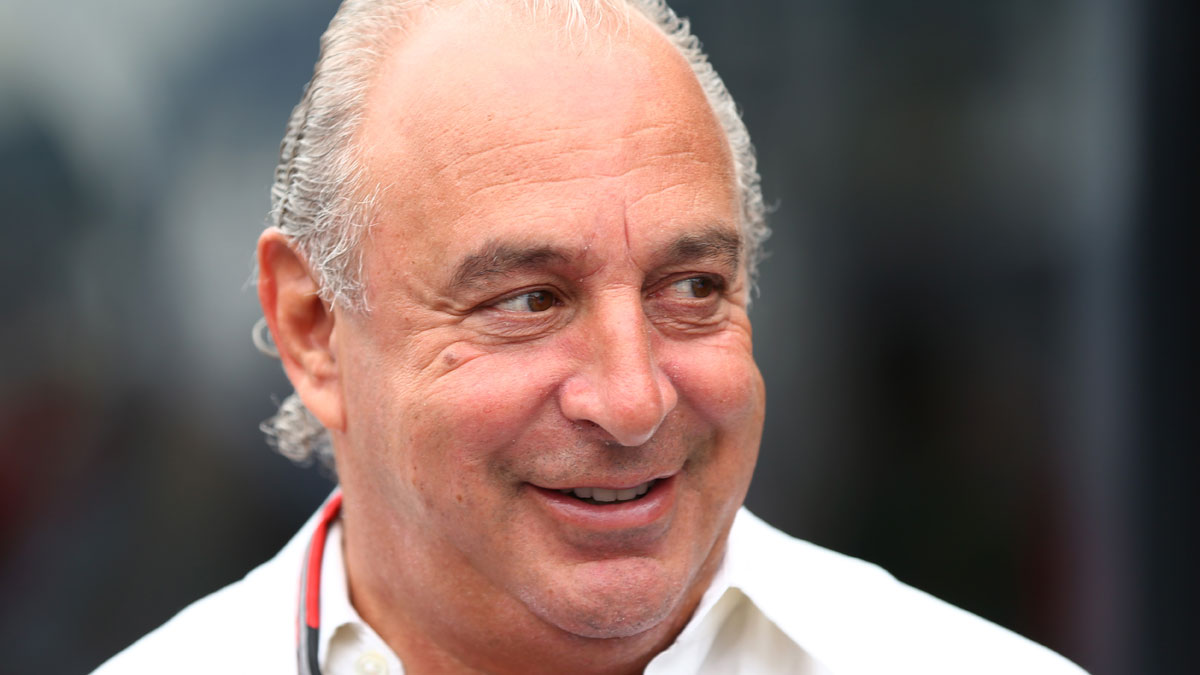

Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Sir Philip Green's Arcadia refused to pay more into BHS pension funds

20 June

Sir Philip Green's claims that he was ignorant for more than a decade of the massive deficit building in the BHS pension scheme have been thrown into question by new evidence submitted to MPs.

Minutes of a meeting in 2009 reveal that Arcadia Group, the retail consolidator co-owned by Green that controlled BHS for 15 years, was asked for – and refused – more money by the department store chain's pension fund trustees.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Chief operating officer Paul Coackley said at the time that a contribution by BHS of £6.5m a year into the funds could not be increased as the retailer was facing a "rocky three years ahead" and was being "stripped to the bone", the Daily Telegraph reports.

He told Margaret Downs, then head of the pension trustees, that "in short, there is currently no free cash flow in the business".

Last week, during a marathon six-hour evidence session in front of the parliamentary committee investigating BHS's collapse, Green claimed he had been unaware of the funding shortfall during the first ten years in charge of the company.

"If somebody had come to us from the trustees and said, 'We want £10m', I think it would have been a five-minute debate," he said. He also accused the trustees of being "asleep at the wheel".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Arcadia eventually sold BHS for a nominal £1 to twice-bankrupt former racing driver Dominic Chappell early last year. At the time, the pension deficit was running in to hundreds of millions of pounds. On a worst-case basis, it now stands at £571m.

Chris Martin, the current chair of the BHS pension trustees, has told MPs that a rescue plan for the schemes being worked on by Green could cost the businessman £110m.

At his evidence last week, Green said his advisers were working on a "resolvable, solvable" solution to the deficit. This is likely to involve members with small savings pots taking a lump sum and payments to others being linked to a lower level of inflation.

BHS pension 'mess' will cost Sir Philip Green more than £100m to fix

16 June

Former BHS owner Sir Philip Green's public reputation now depends on the amount of money he is willing to put in to rescue the firm's stricken pension schemes, MPs said.

However, improving the lot of the fund's 20,000 pensioners, who currently face a ten per cent cut to their payments in the Pension Protection Fund (PPF), could cost upwards of £100m, pension experts have warned, and even as much as £571m.

Green vowed yesterday to sort out the "mess" in the schemes, which are currently cast adrift in the PPF and hundreds of millions of pounds in deficit, the BBC reports.

"We want to find a solution for the 20,000 pensioners," he said, during his marathon six-hour evidence session in front of a joint business and pension parliamentary committee.

A rescue plan, based on a proposal initially worked on in 2014, is "current and in motion", he added.

Business, innovation and skills committee chair Iain Wright told The Guardian: "We hope [Green] will come up with an offer that is satisfactory to the Pension Regulator.

"However, he doesn’t only have to satisfy the [regulator] – today he is before the bar of public opinion. Much of his reputation now depends on how generously he responds."

Labour MP Frank Field, the chair of the work and pensions select committee, agreed that "a lot of credibility now rests on a very generous settlement".

Green declined to give details of the "Project Thor" rescue plan, but it is expected to involve offering "thousands of workers with small pension entitlements the chance to swap a distant trickle of retirement income for an immediate lump of cash", so cutting future liabilities, says the Financial Times.

Those with larger pots could also be offered a settlement linking future payouts to a lower level of inflation, which would still be more generous than under the terms of the PPF.

BHS's pension schemes are £571m in the red on a buyout basis, which includes the costs for a private provider to take them on. The PPF has said it would need to inject £275m and experts warn that even if workers accept lower payouts, Green will need to fill a black hole of more than £100m.

In offering the rescue, the tycoon is pitching himself as the ethical former owner who is taking responsibility for an issue for which he was not directly to blame.

He apologised for the pension problems yesterday, but this contrition was specifically in relation to his not having overseen the schemes for ten years to 2012. During that time, he intimated trustees had been "asleep at the wheel" and said "stupid, idiotic" decisions had been made.

BHS: Sir Philip Green says he knew nothing about pension problems

15 June

Sir Philip Green has sought to distance himself from the pension crisis at BHS, telling MPS that during his 12 years of ownership, he knew nothing of the problems growing within the schemes.

Speaking at a feisty evidence session in front of a joint business and pensions select committee in Westminster, the billionaire said he was not aware of the scale of the deficit and had little-to-no involvement in the schemes from when his Arcadia empire bought the business, in 2000, until 2012.

Arcadia sold BHS for a nominal £1 in early 2015, when the pension deficit was north of £200m. Accounts published by the chain's administrators now put this figure at £571m on a buyout basis, which includes all the costs needed for a private pension provider to take on the scheme. The Pension Protection Fund believes it will need to bail out the funds to the tune of £275m.

Green told the MPS he could not be expected to remember what had happened at meetings in the early 2000s and also denied knowledge of a 2012 meeting with then pensions minister Steve Webb, during which he is said to have lobbied for BHS's contribution to the industry pension rescue fund to be cut.

Instead, he indirectly laid the blame at the door of the pension scheme trustees, saying that some "stupid, idiotic" decisions had been made and that someone had been "asleep at the wheel".

Green was repeatedly challenged on how he could have had no knowledge of the pension schemes when he reportedly took an interest in all areas of the business, down to the hangers used in BHS stores.

He was also quizzed over the £400m or more of dividends he and his colleagues took from BHS, to which he replied that it was proportionate and paled in comparison to the £600m later invested in capital and interest-free loans, part of £800m Arcadia put into the company in total.

But there was a degree of contrition, too. Green apologised for not getting involved earlier and pledged to bring forward a rescue plan, involving personal investment, which is currently being worked on.

It was the second apology of the session. The businessman began the meeting by apologising to the 11,000 BHS staff who stand to lose their jobs. "It didn't need to be like this," he added.

Exchanges were often fiery – chair Frank Field said events did not fit with the image of the businessman as a great "Napoleon-figure", says The Guardian – and questions were frequently interrupted, with Green at one point asking Richard Fuller MP to stop "staring" as it was making him "uncomfortable".

He also repeatedly referred to the women on the committee as "your lady here", which prompted an angry response on Twitter from the likes of SNP MP Mhairi Black.

BHS: Sir Phillip Green 'avoided £160m tax payments'

14 June

Sir Philip Green allegedly avoided paying £160m in tax during his company Arcadia's 15-year ownership of BHS.

The Daily Mirror claims today that "Sir Philip and his family received £609m from the retail chain through a combination of dividend payouts, rent and interest on loans", according to company accounts.

As the Greens held their controlling shares through offshore companies registered in Jersey – and the ultimate beneficiary is thought to have been Sir Philip's wife, Lady Tina, who is based in low-tax Monaco – as much as £100m in dividend taxes may have been legally avoided.

The Mirror also alleges that around £60m in UK corporation taxes payable by BHS itself were offset by rent and interest payments to the Jersey companies, which were deducted from profits.

A spokesperson for Green said the structure was "perfectly standard", adding: "The family’s retail businesses are UK registered and pay UK taxes on their profits. Like many other UK companies, they are ultimately owned by entities outside the UK."

Green is due to appear before the MPs of the joint work and pensions and business, innovation and skills committees tomorrow to give evidence about the sale and collapse of BHS.

According to The Guardian, the session will feature questions over why three-times-bankrupt former racing driver Dominic Chappell was chosen as Arcadia's preferred buyer in 2015.

He will also be questioned on the hundreds of millions of pounds he is said to have taken out of the business, which collapsed with a £571m pension deficit, whether he broke a pledge to maintain insurance cover for suppliers and blocked a potential rescue sale to Mike Ashley.

MPs will effectively be asking "what is a knighthood worth?", according to the BBC's Simon Jack. Some politicians are calling for the Topshop owner to plug BHS's entire pension deficit in order to keep his title.

There is still a chance that the tycoon will refuse to turn up, after committee chair Frank Field rejected his demand to stand down over claims of "bias".

If Green does so, he faces a list of sanctions, including "being found in contempt of parliament or facing a Commons vote on whether he is a 'fit and proper' person to be running a business", says the Guardian.

Sports Direct's Mike Ashley renews interest in BHS stores

13 June

Retail tycoon Mike Ashley has written to the directors of BHS proposing a deal to take over some of their stores.

In his letter, the Sports Direct founder says there is still time to save thousands of jobs at the collapsed chain.

"We can confirm that we have a continued interest in BHS," said a spokesman for the retailer.

"We have written to the administrator seeking to re-open a dialogue about saving a number of jobs and stores along with the BHS name."

Some have dismissed Ashley's interventions as "a publicity stunt at a time when his Sports Direct retail group faces damaging revelations surrounding its treatment of contract workers," the Financial Times says.

Ashley testified before MPs last week answering questions about the working practices at his company.

Former BHS owner Sir Philip Green is due to appear before the parliamentary committee into the collapse of BHS this week. However, his appearance is "still in doubt", the FT says, after the businessman wrote a letter demanding committee chairman Frank Field resigns.

“Sir Philip is waiting for a proper response from Frank Field to his letter and will decide then,” said a spokesman. “He feels the committee is deeply prejudiced and not a proper forum in which to consider the evidence.”

BHS, which has 163 stores across Britain, ran out of money last month, "jeopardising 11,000 jobs and leaving a huge hole in its pension fund," the BBC says.

-

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions