China's economic contagion is overhyped

Will its slowdown make a big difference in the American economy? Probably not.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

So here are two things going on in economics news right now: People are upset that America is importing cheap Chinese goods and thus undercutting American jobs. And people are freaking out about whether China's economic slowdown will harm the rest of the world.

But these two things don't really go together. If people are right to freak out about the first, it doesn't make a lot of sense to freak out about the second.

As I've written previously, China has been deliberately driving the value of its currency below the U.S. dollar for a good long while now. This makes Chinese-made goods cheaper than American-made goods, both when Americans are doing the buying and when anyone else is. As a result, America runs a big trade deficit with China: We buy a lot more stuff from them than we sell to them. That, in turn, means that some portion of the demand Americans generate by buying stuff isn't creating jobs here in America, but is instead going to create jobs in China.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

China remains an extremely unequal country — considerably more so than America — and it's ruled by an entrenched and authoritarian one-party political system, run by a spectacularly wealthy political and business elite. That's a big problem, because as China modernizes, it's making the switch from a manufacturing-based economy to a services-based one. That should require China to generate a lot more of its own demand internally, which requires moving a lot more money down the income ladder so everyday Chinese people can buy more stuff.

But instead of reducing inequality, China has been effectively "exporting" its unemployment problem, by relying on demand from other major countries like the U.S. to fuel its job growth. That has the unfortunate side effect of siphoning off demand here in America, which decreases U.S. employment and increases inequality here at home.

"A trade surplus is a drain on other countries," Dean Baker, an economist and head of the the Center for Economic and Policy, told me in an interview.

But that carries some implications: If China is draining demand from America, then if our economy slows down, their economy slows down too. "We're a big [trade] deficit nation," Baker continued. "So when our economy slows, our imports slow, and that matters a lot" to the economies that provide those imports. The flip side is that if China's economy slows down, America doesn't lose demand, and doesn't have to generate or go looking for more.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

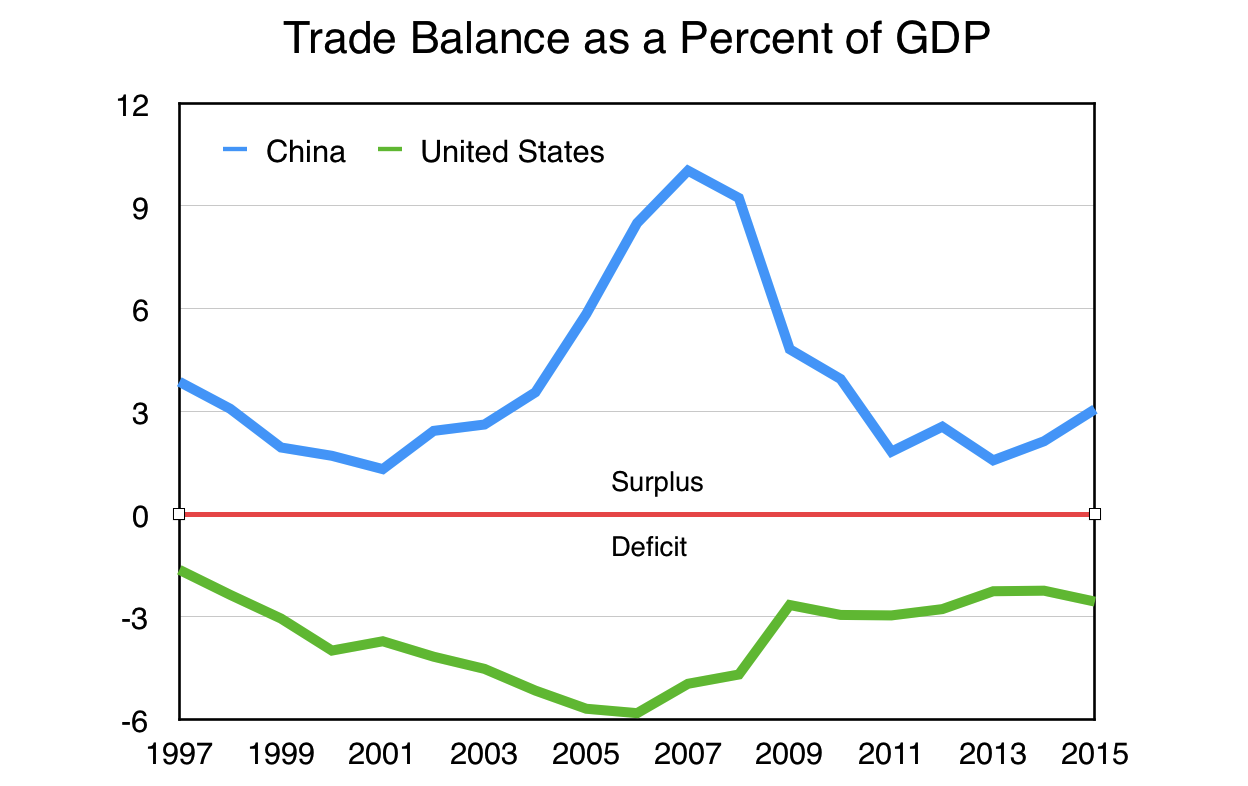

In short, the extent to which a country is running a trade surplus is the extent to which it's relying on other countries as economic engines, rather than being its own engine, or an engine others rely on. And as it stands, China's trade surplus with the world is just over 3 percent of its economy. Meanwhile, America is running a trade deficit of about 2.5 percent of its economy.

These numbers are from the International Monetary Fund. But Robert Scott, a trade expert with the Economic Policy Institute, told The Week that they've been looking at unpublished data from the World Trade Organization that suggests China's total goods trade surplus with the rest of the world was around $1 trillion in 2014, and could be even higher for 2015. With a gross domestic product (GDP) of $10.35 trillion in 2014, that would put China's goods trade surplus just below a whopping 10 percent of its economy.

Now, the total trade balance as measured by the IMF includes goods and services — the later including things like royalty payments, freight fees, banking services, insurance, tourism, and so forth. Developed countries tend to export services more and import goods more, and vice versa for developing countries. So you'd expect China's trade surplus in goods to be higher than its total trade surplus.

But even allowing for how famously unreliable economic data out of China is, Baker said a 10 percent goods trade surplus seemed extremely high compared to the IMF's total trade surplus. Still, this at least opens the possibility that China is an even greater hanger-on to the rest of the global economy than we realize.

There are possible routes by which a Chinese slowdown could hurt America, since their slowdowns have been associated with further drops in the value of their currency. That it turn could inspire other countries to devalue their currencies to stay competitive, all of which would make American goods even more expensive by comparison. "That does have some impact," Baker said. "But I think it really is overplayed."

The other complication is that, while America imports more from China on the whole, the U.S. still exports to them too — but those exports are only about 0.7 percent of our economy. "So say [U.S. exports to China] fell by 20 percent," Baker hypothesized. "That would be a lot." But even that extremely unlikely drop would only eliminate a small fraction of a percent of the demand America relies on. Not nearly enough to cause a recession.

Ultimately, if the engine sputters, that affects everyone who relies on it. But if the hangers-on falter, that's not nearly as big a problem for the engine countries.

As a result, Baker thinks a lot of the panicky headlines we've been seeing over the stock market turmoil in China, and what harm that will do to America, fail to recognize the distinction between the financial markets and the real economy.

China definitely had a stock market bubble that's now popping, but its stock market is also much smaller compared to the size of its economy than, say, America's is. On top of that, America has arguably been looking at a bit of a stock bubble itself. "If you were to go back 3 or 4 years and ask people where do they think the stock market will be in 2016, I doubt anyone would say 2,100 for the S&P 500," Baker said. "That's pretty high. When you have a high market, it doesn't take too much to shake it up a bit. You just need anything to give people a scare to bring a correction."

So a fall in China's stock market "isn't going to have the sort of secondary impact that it did in the U.S. at the end of the dotcom bubble," Baker continued. "That doesn't cause a recession, but it does cause a lot of headlines."

All of which doesn't mean the U.S isn't in for a recession some time soon. But it will be a fall in our own demand that does it to us, not a fall in China's.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military