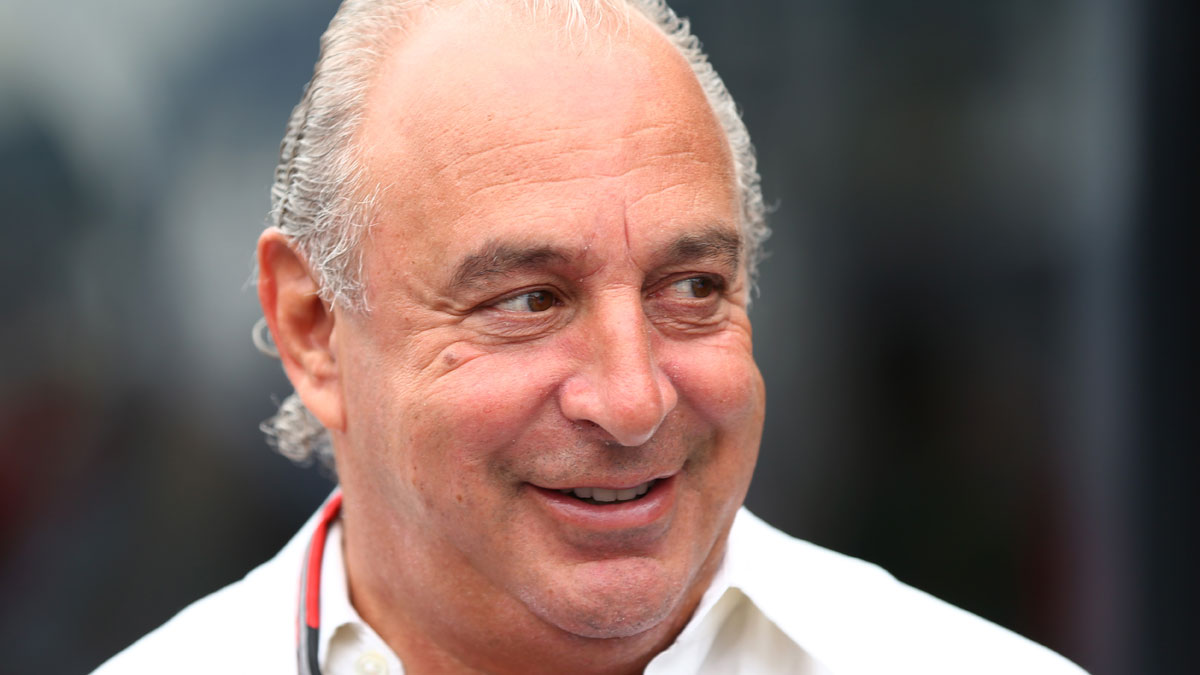

Sir Philip Green's Arcadia agrees £30m deal in BHS legal battle

Payment relates to a charge that had been set aside to repay a loan used to fund 2015 buyout

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

BHS pensions: Sir Philip Green 'owes £400m', says former minister

29 June

Sir Philip Green will have to pay £400m to fulfil his pledge to save the BHS pension schemes and prevent 20,000 members suffering cuts to payouts, says a former government minister.

Lord Myners, who is working as a specialist adviser to the parliamentary inquiry into the collapse of the retail chain, told Sky News the total included a lump sum to cover an asset shortfall and top-up pension payments for members.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Green has said his team is working on a "resolvable, solvable" solution to the deficit, which is as much as £600m. Experts have said any plan would cost at least £100m.

Myners said a rescue deal was expected to be in two parts: a single payout to members with small pots and the residual fund containing those with a more sizeable savings moving into the Pension Protection Fund.

The industry bailout fund would impose an effective ten per cent cut on future payouts to those below retirement age, which Myners said would need to be made up.

Green would need to inject money into the scheme to ensure assets are equal to the PPF's future payout liabilities and to fund an independent company with sufficient sums to meet the top-up payments.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

These final two elements alone would cost "roughly £200m apiece".

Aside from the pension scheme problems, Green has come under renewed pressure over his evidence to MPs about last year's deal to sell BHS for £1 to twice-bankrupt retail novice Dominic Chappell.

MPs are assessing whether the sale amounted to negligence. Green said he only agreed to the deal because Chappell passed a "smell test" with his bankers, Goldman Sachs.

Speaking at a hearing of the joint business and pensions select committee, Goldman vice chairman Michael Sherwood insisted the bank only had a minor, unpaid role on the deal and had not given the buyer a clean bill of health, but merely highlighted generic risks.

The BBC adds that he revealed his bank is now reviewing its relationship with Green "as all this has come to pass".

BHS accountant subject of misconduct investigation

28 June

Fallout from the collapse of BHS has spread to its accountants, PricewaterhouseCoopers, which is now the subject of a regulatory misconduct investigation.

The Financial Reporting Council (FR), which oversees accountancy and audit firms in the UK and has the power to issue fines and ban individuals, announced it will examine accounts submitted by PwC relating to the final financial year of Sir Philip Green's 15-year ownership of the chain.

Little detail was offered, except that the investigation was concerned with the year ending 30 August 2014, The Guardian notes.

These confirmed that BHS was a viable "going concern". Seven months later, in March 2015, the company was sold by Green's Arcadia for a nominal £1 – and 13 months after that, this April, it fell into administration.

FRC spokesperson Peter Timberlake told the BBC it was impossible to say how long the investigation would take.

"It's obviously of high public interest and we will resolve it as soon as we can. But it's important that we do the right job," he said.

Last year's sale to two-time bankrupt Dominic Chappell is being intensely scrutinised by a joint committee of MPs over claims it inexorably led to the demise of the retailer.

The committee has already heard from both parties in the sale and has published a range of written evidence calling into question their respective claims of ignorance of problems brewing in the BHS pension scheme.

With a deficit of as much as £600m, the fate of the 20,000 pension scheme members is a key issue. Green says he will bring forward a plan to save the fund.

The next phase of the parliamentary review will see Goldman Sachs executives said to be close to Green recalled to give more evidence tomorrow, the Financial Times reports.

Banker Michael Sherwood, "along with two of his lieutenants", will respond to questions that they gave Chappell a seal of approval for the sale. Green previously told MPs that "one million per cent" he could not have completed the sale without this endorsement.

During his own session earlier this month, the billionaire said: "If they had said, ‘Don’t deal with this guy,’ that would have been the end of it… but that is not the advice that we got."

BHS pensions: PPF calls for second administrator to be brought in

23 June

The Pensions Protection Fund (PPF) has reportedly called for a second administrator to be appointed to oversee the liquidation of BHS.

The development, revealed on Sky News, follows claims from the retailer's final owner, Dominic Chappell, that current administrator Duff & Phelps was "heavily conflicted".

Giving evidence to MPs investigating the collapse of BHS and its huge pension deficit, Chappell said that his predecessor, Sir Philip Green, referred to the firm as his "ponies".

"They do exactly what Philip tells them to do," he added.

Both Green and Duff & Phelps have denied any improper relationship exits, with the businessman saying the company was chosen because others in the sector were "conflicted".

The Guardian notes the businessman was "first to contact the firm before [BHS's] collapse".

The PPF has tabled a resolution at a meeting of creditors today calling for the appointment of FRP Advisory alongside Duff & Phelps. It has not given a reason for submitting the proposal.

The meeting will also discuss the latest developments on the liquidation and creditors will be asked to approve Duff & Phelps continuing its work. The Times says the firm has so far racked up a bill of £2.8m.

MPs are also expected today to publish more documents relating to the £1 sale of BHS from Green's Arcadia Group to Chappell's Retail Acquisitions consortium last year, as well as the store's eventual collapse. Earlier this week, they called on Green's wife, Lady Tina, to submit written evidence on the "complex web" of companies she nominally runs on behalf of her husband.

The politicians are seeking to establish where the blame lies for the failure of a firm that has left 11,000 staff facing redundancy and a 20,000-strong pension scheme cast adrift with a £571m deficit.

BHS: MPs demand evidence from Sir Philip Green's wife

22 June

Pressure is mounting on Sir Philip Green and his family amid renewed claims that he attempted to walk away from BHS's massive pension deficit despite knowing it could sink the retailer.

Stephen Bourne, a former director at Retail Acquisitions, the company set up by Dominic Chappell to buy BHS from Green's Arcadia empire last year, has revealed written correspondence in which the billionaire is said to have admitted "insolvency is inevitable".

Bourne said an email from accountancy firm Grant Thornton on 6 March last year, days before the sale of BHS for a nominal sum of £1, states that Green, Deloitte, the pension trustees, KPMG and the Pensions Regulator had agreed the scheme "was too big for the company and needed 'right sizing'".

"They could see that insolvency was inevitable unless something was done", the email adds.

Green has said he was unaware of the problems in the pension scheme between buying BHS in 2000 and 2012 – and that when he sold the business in 2015, he was not walking away from the deficit.

Documents published by MPs investigating BHS's collapse have already called into question the claims of ignorance, highlighting meetings in which the deficit was discussed as far back as 2009. They have also alleged that Arcadia sought to offload all liability for the shortfall as part of the sale.

Green has pledged to bring forward a plan to rescue the schemes, which experts believe could cost him more than £100m.

MPs are investigating the sale to twice-bankrupt Chappell, a former racing driver with no retail experience, as a primary factor in the eventual demise of BHS with its £571m pension black hole.

They have also issued a new demand for evidence from Sir Philip's wife, Tina, who ultimately controls her husband's business interests through a series of offshore companies in Jersey and Monaco.

In addition to shedding further light on the sale process, they hope to gain an insight into income such as management fees, former dividends and rent bills gained from BHS, as well as from the rest of the Arcadia retail empire.

"The evidence so far points to a complex and very opaque web of privately-owned family businesses which helped make the deal possible," said business committee chair Iain Wright.

BHS pensions: Both Green and Chappell's evidence in question

21 June

Evidence given by former bankrupt Dominic Chappell relating to his buyout of BHS and its pension woes has been called into question following the publication of documents by MPs.

The joint parliamentary committee investigating the collapse of the high street store has released correspondence relating to its purchase by Chappell's Retail Acquisitions consortium from Sir Philip Green's Arcadia last year.

According to The Guardian, the correspondence reveals that Chappell's legal advisers, Olswang, had prepared a report that cited a "potential £500m" deficit in the pension scheme that could prompt intervention by the regulator.

The documents also show there had been no access to the funds' trustees nor an up-to-date valuation provided. Olswang said it had been "instructed that it is not possible [to complete this due diligence] in the time available and that the transaction will nevertheless proceed".

These revelations appear to directly contradict Chappell's evidence to MPs that he knew nothing of the huge deficit, which he says he discovered the day after his consortium took over the company from Sir Philip Green's Arcadia.

They also undermine Green's claims when he appeared before the parliamentary committee, in particular his assertion that he had never planned to "run away" from the pension deficit.

The Guardian says the reports show Arcadia believed Retail Acquisitions "should assume the full risk of the pension deficit and pay for a restructuring of the scheme".

The Financial Times adds that the documents also reveal that throughout the sales process, Green substantially watered down an initial pledge to meet the pension scheme contributions for three years and "make available" a £50m fund for expenses.

Having been lowered to an annual contribution of £10m a year, plus a £20m payment, the final figure at the time of the takeover was £5m per year, which was to come from Arcadia, not Green.

The billionaire has said he will "sort out" the pension schemes, which now have a deficit of £571m. It is thought that he will resurrect a plan first mooted in 2014 that would see members with small pots offered a one-off lump sum. Pension experts believe this will cost Green around £110m.

-

The EU’s war on fast fashion

The EU’s war on fast fashionIn the Spotlight Bloc launches investigation into Shein over sale of weapons and ‘childlike’ sex dolls, alongside efforts to tax e-commerce giants and combat textile waste

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Former BHS owner Dominic Chappell banned as director

Former BHS owner Dominic Chappell banned as directorSpeed Read Disgraced businessman bought the chain for £1 a year before it collapsed

-

Employers to face jail for pension pot mismanagement

Employers to face jail for pension pot mismanagementSpeed Read Beefed up response follows a series of high-profile corporate failures

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

-

House of Fraser enters administration: can anything save the British high street?

House of Fraser enters administration: can anything save the British high street?Speed Read Mike Ashley buys retail chain for £90m despite dwindling consumer activity

-

House of Fraser to close stores

House of Fraser to close storesSpeed Read More woe for the beleaguered high street as another big name faces restructuring

-

Philip Green defiant – but selling BHS was ‘worst mistake’

Philip Green defiant – but selling BHS was ‘worst mistake’Speed Read Tophshop and Miss Selfridge tycoon ‘sad’ he is not credited for pensions