richess Group, was registered on 12 May, two days after the first deadline for bids.

The group is led by the former boss of both Mothercare and the Burton menswear chain, Greg Tufnell, the brother of former England cricketer Phil. The Daily Telegraph reports that fellow directors include Nick de Scossa, the former director of Bristol Rugby Club and one-time Credit Suisse banker, and Portuguese businessman Jose Maria Soares Bento.

As for the unnamed backers, the paper says rumours point to the Soares dos Santos family, which controls the supermarket chain Jeronimo Martins in Portugal. However, the family has officially denied any involvement.

Sky News, on the other hand, has suggested an entity "affiliated to Isabel dos Santos, the daughter of Angola's president, which has interests in the Portuguese banking and energy sectors".

Matalan founder John Hargreaves and Cafer Mahiroglu, the Turkish discount fashion entrepreneur, who had been considered frontrunners to secure BHS after they placed a bid worth as much as £75m, may have dropped out of the running "after being asked to sweeten their offer".

A final decision by administrators at Duff & Phelps was expected at the beginning of this week, but is now likely to come either tomorrow or on Friday.

Meanwhile, an MPs' inquiry into the collapse of BHS, leaving the firm's pension scheme stricken with a deficit of hundreds of millions of pounds, rolls on. A joint parliamentary committee is today questioning advisers to Retail Acquisitions, which bought the company for £1 last year and oversaw its demise, as well as trustees of the pension funds.

Already headlines have been made following the evidence of trustee chairman Chris Martin this morning, who revealed his company had been paid around £250,000 for its work. Martin's firm did not become involved with the BHS schemes until January 2014, by which time it was already hugely in the red.

-

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions