China tightens grip on rare-earth materials

Arms race intensifies for vital green energy resources in the face of skyrocketing demand and trade tensions with the West

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

China has declared that the nation's rare earths belong to the state, as the arms race with the West heats up to control the metallic minerals needed for the green energy transition.

"No organisation or individual may encroach upon or destroy rare-earth resources," said the new regulation, which will take effect in October. The aim is to "ensure national resource security and industrial security", according to the text released by the country's State Council on Saturday.

But it is also China's "latest move to ring-fence its trove of industrially important metals", said Nikkei Asia, including "magnet-making materials" vital for a range of technologies, from electric vehicles (EVs) to lasers and missiles.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Global demand for rare earths is expected to skyrocket amid the global transition to green energy. But the regulation is also a "response to US efforts to restrict Chinese access to advanced chip technology", part of the intensifying trade war between Beijing and the West.

Stranglehold in the rare-earth market

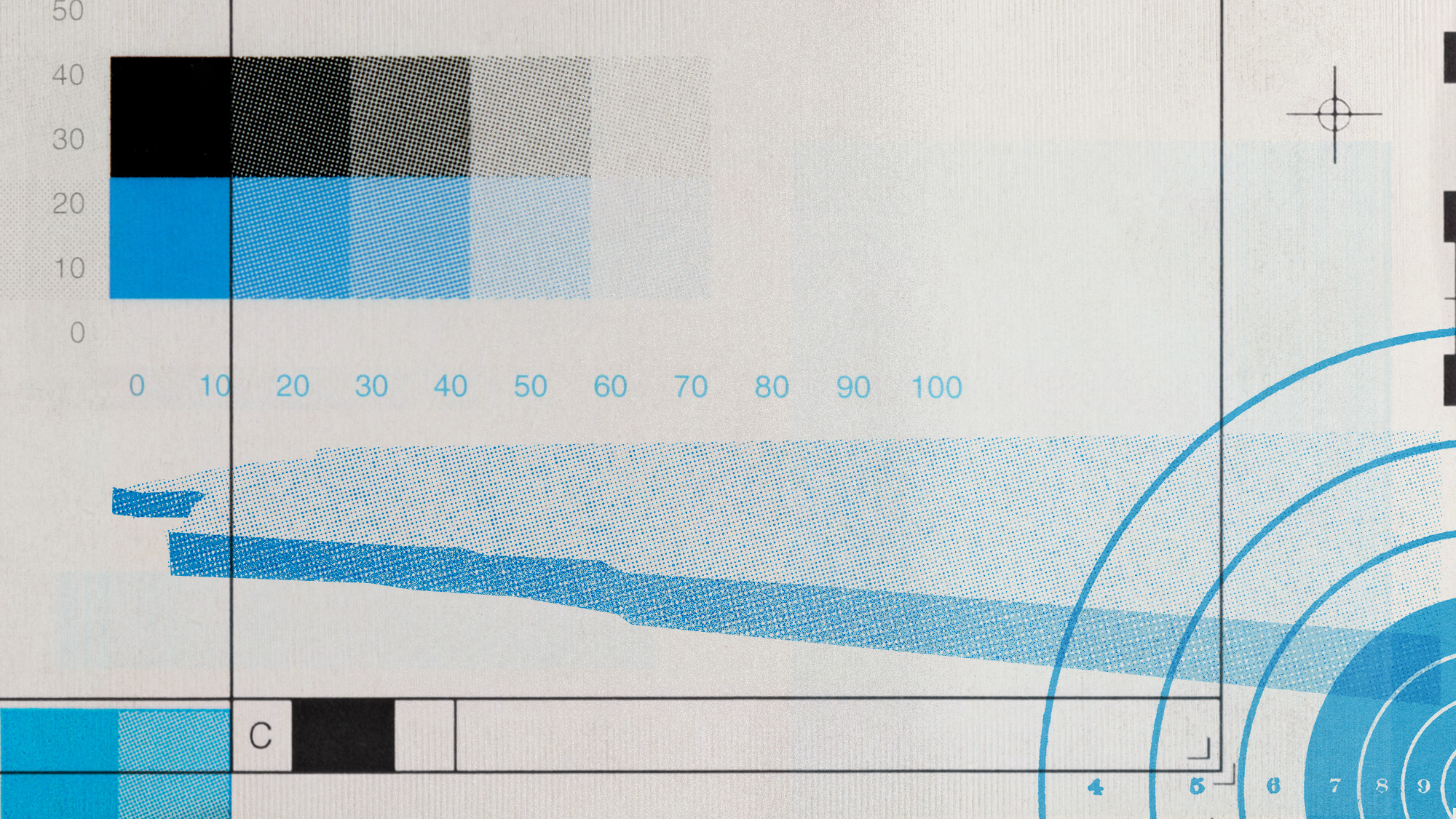

Beijing has a "particularly strong hold over rare earths", a group of 17 metallic elements and minerals used to power EV batteries and wind turbines, said Semafor. China produces about 60% of the world's rare-earth metals and accounts for nearly 90% of rare-earth refining.

China was able to establish that dominance "in large part because of lax environmental regulations", said the Harvard International Review. "Low-cost, high-pollution methods enabled China to outpace competitors and create a stronghold in the international REE [rare earth elements] market."

Under an EU law that came into force in May, the EU set "ambitious 2030 targets for domestic production of minerals crucial in the green transition – particularly rare earths", said Reuters. Demand in the bloc is "forecast to soar sixfold in the decade to 2030 and sevenfold by 2050".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But overreliance on Chinese suppliers is risky, according to a 2022 analysis by the European Parliament. With geopolitical tensions rising, the US and European Union have "sought to diversify their procurement of rare earths, as well as other minerals", said Semafor.

Last year Ursula von der Leyen announced that the bloc would construct the world's first large-scale rare-earth refinery outside of Asia, in Estonia. The move would "bolster European resilience and security of supply", said the European Commission president. Similar projects are under way in Vietnam, Brazil and Australia.

But China's rare-earth mining and refining sectors are suffering from falling revenues and profits. Fears that Beijing is trying to "exert control over the industry", which could disrupt both vital technology and green energy supply chains, have "sparked a race to shore up supplies from alternative suppliers", said Politico.

'Forever' trade war with the West

Last month a Norwegian mining firm announced that it had discovered Europe's largest proven deposit of rare-earth elements – one of the world's few deposits not owned or controlled by China. The discovery by Rare Earths Norway was a "welcome boost in Europe's bid to break China's rare-earths dominance", said CNBC.

Norway's discovery could "finally make Europe a player in the industry", said Fortune, and "strengthens Europe's hand against rivals like China".

It also comes at a time of wider "tense trade relations" between the West and China, with Europe being "wary" of China's "allyship with Russia".

The EU has increased tariffs on imports of Chinese EVs by nearly 50%, after an anti-subsidy probe launched last year. The Biden administration went even further, with tariffs of 100% on Chinese EVs.

In retaliation, China has opened an investigation into pork imports from the EU, which could be catastrophic for the industry. Beijing has already moved to restrict the export of graphite, a key material in EV batteries, and gallium, used for semiconductor chips. And in those tiny but vital microprocessors lies the battle for global supremacy between China and the US.

That contest is "entering a new phase", said Bloomberg, as the American government pumps $100 billion into subsidies for tech firms and China builds dozens of new facilities to strengthen its supply chain. China is the "largest global supplier" of older "legacy chips", but the Biden administration is aiming to use its investment to help control nearly 30% of the overall chip market by 2032.

Right now the entire electronics industry depends on a "fragile semiconductor supply chain" stretching from Europe to Asia, said The Economist. "The chip war threatens to bludgeon it."

Harriet Marsden is a senior staff writer and podcast panellist for The Week, covering world news and writing the weekly Global Digest newsletter. Before joining the site in 2023, she was a freelance journalist for seven years, working for The Guardian, The Times and The Independent among others, and regularly appearing on radio shows. In 2021, she was awarded the “journalist-at-large” fellowship by the Local Trust charity, and spent a year travelling independently to some of England’s most deprived areas to write about community activism. She has a master’s in international journalism from City University, and has also worked in Bolivia, Colombia and Spain.

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

As temperatures rise, US incomes fall

As temperatures rise, US incomes fallUnder the radar Elevated temperatures are capable of affecting the entire economy

-

Climate change could lead to a reptile ‘sexpocalypse’

Climate change could lead to a reptile ‘sexpocalypse’Under the radar The gender gap has hit the animal kingdom

-

Why scientists want to create self-fertilizing crops

Why scientists want to create self-fertilizing cropsUnder the radar Nutrients without the negatives

-

The former largest iceberg is turning blue. It’s a bad sign.

The former largest iceberg is turning blue. It’s a bad sign.Under the radar It is quickly melting away

-

Why the Middle East is obsessed with falcons

Why the Middle East is obsessed with falconsUnder the Radar Popularity of the birds of prey has been ‘soaring’ despite doubts over the legality of sourcing and concerns for animal welfare

-

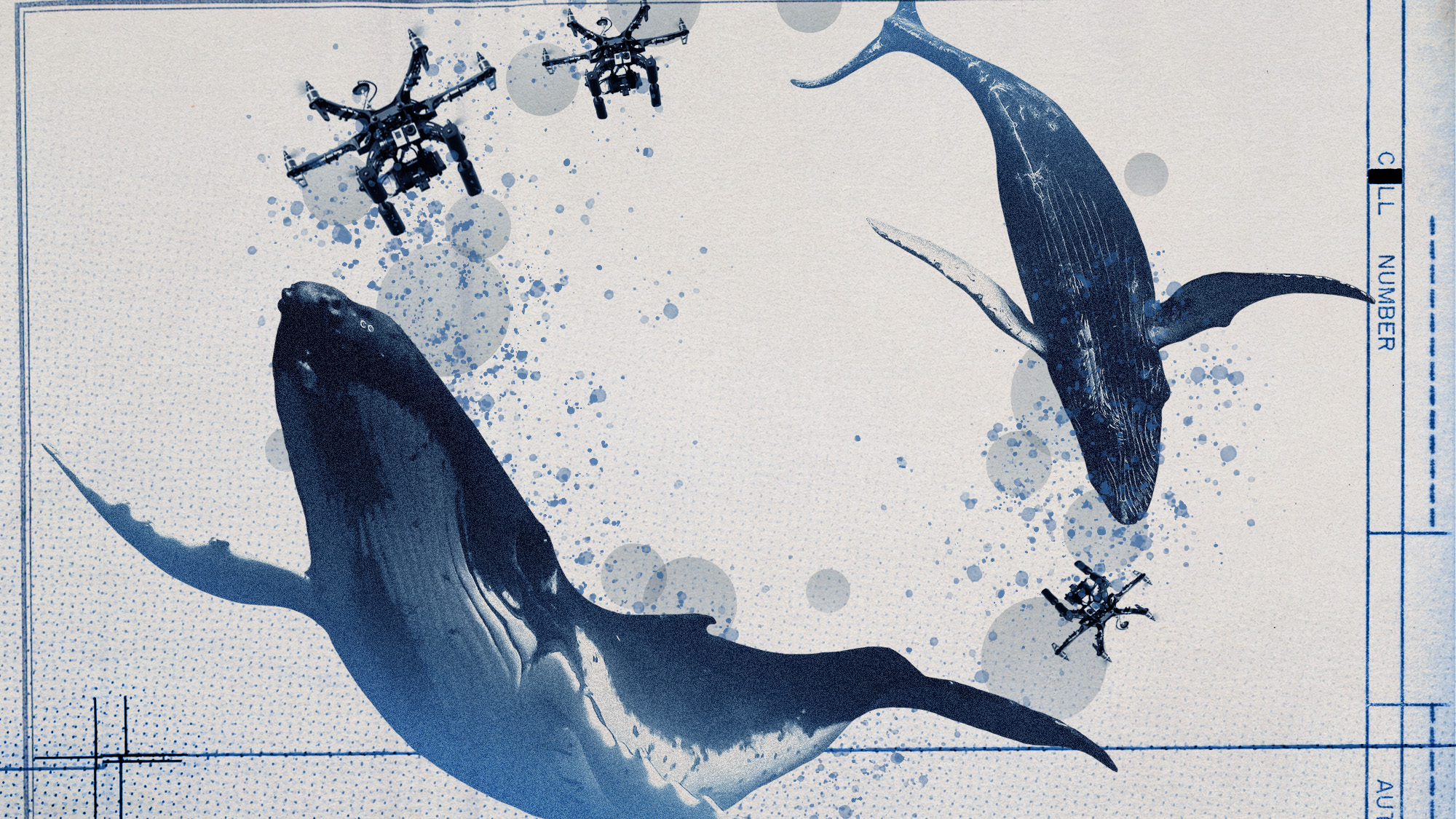

How drones detected a deadly threat to Arctic whales

How drones detected a deadly threat to Arctic whalesUnder the radar Monitoring the sea in the air

-

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming Arctic

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming ArcticUnder the radar The species is adapting to warmer temperatures

-

Environment breakthroughs of 2025

Environment breakthroughs of 2025In Depth Progress was made this year on carbon dioxide tracking, food waste upcycling, sodium batteries, microplastic monitoring and green concrete